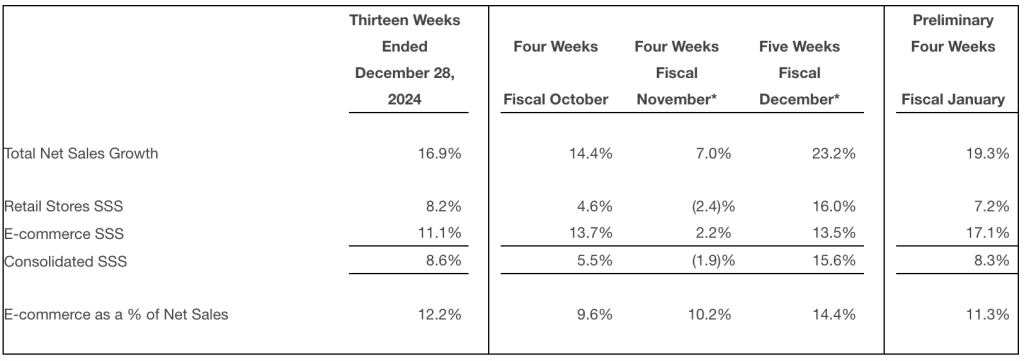

Boot Barn Holdings, Inc. reported that fiscal third-quarter net sales increased 16.9 percent to $608.2 million for the period ended December 28, 2024, compared to $520.4 million in the prior-year Q3 period.

Consolidated same-store sales increased 8.6 percent, with retail store same-store sales increasing 8.2 percent and e-commerce same-store sales increasing 11.1 percent. The increase in net sales was said to result from incremental sales from new stores and consolidated same-store sales.

*Thanksgiving and Black Friday shifted from Fiscal November in fiscal year 2024 to Fiscal December in fiscal year 2025.

*Thanksgiving and Black Friday shifted from Fiscal November in fiscal year 2024 to Fiscal December in fiscal year 2025.

“I want to thank the entire Boot Barn team for their excellent execution and dedication during a busy holiday season, which resulted in strong third-quarter results and earnings per diluted share above the high-end of our guidance range,” offered John Hazen, Interim CEO, Boot Barn Holdings, Inc. “The strength we saw in the business was once again driven by broad-based growth across all major merchandise categories, channels and geographies, resulting in a consolidated same-store sales increase of 8.6 percent.

“In addition to strong sales, we continued to maintain our full-price selling model, resulting in merchandise margin expansion of 130 basis points. As we enter our fourth fiscal quarter, we feel very good about the overall tone of the business and the future growth potential of the brand,” continued Hazen.

Gross margin was 39.3 percent of net sales in the period, compared to 38.3 percent of net sales in the prior-year Q3 period. The 100 basis-point improvement in gross margin was reportedly driven primarily by a 130 basis-point increase in merchandise margin rate, partially offset by 30 basis points of deleverage in buying, occupancy and distribution center costs. The increase in merchandise margin rate was primarily the result of supply chain efficiencies, better buying economies of scale, and growth in exclusive brand penetration. The deleverage in buying, occupancy and distribution center costs was driven by the occupancy costs of new stores.

Selling, general and administrative (SG&A) expenses were $139.4 million, or 22.9 percent of net sales, compared to $124.0 million, or 23.8 percent of net sales, in the prior-year Q3 period. The increase in SG&A expenses compared to the prior-year period was said to be primarily the result of higher store payroll and store-related expenses associated with operating more stores, marketing expenses, and incentive-based compensation in the current year, partially offset by the company’s former CEO’s forfeiture of unvested long-term equity incentive compensation and the reversal of fiscal 2025 cash incentive bonus expense as a result of his resignation.

SG&A expenses as a percentage of net sales decreased by 90 basis points primarily as a result of the aforementioned forfeiture of unvested long-term equity incentive compensation and reversal of 2025 cash incentive bonus expense.

Income from operations increased $24.3 million to $99.5 million, or 16.4 percent of net sales, compared to $75.1 million, or 14.4 percent of net sales, in the prior-year Q3 period, primarily due to the factors noted.

Income tax expense was $24.1 million, or a 24.3 percent effective tax rate, compared to $19.4 million, or a 25.8 percent effective tax rate, in the prior-year Q3 period. The decrease in the effective tax rate was said to be primarily due to reductions in nondeductible expenses.

Net income was $75.1 million, or $2.43 per diluted share, in the third quarter, compared to $55.6 million, or $1.81 per diluted share, in the prior-year period. The increase in net income is primarily attributable to the factors noted.

Balance Sheet Highlights

- The company had cash of $153 million at quarter-end (December 28, 2024).

- The company has zero dollars drawn from the $250 million revolving credit facility.

- Average inventory per store increased approximately 1.0 percent on a same-store basis compared to December 30, 2023.

The company opened 13 new stores during the quarter and 39 stores for the nine-month year-to-date period, bringing the total store count to 438 at quarter-end.

Fiscal 2025 Full-Year Outlook

The company is providing updated guidance for the fiscal year ending March 29, 2025, superseding in its entirety the previous guidance issued in its second-quarter earnings report on October 28, 2024.

- To open a total of 60 new stores;

- Total sales of $1.908 billion to $1.918 billion, representing growth of 14.5 percent to 15.1 percent over the prior year;

- Same-store sales growth of approximately 5.4 percent to 5.9 percent, with retail store same-store sales growth of approximately 4.8 percent to 5.4 percent and e-commerce same-store sales growth of approximately 9.7 percent to 10.2 percent;

- Gross profit between $711.6 million and $716.3 million, or approximately 37.3 percent to 37.4 percent of sales;

- Selling, general and administrative expenses between $474.3 million and $475.2 million, or approximately 24.9 percent to 24.8 percent of sales;

- Income from operations between $237.3 million and $241.1 million, or approximately 12.4 percent to 12.6 percent of sales;

- Net income of $179.4 million to $182.2 million;

- Net income per diluted share of $5.81 to $5.90, based on 30.9 million weighted average diluted shares outstanding; and

- Capital expenditures of between $115.0 million and $120.0 million, which is net of estimated landlord-tenant allowances of $30.2 million.

Fiscal Fourth Quarter Outlook

- Total sales of $451 million to $460 million, representing growth of 16.1 percent to 18.4 percent over the prior-year period;

- Same-store sales growth of approximately 5.3 percent to 7.8 percent, with retail store same-store sales growth of approximately 4.7 percent to 7.2 percent and e-commerce same-store sales growth of approximately 9.6 percent to 12.1 percent;

- Gross profit between $163.1 million and $167.8 million, or approximately 36.2 percent to 36.5 percent of sales;

- SG&A expenses between $115.4 million and $116.4 million, or approximately 25.6 percent to 25.3 percent of sales;

- Income from operations between $47.7 million and $51.4 million, or approximately 10.6 percent to 11.2 percent of sales;

- Effective tax rate of 25.4 percent; and

- Net income per diluted share of $1.17 to $1.26, based on 30.9 million weighted average diluted shares outstanding.

Image courtesy Boot Barn Holdings, Inc.