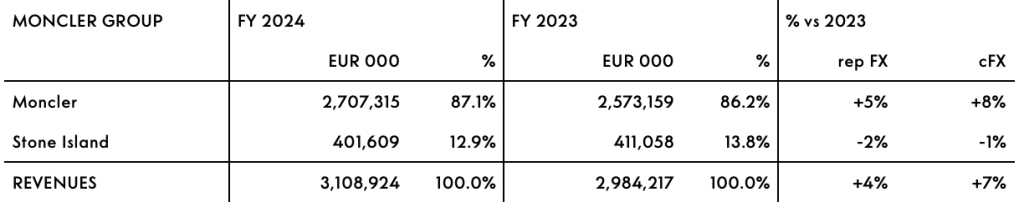

Moncler S.p.A. (Group), the Italy-based parent of the Moncler and Stone Island brands, saw full-year 2024 consolidated revenues increase 7 percent in constant-currency terms (cFX), to €3,108.9 million, compared to €2,984.2 million in full-year 2023. Sales grew 4 percent at current exchange (reported) rates.

In the fourth quarter, Group revenues were €1,243.2 million, up 8 percent cFX compared to the 2023 fourth quarter.

Moncler Brand

Full-year Moncler brand revenues were €2,707.3 million, an increase of 8 percent cFX compared with full-year 2023.

In the fourth quarter, revenues for the brand amounted to €1,134.1 million, up 8 percent cFX versus Q4 2023, and accelerating compared with growth in the 2024 third quarter.

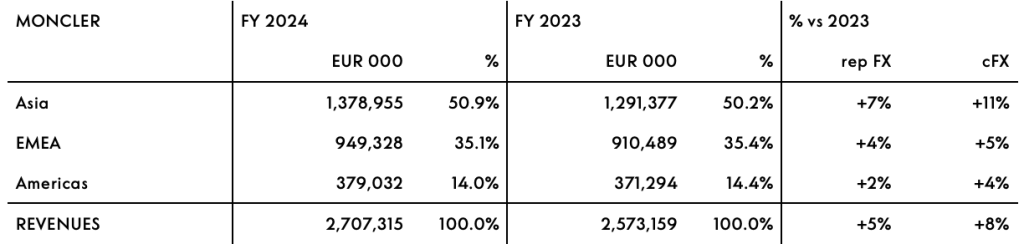

Moncler Brand Revenues by Region

The Moncler brand’s full-year revenues in Asia (which includes APAC, Japan and Korea) were €1,379 million in 2024, up 11 percent cFX compared with full-year 2023.

In the fourth quarter, revenues in the Asia region grew 11 percent cFX versus the prior-year quarter, improving sequentially. This was supported by a return to solid double-digit growth in the Chinese mainland, despite a high comparable base and still challenging macroeconomic conditions affecting consumer confidence. Japan, Korea, and the rest of APAC also delivered a solid performance, all accelerating compared with the previous quarter.

Moncler brand EMEA revenues amount to €949.3 million in 2024, up 5 percent cFX compared with 2023.

In the fourth quarter, revenues in the region increased by 3 percent cFX versus Q4 2023, improving compared with the previous quarter thanks to the acceleration of the DTC channel, which registered a positive contribution from both tourists and locals, despite remaining penalized by more difficult trends in the direct online channel.

Moncler brand revenues in the Americas increased by 4 percent cFX to €379.0 million in 2024.

In the fourth quarter, Moncler brand revenues in the Americas region were up 5 percent cFX versus Q4 2023, with the performance of the DTC channel driving the improvement compared with the previous quarter, both in the physical and in the online channels.

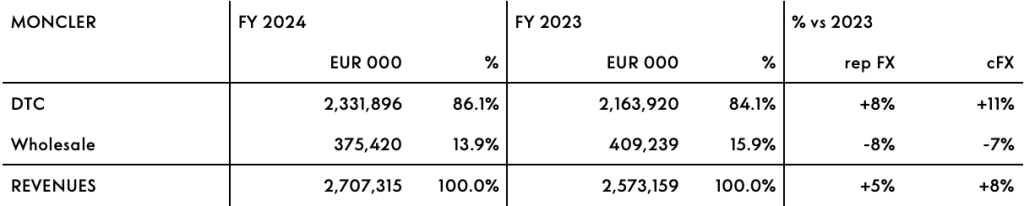

Moncler Brand Revenue by Channel

In 2024, the DTC channel recorded revenues of €2,332 million, up 11 percent cFX compared with 2023.

In the fourth quarter of 2024, revenues increased by 9 percent cFX versus Q4 2023, driven by sequential improvements across all regions, despite a progressively tougher comparable base. The physical channel continued to outperform the online channel, whose performance remained weak in the fourth quarter, albeit improving substantially compared with the previous quarter.In 2024, revenues from stores open for at least 12 months (Comparable Store Sales Growth4) grew by 3 percent compared with 2023.

The Wholesale channel recorded revenues of €375.4 million, a decline of 7 percent cFX compared with 2023. In the fourth quarter, revenues in the Wholesale channel declined 7 percent cFX versus Q4 2023, impacted by still challenging market trends and by ongoing efforts to upgrade the quality of the distribution network.

Moncler Mono-Brand Boutiques by Region

As of December 31, 2024, the network of Moncler mono-brand boutiques counted 286 directly operated stores (DOS), a net increase of 1 unit compared with 30 September 2024 and of 14 units compared with December 31, 2023. Amongst the most important stores opened in the fourth quarter are New Bond Street in London and Boca Raton in Florida. The Moncler brand also operated 56 wholesale shop-in-shops (SiS), a net decrease of 1 unit compared with December 31, 2023.

Stone Island Brand

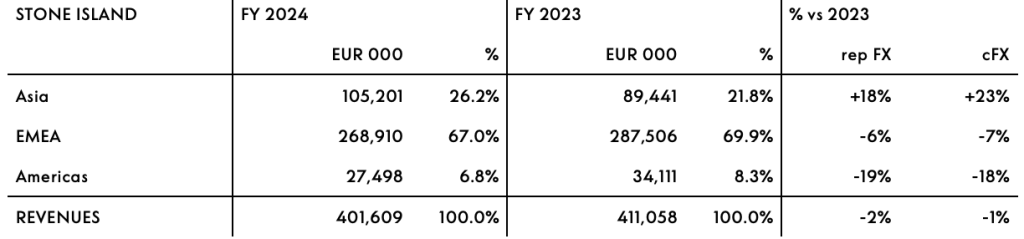

In 2024, Stone Island brand revenues reached €401.6 million, a decrease of 1 percent cFX compared with 2023. In the fourth quarter, Stone Island brand revenues amounted to €109.2 million, up 10 percent cFX versus the 2023 Q4 period.

Stone Island Brand Revenues by Region

Asia (which includes APAC, Japan and Korea) reached €105.2 million revenues in 2024, growing 23 percent cFX compared with 2023. In the fourth quarter, the region grew by 23 percent cFX, mainly driven by the ongoing strong performance of Japan and the improving trends in the Chinese market. Korea continued to show softer trends compared with the rest of the region.

In 2024, EMEA – which continues to be the most important region for the brand – recorded revenues of €268.9 million, a decrease of 7 percent cFX compared with 2023. In the fourth quarter, revenues were up 4 percent cFX versus Q4 2023, thanks to the solid performance of the DTC channel and improving trends in the wholesale channel. Italy, in particular, outperformed the rest of the EMEA region.

Revenues in the Americas were down 18 percent cFX compared with 2023. In the fourth quarter, revenues were up 2 percent cFX versus Q4 2023, returning to growth after several quarters of deterioration, mainly thanks to the improvement recorded by the wholesale channel.

Stone Island Brand Revenues by Channel

In 2024, the DTC channel grew by 23 percent cFX compared with 2023 to €208.9 million, representing 52 percent of total 2024 revenues. In the fourth quarter, revenues in this channel were up 15 percent cFX versus Q4 2023, with

Asia and EMEA outperforming.

The physical channel continued to outperform the online channel across all regions.

The Wholesale channel recorded revenues of €192.7 million in 2024, down 19 percent cFX compared with 2023. In the fourth quarter, revenues decreased by 1 percent versus Q4 2023, showing substantial improvement, albeit still impacted by challenging market trends as well as by the strict volume control adopted in the management of this channel to continuously improve the quality of the network.

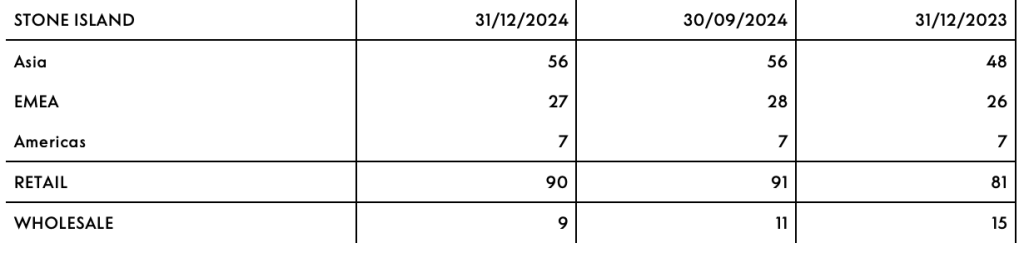

As of December 31, 2024, the network of Stone Island mono-brand stores comprised 90 directly operated stores (DOS), a net decrease of 1 unit compared with 30 September 2024 and a net increase of 9 units compared with 31 December 2023. The Stone Island brand also operated 9 mono-brand wholesale stores, a net decrease of 6 units compared with 31 December 2023.

Stone Island Mono-Brand Stores by Region

Group Net Income Summary

Full-year consolidated gross profit was €2,426.6 million in 2024, or 78.1 percent of revenues, compared with 77.1 percent in 2023. The increase in margin is primarily driven by the positive channel mix, with a higher incidence of the DTC channel at both Moncler and Stone Island.

In 2024, selling expenses were €937.3 million, compared with €868.1 million in 2023, with a 30.2 percent incidence on revenues, higher than 2023 due to the progressive shift toward a more DTC-led business model. General and administrative expenses were €351.7 million, with a 11.3 percent incidence on revenues, compared with €331.2 million in 2023 (11.1 percent on revenues), reflecting continuous investments in the organization.

Marketing expenses were €221.2 million, representing 7.1 percent of revenues, compared with 7.0 percent in 2023. The higher marketing spending in the second half of 2024 compared with the same period of 2023 (and the related incidence on sales) is mainly due to a different phasing of marketing activities in H1 vs H2 compared with the previous fiscal year.

Depreciation and amortization, excluding those related to the rights of use recorded in application of IFRS 16, were €120.7 million, compared with €114.2 million in 2023.

Group EBIT was €916.3 million with a margin of 29.5 percent, compared with €893.8 million in 2023 with a margin of 30.0 percent, showing resilience despite a more challenging trading environment.

In 2024, net financial expenses were €6.5 million, compared with €23.2 million in 2023, including €31.4 million of interest on lease liabilities (vs €29.0 million in 2023). The decrease was driven by a higher level of interest income due to higher interest rates and good cash management.

The tax rate in 2024 was equal to 29.7 percent, said to be in line with 2023.

Group net income was €639.6 million, or 20.6 percent of revenue, in 2024, compared with €611.9 million, or 20.5 percent of revenue, in 2023, representing an increase of 5 percent year over year.

Consolidated Balance Sheet Summary and Cash Flows

As of December 31, 2024, the net financial position (excluding the effect related to IFRS 16) was positive and equal to €1,308.8 million compared with €1,033.7 million of net cash as of 31 December 2023. As required by the IFRS 16 accounting standard, the Group accounted lease liabilities equal to €924.1 million as of December 31, 2024 compared with €805.2 million as of 31 December 2023.

Net consolidated working capital as of December 31, 2024 was €255.5 million compared with EUR 240.2 million as of 31 December 2023, equal to 8.2 percent of revenues (8.0 percent as of 31 December 2023), reflecting the continuous and rigorous control of working capital levels.

In 2024, net capital expenditures were €186.7 million (6.0 percent of revenues) compared with €174.1 million in 2023.

Investments related to the distribution network were equal to €104.1 million, of which more than half dedicated to renovation and expansion projects. Investments related to infrastructure were equal to €82.6 million, mainly related to IT, production and logistics.

Net cash flow in 2024 was positive and equal to €275.1 million after the payment of €311.0 million of dividends, compared to a positive net cash flow of €215.5 million in 2023.

Outlook

Entering 2025, the “global macroeconomic context and operating environment remain volatile and unpredictable. In this uncertain landscape, the Group remains focused on operational agility and responsiveness while continuing to invest in its organization, talent, and distinctive brands.”

Leveraging its brand heritage and commitment to innovation and creativity, the Group is “well-positioned to adapt to evolving market dynamics, aiming to shape new opportunities and create long-term value.”

These are the main strategic lines of development:

- During 2025, the Moncler brand expects to continue to reinforce its three complementary brands — Moncler Grenoble, Moncler Collection and Moncler Genius — through events and marketing strategies to “unlocking their respective potential across all regions.”

- Moncler Grenoble, most closely tied to the brand’s DNA, will continue to elevate its “signature blend of performance and style, with dedicated marketing initiatives and a more complete collection suitable for all the seasons of the year.”

- Moncler Collection will continue to “elevate the product, re-imagine iconic pieces, and enhance the brand’s ability to serve customers year-round through relevant collections and concepts.”

- Stone Island will continue to drive global brand awareness in 2025 through intentional marketing to drive new target segments, expanding core categories and maximizing brand reach through iconic pieces and sub-collections while reinforcing a “total-look approach as a distinctive signature.” The brand will also continue to enhance its distribution network, implementing a selective omni-channel and consumer-centric strategy across all touchpoints.

Image Moncler S.p.A.