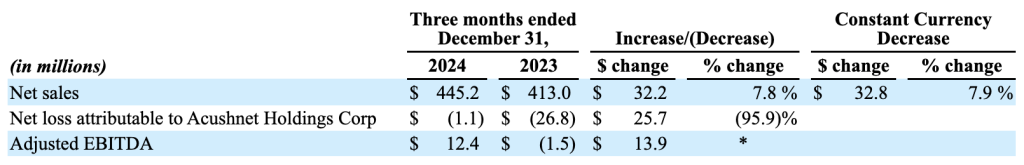

Acushnet Holdings Corp., parent of the iconic Titleist and Footjoy golf brands, reported that consolidated net sales for the 2024 fourth quarter increased 7.8 percent, or 7.9 percent on a constant-currency (cc) basis, to $445.2 million, reportedly driven by increased average selling prices across all reportable segments, higher sales volumes in Titleist Golf Equipment and Golf Gear and higher net sales of products that are not allocated to one of the company’s three reportable segments.

GOLF shares were down modestly on Thursday, February 27 as the company missed on the top-line but blew past bottom-line expectations. While the company posted an EPS loss of 2 cents per share for the fourth quarter, that was nearly 94 percent better than Wall Street expected.

The net sales number came up 2.2 percent short against the consensus estimate of $455.1 million.

Consolidated net sales for the full year increased 3.2 percent (+3.9 percent cc), said to be primarily driven by higher sales volumes in Titleist golf equipment and Golf Gear and higher average selling prices in FootJoy Golf Wear and Golf Gear, partially offset by a sales volume decline in FootJoy Golf Wear and products that are not allocated to one of our three reportable segments.

Fourth Quarter 2024

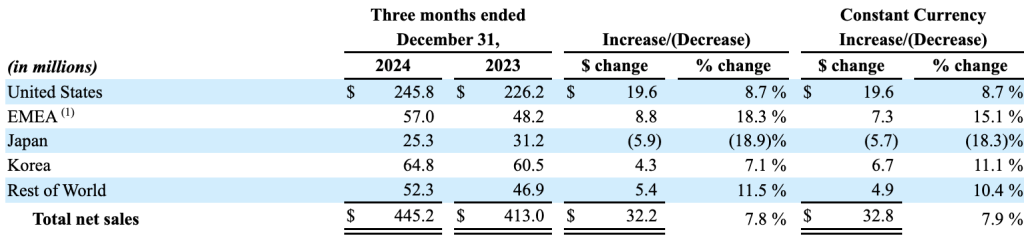

Region Summary

On a geographic basis, consolidated net sales in the United States were higher primarily as a result of increases of $13.5 million in Titleist golf equipment and $4.8 million in Golf Gear. The increase in Titleist Golf Equipment was primarily related to higher sales volumes of GT drivers and fairways. The increase in Golf Gear was said to be largely related to higher sales volumes in travel product categories.

Net sales in regions outside the United States were up 6.7 percent (+7.1 percent cc) due to net sales increases in EMEA, Korea and Rest of World, partially offset by a decrease in net sales in Japan.

In EMEA, the company said net sales increased primarily due to higher sales volumes of products that are not allocated to one of our three reportable segments, Titleist golf equipment and Golf gear.

In Korea, the increase was said to be primarily due to higher net sales of products that are not allocated to one of the three reportable segments and Titleist Golf Equipment.

In Rest of World, the increase was reportedly driven by higher net sales across all reportable segments. In Japan, the decrease was largely related to lower net sales across all reportable segments in addition to products that are not allocated to one of the three reportable segments.

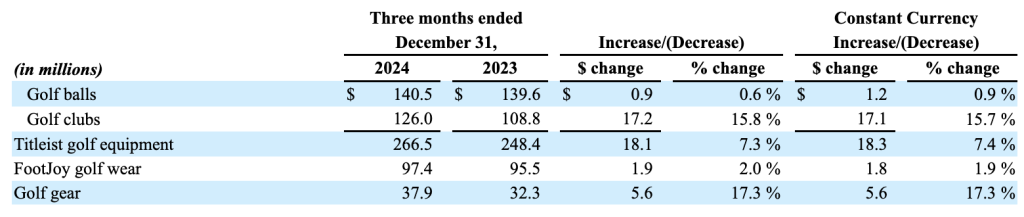

Segment Summary

Titleist Golf Equipment increased 7.3 percent (+7.4 percent cc) year-over-year, reportedly largely due to higher sales volumes of GT drivers and fairways launched in the third quarter of 2024 and higher average selling prices across all club categories, partially offset by lower sales volumes of irons.

FootJoy Golf Wear net sales grew 2.0 percent (+1.9 percent cc) year-over-year, said to be primarily due to higher sales volumes in footwear. Net sales in apparel and golf gloves were slightly down, as higher average selling prices were offset by lower sales volumes.

Golf Gear jumped 17.3 percent (+17.3 percent cc) year-over-year, said to be primarily due to higher sales volumes in travel product categories and golf gloves.

The net loss attributable to Acushnet Holdings Corp. for the quarter was reported at $1.1 million, compared to $26.8 million for the same period in 2023. This improvement was said to be primarily a result of a decrease in loss from operations driven by higher gross profit, partially offset by higher operating expenses.

Adjusted EBITDA was $12.4 million, compared to a loss of $1.5 million in the prior year. Adjusted EBITDA margin was 2.8 percent for the fourth quarter versus negative 0.4 percent for the prior-year period.

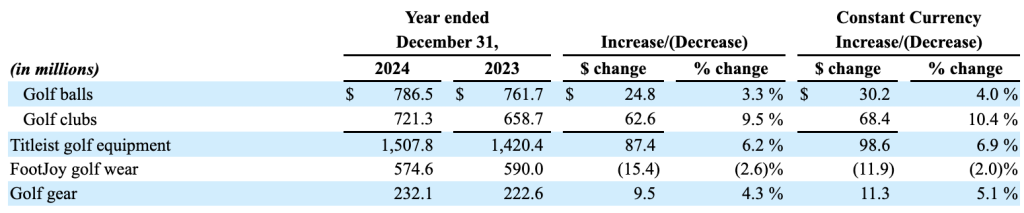

Full Year Summary

Consolidated full year net sales were $2.46 billion, up 3.2 percent year-over-year, or up 3.9 percent in constant-currency (cc) terms.

“Acushnet experienced another positive year in 2024, delivering 4 percent full year constant currency sales growth and adjusted EBITDA growth of 7.5 percent,” said David Maher, president and CEO, Acushnet Holdings Corp. “Titleist Golf Equipment posted healthy gains, driven by the successful introduction of GT metals and SM10 wedges and continued golf ball success led by Pro V1, Pro V1x and AVX models.”

Segment Summary

In Titleist Golf Equipment, the 6.2 percent (+6.9 percent cc) increase for the year was said to be primarily driven by higher sales volumes of SM10 wedges, GT drivers and fairways and Pro V1 and Pro V1x golf balls, partially offset by lower sales volumes of hybrids which are in their second model year.

“Our strong golf ball performance in 2024 was fueled by balanced growth across our Pro V1 and performance models and strong adoption throughout the pyramid of influence,” offered Maher on a conference call with analysts. “Titleist Golf Clubs also posted strong results in 2024 with overall sales up double digits and growth in all regions, led by the U.S. and Japan. Our SM10 wedge launch in Q1 and GT Metals launch in Q3 were well received and these franchises are in great shape as we start the 2025 season and also plan for the new putter and iron launches.”

Maher said the 4 percent growth in Titleist Golf Ball sales in 2024 was noteworthy given this followed the 2023 Pro V1 launch year when ball sales increased in double digits.

“We generally expect second year sales to be down slightly due to the timing associated with our two-year product cycles,” he noted.

In Golf Gear, the 4.3 percent (+5.1 percent cc) increase in net sales increase said was primarily due to higher sales volumes in travel product categories and higher average selling prices across all product categories, partially offset by lower sales volumes in golf bags.

“Again, growth was led by the U.S. market, which was up double digits,” Maher added. “FJ sales were off 2 percent for the year with gains in the U.S. more than offset by declines in international markets.”

In FootJoy Golf Wear, a 2.6 percent decrease (-2.0 percent cc) in net sales was said to be largely due to higher sales volumes in footwear and higher average selling prices in apparel, partially offset by lower sales volumes in golf gloves.

Maher said FootJoy has done good work navigating what has been a correcting footwear and apparel market, effectively managing inventories and leaning into high-performance offerings across footwear, apparel and gloves. In doing so, he said FootJoy delivered improved bottom-line performance in 2024 despite a top-line decline.

In the Other category, which is comprised of Titleist apparel and shoes, Maher said the key 2024 themes are continued growth of shoes, Golf in the U.S. and U.K., and softness in the Asia’s specific Titleist apparel market.

Full Year Income Statement Summary

- Full year gross margin was 48.3 percent of net sales, up 130 basis points year-over-year.

- Full year net income attributable to Acushnet Holdings Corp. of $214.3 million, up $15.9 million year-over-year.

- Full year Adjusted EBITDA of $404.4 million, up $28.3 million, or 7.5 percent, year-over-year.

Overall gross profit for the full year was $1.2 billion, up 6 percent, or $68 million, primarily resulting from increased volumes in Titleist Golf Equipment and Golf Gear. Gross margin grew to 48.3 percent of net sales, up 130 basis points from the prior year, primarily driven by a favorable product mix shift.

“The impact from the one-time PTO benefit was 20 basis points on gross margin for 2024,” said CFO Sean Sullivan. The impact from the one-time PTO benefit was 150 basis points on gross margin for the quarter.

SG&A expense of $193 million in the quarter increased $9 million, or 5 percent compared to the fourth quarter of 2023 and includes a $9 million benefit related to the one-time PTO adjustment. SG&A expense of $802 million for the full year increased $46 million, or 6.1 percent from 2023, and includes the $9 million PTO benefit.

The increase was said to be primarily due to $18 million of restructuring costs related to the company’s footwear manufacturing move to Vietnam, which is included in operating income but added back for adjusted EBITDA purposes. The increase was also impacted by higher employee expenses including the support of golf equipment fitting initiatives, higher information technology-related expenses, and higher A&P expense related to new product launches.

The CFO noted that the company recorded a one-time benefit to its income statement associated with a change in the company’s paid time off policy, or PTO, totaling approximately $18 million in the fourth quarter. The amount of the benefit that is included in gross profit, SG&A, and R&D is $7 million, $9 million, and $2 million, respectively. The total amount has been excluded from adjusted EBITDA.

Interest expense was up $11 million for the full year due to an increase in borrowings and a higher weighted average interest rate in 2024.

“Our full-year effective tax rate was 19.2 percent, up from 17.8 percent last year,” stated Sullivan. “The increase in ETR was primarily driven by changes in our jurisdictional mix of earnings as well as changes in our valuation allowance.”

2025 Outlook

Before walking through the details in the 2025 guidance Maher walked the participants through some data points that inform management’s planning and outlook.

“In the U.S. market, rounds increased 2 percent in 2024 to a record 543 million,” he noted.” Noteworthy is that these rounds were played across some 16,000 golf courses, a supply that is down about 1,500 courses since 2,000. Driving this participation growth is a golfer base that increased 6 percent in 2024 to 28.1 million golfers. This 1.5 million net gain represents the largest single-year increase since 2000, and the number of beginners top 3 million for the fifth consecutive year in a row.”

He said that, given these metrics, it is not surprising that 70 percent of public facilities rate their financial health as good or excellent, versus 23 percent in 2016, and 80 percent of private golf courses report good or excellent financial health, versus 46 percent in 2016.

“Annual U.S. rounds are up over 20 percent since 2019, as is participation in the U.K., Canada, Korea, and Australia. Japan players grown 10 percent during the same period,” he shared.

“Healthy golfer participation and, in particular the strength of the dedicated golfer, are the foundation for our perspective on the state of the global game and particularly in the U.S., the CEO continued. “Looking outside the U.S. we are planning for growth, however, continue to take a measured approach for while golf participation has been resilient, the macroeconomic backdrop in key regions continues to be more challenging. And while FX headwinds and tariff uncertainty are inevitable pieces of the planning process, we remain confident in our ability to execute against our priorities and what we can control.”

Acushnet expects full year consolidated net sales to be approximately $2.49 billion to $2.54 billion on a reported basis, up 2.2 percent year-over-year at the midpoint. This reportedly includes an estimated negative impact from foreign currency rates of approximately $35 million.

On a constant-currency basis, consolidated net sales are expected to be up between 2.6 percent and 4.6 percent. Acushnet expects full year adjusted EBITDA to be approximately $405 million to $420 million in 2025.

The company said this outlook does not reflect the impact of any imposition of import tariffs by the U.S. and potential retaliatory actions taken by other countries. The company sources ~ 6 percent of the cost of goods sold from China and has limited exposure to Canada and Mexico. The China 10 percent incremental tariff would equate to an approximately $7 million headwind.

“We are actively exploring actions to mitigate this impact, including leveraging our supply chain and potential pricing actions,” said Sullivan

Image courtesy Titleist/Acushnet Holdings Corp.