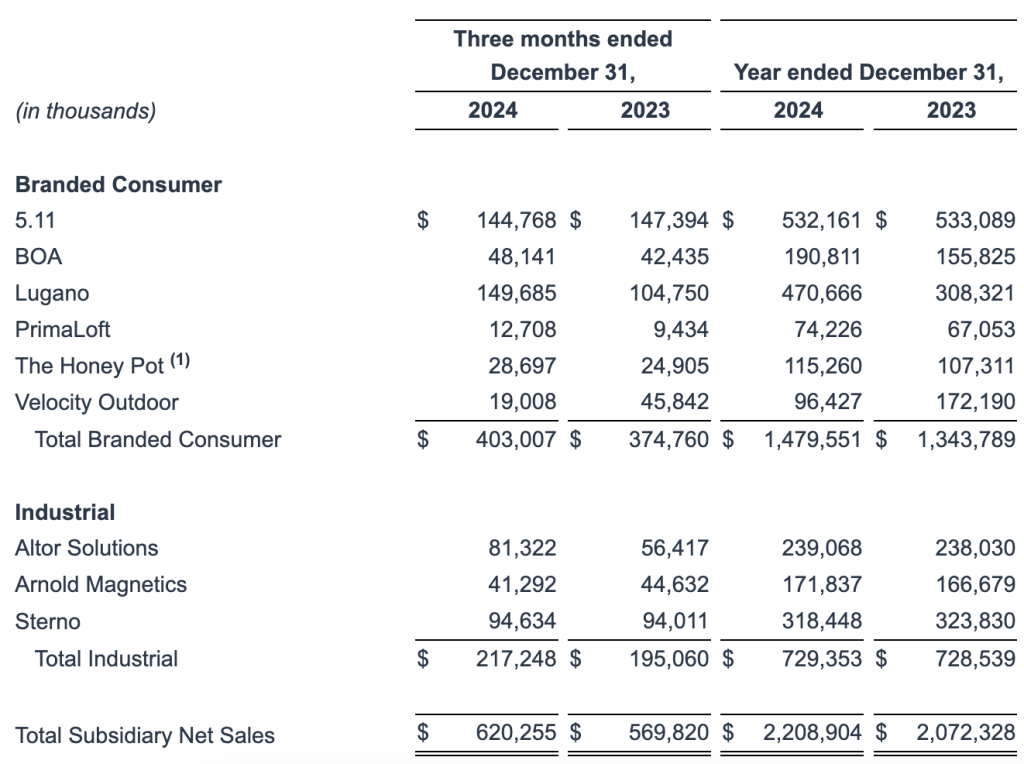

Compass Diversified’s (CODI) Branded Consumer net sales, which includes 5.11 Tactical, Boa, The Honey Pot, Lugano, Primaloft, and Velocity Outdoor, increased 8 percent in the 2024 fourth quarter to $403.0 million year-over-year. On a pro forma basis, Branded Consumer net sales increased 10 percent to $1.5 billion in the full year 2024.

For the full year 2024, our consumer vertical saw pro forma revenues grow double digits, and pro forma adjusted EBITDA increased by greater than 27 percent versus the prior year,” offered Patrick Maciariello, partner and COO of Compass Diversified, on a conference call with analysts. “This is despite the one-time impact of an approximately $12 million write-down of inventory at 5.11 related to PFAs regulations. Excluding this impact, our pro forma adjusted EBITDA on the consumer segment grew over 30 percent and our adjusted EBITDA margin was greater than 27 percent, representing a more than 400 basis point improvement over 2023.”

PrimaLoft Technologies

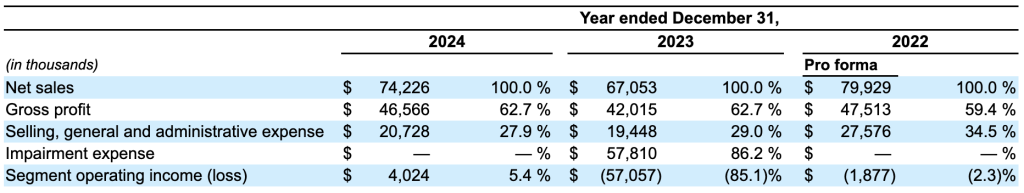

PrimaLoft Technologies, the provider of branded, performance, synthetic insulation and materials used primarily in consumer outerwear and accessories, saw some upside in 2024 as inventory levels in the retail market began normalizing, increasing orders from retailers with the company’s brand partners.

Net sales for the year ended December 31, 2024, were $74.2 million, an increase of $7.2 million compared to net sales of $67.1 million in 2023.

Gross profit for 2024 increased by $4.6 million from the full year 2023, but the gross margin remained flat at 62.7 percent for both years.

The year’s selling, general and administrative (SG&A) expense was $20.7 million, or 27.9 percent of net sales, compared to $19.4 million, or 29.0 percent of net sales for the year ended December 31, 2023. SG&A expense in the prior year included $2.4 million in integration services fees associated with CODI’s acquisition of PrimaLoft. Excluding the integration service fee, SG&A expense increased approximately $3.7 million due to increased stock compensation expense, bonus compensation and reorganization costs incurred as PrimaLoft continues its focus on future growth.

PrimaLoft performed an interim impairment test of goodwill as of December 31, 2023, due to operating results that were below forecast amounts used as the basis for the purchase price allocation at acquisition. The impairment test resulted in PrimaLoft recording an impairment expense of $57.8 million in the year ended December 31, 2023.

Primaloft’s operating income for the year ended December 31, 2024, was $4.0 million, compared to a segment operating loss of $57.1 million for the full year 2023, primarily due to the goodwill impairment recorded in the fourth quarter of 2023.

Compass Diversified

Compass Diversified (CODI), parent of the 5.11 Tactical, Boa, Primaloft, and Velocity Outdoor consumer brands, posted net sales of $620.3 million in the 2024 fourth quarter, up 13.8 percent compared to $544.9 million in the fourth quarter of 2023.

For the full year 2024, CODI’s consolidated net sales were $2.2 billion, up 11.9 percent compared to $2.0 billion in 2023.

For the full year 2024, CODI’s operating income increased 170 percent to $230.1 million compared to $85.2 million a year ago. The increase was reportedly due to an increase in net sales year-over-year and non-cash impairment charges the company took in 2023 of $89.4 million.

For the full year 2024, CODI’s net income was $47.4 million compared to $262.4 million in 2023. The decreases in net income were due primarily to the $179.5 million gain on the sale of Marucci Sports in November 2023 and the $98.0 million gain on selling Advanced Circuits in February 2023.

For the full year 2024, CODI’s income from continuing operations was $42.3 million, compared to a loss from continuing operations of $44.8 million in 2023. The net income increases from continuing operations were primarily due to the non-cash impairment expenses associated with PrimaLoft and Velocity Outdoor in 2023.

For the full year 2024, CODI’s Adjusted Earnings was $161.6 million compared to $101.2 million a year ago.

For the full year 2024, CODI’s Adjusted EBITDA was $424.8 million, up 30 percent compared to $326.5 million a year ago. The increases were primarily due to strong results at Lugano. Management fees incurred during the fourth quarter and full year were $19.5 million and $74.8 million, respectively.

Image courtesy Primaloft/Compass Diversified