Canada Goose reported solid gains in its DTC (direct-to-consumer) business in North America in its fiscal third quarter ended December 29, boosted by a 22 percent comparable-store hike in December due to the Snow Goose launch. However, planned wholesale declines and weakness in China led to an overall sales decline in the quarter.

All amounts are in Canadian dollars unless otherwise indicated.

Revenue for the third quarter was $608 million, slightly below last year’s $610 million and down 2.2 percent on a constant-currency basis. Analysts’ average estimate was $620.9 million.

By channel, DTC revenue in the quarter increased 0.7 percent to $517.8 million, or down 1.4 percent on a constant-currency basis with DTC comparable sales declining 6.2 percent, partially offset by sales from non-comparable stores.

Wholesale revenue decreased 7.5 percent to $75.7 million or 8.1 percent on a constant-currency basis due to a planned lower order book as Canada Goose continued to elevate its presence within this sales channel by right-sizing its inventory position and building strong relationships with brand-aligned partners.

By region, North American revenue declined 2 percent, driven by a planned reduction in wholesale order volume. This was partially offset by strong DTC performance in both the U.S. and Canada, which continued to show momentum into January. North America DTC comps were up 3 percent year-over-year.

The North America strength was boosted by the Snow Goose launch in late-November but Canada Goose officials were encouraged by the results. We are particularly encouraged by this performance as it validates the inherent strength of our business, when we execute well across product and marketing.

Dani Reiss, chairman and CEO of Canada Goose, said on an analyst call about the North American December DTC performance, “We are particularly encouraged by this performance as it validates the inherent strength of our business, when we execute well across product and marketing.”

He noted that while DTC comps were below expectations, the decline represented an improvement versus the year-to-date comp.

“The third quarter marked solid progress towards our three operating imperatives, leading to favorable momentum throughout the month of December and into the New Year,” said Reiss.

“The third quarter marked solid progress towards our three operating imperatives, leading to favorable momentum throughout the month of December and into the New Year,” said Reiss.

Reiss said Snow Goose, representing the first capsule collection from creative director Haider Ackermann, set records in media with over 30 billion impressions, representing the highest launch in recent history.

“The commercial results were equally impressive – 25 percent of people who purchased Snow Goose also bought mainline products, while nearly two-thirds of existing customers returning to the brand,” said Reiss. “We also had a three-year high in U.S. search interest and exceeded our customer acquisition targets. All of this validates the more intensive mature approach we took with our marketing and organizational alignment to reach both loyal fans and new customers.”

Other marketing highlights include placement with the films, Wicked and Babygirl, as well as its partnership ambassador Shai Gilgeous-Alexander, the NBA star who’s being mentioned as a possible MVP candidate.

He added, “The breadth and caliber of these campaigns, alongside the extraordinary reach of the Snow Goose campaign, showcases the growing global relevance of Canada Goose as a lifestyle brand.”

Among other “imperatives,” Reiss said Canada Goose is making progress on best-in-class regional execution as a focus on inventory management, labor optimization, and boosting sales training drove improvements in store conversion rates year-over-year, particularly in North America and EMEA.

Finally, Reiss said Canada Goose continues to streamline operations while maintaining strategic investments in key growth areas. Beyond tight expense controls, the company marked its fifth consecutive quarter of inventory decreases. He said, “Our retail execution delivered solid results despite ongoing macro challenges and, looking ahead, our focus remains on balancing operational excellence with strategic investments and strengthening the foundations that will continue driving both brand heat and commercial momentum across all our channels.”

Gross margin for the third quarter was 74.4 percent compared to 73.7 percent in the third quarter of fiscal 2024, primarily due to pricing and lower inventory provisioning, partially offset by product mix.

Adjusted EBIT for Q3 was $205.2 million, representing a margin of 33.8 percent, compared to $207.2 million and a margin of 34 percent last year.

SG&A expense as a percentage of sales was 40.7 percent, down 40 basis points year-over-year.

Net income attributable to shareholders was $139.7m, or $1.42 per diluted share, compared with a net income attributable to shareholders of $130.6m, or $1.29 per diluted share in the prior year period.

Adjusted net income attributable to shareholders was $148.3m, or $1.51 per diluted share, compared with an adjusted net income attributed to shareholders of $138.6m, or $1.37 per diluted share in the prior year period.

“During the third quarter, while macro factors influenced consumer behavior in certain markets, overall, we saw strong performance and operational improvement and marketing initiatives gained traction,” concluded Reiss. “As we continue our transformation journey, we are energized with the strong execution of our strategy and increasing global resonance of our brand. Positive response to initiatives like Snow Goose, the related marketing campaign and an expanded product offering demonstrates how we are building and sustaining our momentum with consumers worldwide.”

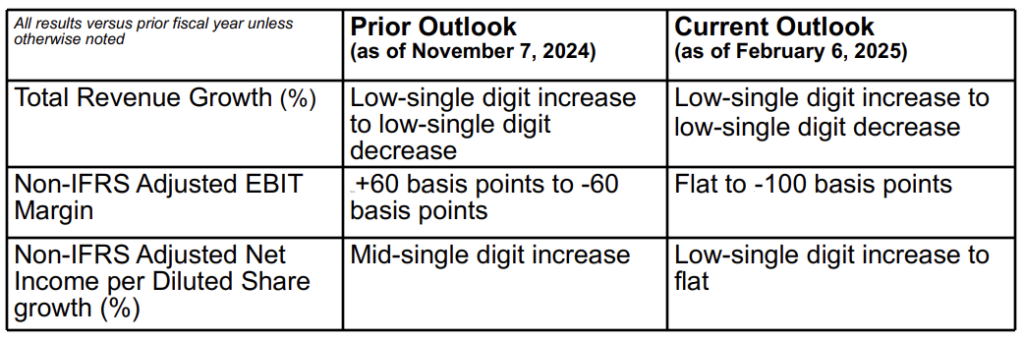

Fiscal 2025 Outlook.

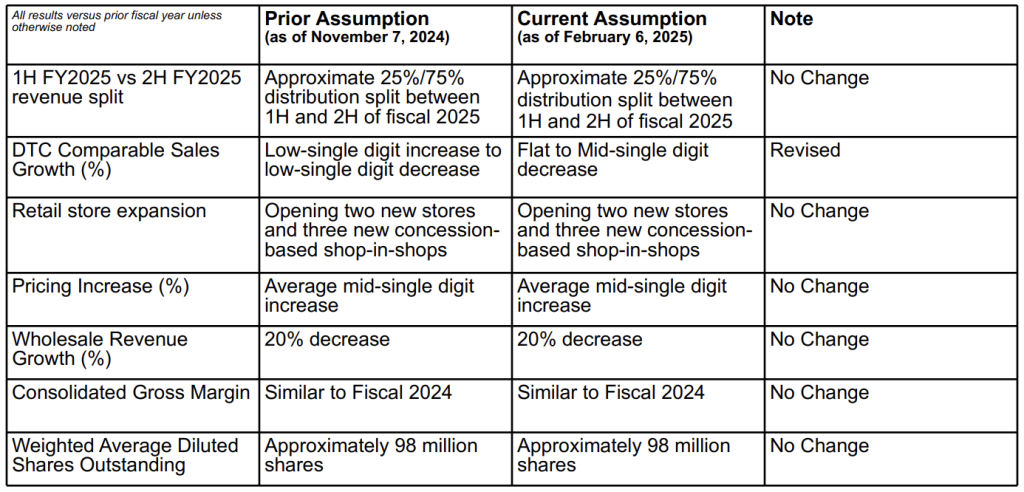

Canada Goose is updating the fiscal 2025 guidance issued with second quarter fiscal 2025 results published on November 7, 2024, to the following:

Canada Goose’s updated outlook takes into account it DTC year-to-date performance, which fell short of expectations due to trends in global luxury consumer spending, and an increase in marketing investments in fiscal 2025, along with the following assumptions: