Leaders in the athletic lifestyle space expressed cautious optimism about 2025 with inflationary pressures easing, supply chains largely normalized and generally healthy interest in sports.

While consumers have been trading down to value in the inflationary climate, many athletic vendors were encouraged that consumers continue to show they’re willing to pay up for quality. Concerns include uncertainties arriving with the returning Trump administration, including the potential impact of tariffs.

This is the third installment in a three-part SGB Media series exploring the industry’s outlook for 2025. For links to the first two installments scroll to the bottom of this page.

* * *

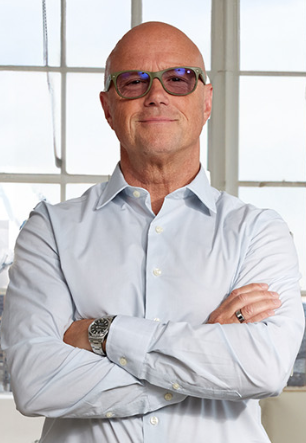

Terry Babilla

Terry Babilla

President, BSN Sports

The outlook for the team sporting goods industry in 2025 is shaped by innovation, customizable experiences and a shift in how companies engage beyond transactions with customers. As the market evolves, providing a B2C experience for B2B customers is crucial.

Teams and schools are becoming accustomed to the convenience and personalization of direct-to-consumer platforms characterized by ease of access and streamlined digital interfaces. As a result, there is a rising demand for similar experiences in B2B transactions. To stay competitive, businesses must invest in intuitive online platforms, personalized product recommendations, and efficient delivery systems. Integrating B2C elements into the B2B model allows companies like BSN Sports to meet the specific needs of coaches and athletic directors, providing a more retail-like experience that enhances customer satisfaction and loyalty. As these trends continue, the convergence of B2B and B2C models will be critical for industry success in 2025.

We also anticipate the momentum driving the growth of women’s sports to continue making a lasting impact on our industry. Encouraging girls to stay in sports is good for our communities, good for their futures and frankly good for our business. Consumers are looking to companies to be a force for good beyond just goods and services, and last year, we doubled down on our commitment to girls sports with the launch of our dedicated girls sports program, SURGE, which stands for Strength, Unity, Resilience, Growth, and Equity, aims to empower girls to stay in sports and lead healthy, successful lives. We developed this program in response to a clear need communicated by our coaches—they are craving resources and tools to elevate the experience of their girl athletes.

Mike and Rob Barnes

Co-CEOs & Co-Founders, Selkirk Sport

We see 2024 as a year of challenges and immense opportunities for the pickleball industry. While economic concerns like inflation and potential tariff changes remain on the horizon, the growing global focus on health, wellness, and community-driven activities positions pickleball and the outdoor recreation sector as a whole for continued growth.

Domestically, pickleball’s popularity continues to expand across recreational and competitive levels. Internationally, however, the potential is even more striking. Countries like Vietnam and Australia are experiencing rapid increases in the sport’s popularity, fueled by grassroots initiatives, community tournaments and widespread recognition of pickleball’s health benefits. This signals an exciting trajectory for brands ready to expand their global footprint.

Patented technologies are also set to alter the competitive landscape. As leading manufacturers invest more in unique designs and proprietary materials, it will become harder for new entrants to rely on generic technology. This trend will drive both product differentiation and heightened consumer expectations.

Looking ahead, international growth will be a major focus. For paddle companies, the core challenge by 2026 will be successfully transitioning into global organizations, balancing rising demand with the need to uphold product quality and innovation. Investments in international partnerships, culturally resonant marketing, and forging connections with diverse player communities will be critical to establishing a robust global presence.

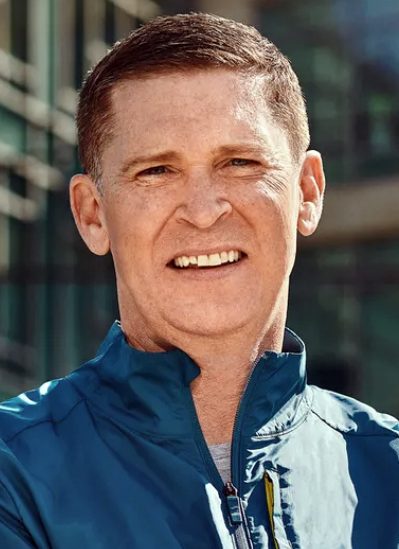

Joe DeSimone

Joe DeSimone

Founder & CEO, Lacrosse Unlimited

As we look ahead to 2025, the lacrosse industry faces challenges and opportunities. Despite inflationary pressures and supply chain disruptions, demand for lacrosse gear and rising participation rates remain strong. The sport’s growing visibility, particularly with its inclusion in the 2028 Olympics, will help attract new players.

The new leadership at US Lacrosse, focusing on youth development, presents an exciting opportunity for growth in the grassroots market. However, the rapidly changing retail landscape, especially the shift to direct-to-consumer e-commerce, means we must stay agile and innovative to meet evolving consumer expectations.

Jim Duffy

Jim Duffy

Managing Director, Equity Research Analyst, Sports and Lifestyle Brand, Stifel

The macro backdrop into 2025 is supportive for execution. The U.S. economy features low unemployment, wage growth outpacing inflation, and inflation-adjusted wealth improvement across income tiers. In foreign markets, consumers are mostly better off than a year ago with few notable exceptions (China, Germany, Australia).

Looking into 2025, consumer interest in active lifestyles and adventure continues, inventories are broadly healthy, supply chains are normalized and commodity prices are generally benign. Tariff risk is a specter for some, but following supply chain diversification after the first set of Trump tariffs, it is largely contained for most in the active footwear and apparel landscape.

Our stock selection bias favors share gainers with momentum (Birkenstock, On Holdings, Skechers), inflecting legacy players with margin recapture opportunities (Fox Factory, Under Armour, VF Corp., Wolverine Worldwide) and those with undemanding valuations and margin drivers (Columbia Sportswear and Levi Strauss). We remain cautious on brands or brand portfolios with uninspiring growth and full valuations.

Jeremy Erspamer

Jeremy Erspamer

President & CEO, Certor Sports

Certor Sports (Schutt, Vicis and Tucci) is cautiously optimistic regarding the 2025 outlook. We believe our rapidly advancing technologies, along with increasing consumer awareness of the importance of head and body protective gear, is generating quicker re-purchase cycles at the consumer level to ensure athletes are utilizing the most current technologies in their protective sporting goods equipment. Within the football space, this includes the evolution of position-specific helmets with advancing custom-fit capabilities at all levels of play. However, some team sports industry headwinds, particularly at the public high school level, with federal government funding related to COVID (in particular HEERF funds along with ESSER 1 and ESSER 2 grants) dried up at the end of 2023.

The cessation of this government funding has resulted in reduced public school budgets, causing not only widespread educator layoffs but also a reduction in available budget spend for athletic programs. Therefore, we project a slight shift in spending from high school team purchases to individual consumers as they search for the best product available if not able to be provided by the schools.

Patrik Frisk

Patrik Frisk

CEO, Reju

“The textile industry stands at a crossroads as traditional business models face intense pressure, and go-to-market strategies evolve rapidly. Over the past 25 years, we’ve witnessed the decline of mail orders, the rise of e-commerce and the acceleration of fast fashion to ultra-fast fashion. Global sourcing has consolidated largely in the Far East, while supply chain disruptions—driven by geopolitical instability and irrational supply-demand dynamics—remain a challenge.

“Retail expansion has stalled globally. Once promising markets like China have stagnated, forcing mature brands to shift focus from growth to market share attrition. Even luxury, long insulated, faces headwinds. Amidst this, factory-to-consumer models have emerged, prioritizing ultra-fast fashion, convenience, and price over sustainability or accountability. This behavior exacerbates downstream issues, flooding the second-hand market with low-quality items and destabilizing textile waste management.

“Regulation looms, with Europe set to enforce textile waste separation by 2025, intensifying pressure on an already strained system. Meanwhile, textile consumption accelerates—from 116 million tons to 124 million tons between 2023 and 2024, fueled largely by polyester.

“Opportunities persist, but success demands precision and excellence. The industry can no longer ignore the runaway train of resource extraction, pollution and waste creation. Every sale must now be earned.”

John Gaither

John Gaither

CEO, Feetures

As 2024 comes to a close, I am thankful to be in an industry that is resilient and steady even in challenging and uncertain conditions. There continue to be opportunities for the brands and retailers that are providing great products and great experiences to consumers.

The arrival of a new administration and threats of tariffs that could impact our industry create some uncertainty as we start the new year; however, any new year brings a certain amount of uncertainty, and we remain optimistic that business conditions will be favorable for our industry.

The active lifestyle consumer has already been impacted by higher prices, so it will be important that the new administration limits further inflation.

In the performance socks category, specifically, we believe there continues to be an opportunity to reach new consumers by working with retailers to educate them about the benefits of premium performance socks. We will be focused on continuing to work with our retail partners to grow the category to our mutual benefit.

Beth Goldstein

Beth Goldstein

Footwear Industry Advisor, Circana

Uncertainty in the macro environment will continue to weigh on consumers’ wallets in 2025, and, therefore, we are unlikely to see strong footwear sales growth. However, we have seen a willingness to pay a premium when given a reason to buy. Demand for retro product will continue, so brands will need to carefully manage the supply and demand here, but they should also stay focused on innovation.

Versatility will remain important, especially as consumers look to maximize value and the weather becomes more unpredictable. We’ll see the continued evolution of the retail landscape as brands look to optimize their distribution, as well as more emerging brands looking to gain share.

Kris Hartner

Kris Hartner

Founder & Owner, Naperville Running Company

We finished 2024 a bit ahead of plan and are hoping for fairly similar growth in 2025 (low-single-digit growth in customer count and mid-single-digit growth in sales).

We continue to see strength in the higher-end cushioned category. Customers are trading up from the mid-range much more frequently than they have in years. This dollar growth is spurred on by strong versions of 1080, Glycerin, Nimbus, and even the Glycerin Max which debuted in our Top 12 models. That doesn’t happen very often. The long-awaited update to the Bondi in January should bring even more activity in that price range.

Price increases seem to have leveled off and the tariff situation is a discussion with most brands. There are so many variables regarding the tariffs, but it sounds like if they do happen, it might be more in the $10 added to the suggested retail price for some of the shoes we carry.

The biggest challenge we’re seeing for 2025 is a very large increase in the ‘living wage,’ which we use as the base pay for our new full-time employees. It was $18.45 this year but has a massive increase to $24.15 for 2025, so we’re scrambling to find a way to make that work. We feel that any full-time employee of ours should be able to live in the town we operate out of. That just got a lot more difficult. I keep hoping there was a glitch in MIT’s calculation, but it doesn’t look like it.

Another big concern is the huge increase we just received notice of for our employee health insurance. It’s going up around 18 percent next year. We cover the full premium for most of our employees, and this will add around $16,000 to that cost.

Steve Lawrence

Steve Lawrence

CEO, Academy Sports + Outdoors

Looking ahead to 2025, Academy Sports + Outdoors anticipates the industry landscape for sporting goods and outdoor retailers to be shaped by a mix of cautious consumer spending, a focus on value, continued interest in newness, and an emphasis on omni-channel retailing.

Retailers that cater to value-conscious shoppers will benefit by emphasizing new partnerships, promotions and private-label offerings. As e-commerce continues to drive growth in-store, we expect to see even greater integration between the digital and physical shopping experience with a focus on rising demand for convenience, such as BOPIS.

Bob Mullaney

Bob Mullaney

CEO, RG Barry

As we approach 2025, we are prepared to thoughtfully address the challenges posed by inflation and upcoming tariffs, recognizing the significant impact these factors can have on purchasing decisions.

The evolving footwear market presents opportunities as consumers increasingly prioritize health, wellness, comfort, and versatile products that seamlessly fit into their lives. We see tremendous potential to innovate—not only in terms of style and comfort but also by adopting sustainable practices that align with their values. Sustainability isn’t just an industry expectation but a company passion to leave things in a better position than we received.

Ron Ostrowski

Ron Ostrowski

President & CEO, Rawlings Sporting Goods

We are optimistic about growth in 2025, given that baseball and softball participation seem to have returned to pre-pandemic levels and that we are finally seeing a normalization within the supply chain. However, we are concerned that tariff actions will bring inflationary pressure back to the sports industry. Furthermore, we look forward to baseball fans coming together globally in 2025. The 2024 MLB World Series yielded record viewership, and there’s plenty of excitement heading into the MLB opening day series in Tokyo between the Cubs and Dodgers, where the Rawlings brand will have a sizable presence. Looking ahead, we have dynamic marketing and sales plans to support solid future growth for our industry-leading performance product pipeline.

Joe Pellegrini

Joe Pellegrini

Senior Partner, Baird

Although 2024 turned out to be an M&A recovery year for most Wall Street advisors, we experienced significant (>50 percent) growth, and we expect our deal flow to gather pace in 2025.

Looking beyond 2024, we believe there are likely four key trends that will prompt a pickup in deal activity: Strategic buyers will continue to be ambitious, and they are better positioned from a balance sheet perspective than before the pandemic; although private equity is under pressure from limited partners to return capital before they commit to new funds, top tier firms have near record dry powder (~$1.5 trillion), and they will become more active pursuing a swelling pipeline of quality opportunities; decisionmakers, including CEOs, are gaining confidence in the political and interest rate environment, including a more stable and growing macroeconomic cycle; and evolving business models, including strategic portfolio management and corporate and PE collaborations, will likely put in play assets that would not otherwise be available, particularly as corporates streamline portfolios.

Joey Pointer

Joey Pointer

President and CEO, Fleet Feet

We have a lot of momentum heading into the new year and plan on opening a record number of new locations, with six stores opening in January alone. We’re also eyeing international expansion.

It’s never been a better time to be in the running industry. There’s a renewed excitement in brick-and-mortar retail and in delivering enhanced customer experiences. As a community retailer, this is something each and every one of our franchise owners and operating partners is passionate about.

I’m most excited about the products that are coming out this year. Brands are producing really amazing footwear across the board, and our customers will be the real winners in 2025.

Nathan Pund

Nathan Pund CEO, Brooks Running

The sun is shining on running right now, and all indicators point toward that continuing into 2025 and beyond. Those conditions present incredible opportunities for Brooks, retailers and the entire category. Best of all, consumers will benefit from fantastic product in the marketplace. We’re excited to continue our lead in performance run while expanding our product portfolio and consumer base globally.

Brooks will remain anchored in performance running shoes and apparel as we expand our brand reach to adjacent activities. Ultimately, we know growth starts with making the best product, so we’re innovating at a rapid pace. Last year, we saw great success with the launch of the Glycerin Max. This year, we’ll continue to evolve existing franchises while stepping into new categories. Brooks is accelerating our growth around the world. Despite ongoing political conversations and economic headwinds, puzzles that we’ll need to solve tactfully.

Jill Thomas

CMO, PGA Tour Superstore

The golf industry has seen impressive growth over the past five years—a 32 percent increase in participation—making it the fastest-growing sport by volume, outpacing even pickleball. Notably, this includes more diverse players hitting the links, with people of color up by 46 percent, youth increasing by 45 percent and women growing by 40 percent. This evolution brings fresh perspectives and energy to the game. We’re also seeing off-course options, like the rise of in-home simulators, making golf more accessible to a wider audience and offering new ways for golfers, both seasoned and new, to enjoy the game year-round. In fact, 6.2 million Americans used a simulator last year, a 73 percent increase from pre-pandemic levels.

CB Tuite

CB Tuite

Chief Sales Officer, OrthoLite

As a global partner to over 550 of the leading footwear brands, OrthoLite has a unique lens into both the material and development trends as well as visibility into any supply chain adjustments to mitigate geo-political risks. Brands have all been reallocating production volumes over the last few years to help avoid the potential for pandemic or geo-political disruptions. That has not changed. It was ongoing with the last administration, and it is still active and in process.

Today, the leading footwear brands are fairly well-positioned to navigate these potential challenges, which started during COVID and continue into 2025. We don’t have a crystal ball on what tariffs will or will not be implemented, but we do know that brands have shuffled production across multiple countries in anticipation of potential increases. What’s most encouraging is that the prior inventory issues have diminished as we kick off the new year, and we’ve also seen global production levels increasing, across all regions.

OrthoLite continues to expand our global capacities to support the anticipated market demands, and we expect the start of 2025 to be extremely positive. We’ve also seen an uptick in brands utilizing higher quality, more premium materials. These upgrades signal that much of the past cost-cutting initiatives are behind us as inventories improve and that the leading brands are more focused on investing in the benefits of driving both value and comfort.

Consumers demand higher quality and better performance—at a great value—and we believe that this trend will definitely continue forward.

Image courtesy Adidas

See below for additional SGB Media coverage on the 2025 Look Ahead from the outdoor active lifestyle market and industry trade associations: