Macy’s, Inc. is reporting that its reported financial results for the third quarter of 2024 are consistent with its previously announced preliminary results. The reported financial results and outlook are said to reflect revisions to properly reflect previously misstated delivery expense, the related accrual and tax effects.

As reported on November 25, as a result of an independent investigation and forensic analysis, the company identified that a single employee with responsibility for small package delivery expense accounting intentionally made erroneous accounting accrual entries to hide approximately $132 million to $154 million of cumulative delivery expenses from the fourth quarter of 2021 through fiscal quarter ended November 2, 2024. During this same time period, the company recognized approximately $4.36 billion of delivery expenses.

The company originally delayed its reporting to allow for completion of an independent investigation into erroneous accounting accrual entries. The company reported on November 25 that during the preparation of its unaudited condensed consolidated financial statements for the fiscal quarter ended November 2, it identified an issue related to delivery expenses in one of its accrual accounts. The company consequently initiated an independent investigation.

As previously communicated, the investigation determined that this matter had no impact on the company’s reported net cash flows, inventories or vendor payments.

As a result of the investigation, the company said it identified deficiencies in the design of its controls, noting that the controls did not adequately account for the risk of employees bypassing them. This oversight affected the accuracy of accrued liabilities tied to delivery and other non-merchandise costs.

The company is revising its historical consolidated financial statements that were impacted by the misstatements to properly reflect delivery expense, the related accrual and tax effects.

The total misstatement to delivery expense for the first half of fiscal 2024 amounted to $9 million, which was adjusted in total during the third quarter of 2024 as reported below. Additional details and revised financial information for fiscal years 2021, 2022, and 2023, and quarterly periods for fiscal year 2023 can be found in the company’s Form 8-K filed on December 11 with the Securities and Exchange Commission (SEC).

Notes to the third quarter income statement and balance sheet to reflect the outcome of the company’s investigation into the accounting matter include:

- Inclusive of go-forward locations and digital. For Macy’s, Inc. this reflects go-forward locations and digital across all three nameplates.

- Inventories and Gross Margin are not directly comparable to the prior year given the conversion to cost accounting at the beginning of fiscal 2024.

- To properly reflect delivery expense, third quarter of 2024 gross margin includes a $13 million adjustment (of which $9 million relates to the first half of 2024), or approximately 30 bps, and third quarter of 2024 adjusted diluted EPS includes a 4 cents adjustment. Third quarter of 2023 gross margin has been revised by $3 million, or approximately 10 basis points. There is no change to third quarter of 2023 diluted EPS or adjusted diluted EPS.

“We’ve concluded our investigation and are strengthening our existing controls and implementing additional changes designed to prevent this from happening again and demonstrate our strong commitment to corporate governance,” said Spring. “Our focus is on ensuring that ethical conduct and integrity are upheld across the entire organization.”

“As the company evaluates and enhances its internal control over financial reporting, it may take additional measures to modify, or add to, the remediation measures,” Macy’s added.

However, the retailer is also reported it is revising its EPS guidance downward for the full year, an announcement that sent M shares tumbling nearly 10 percent in pre-market trading on Wednesday, December 11.

Third Quarter Sales Summary

As previously reported, Macy’s, Inc.’s net sales decreased 2.4 percent to $4.74 billion in the fiscal third quarter, with comparable sales down 2.4 percent on an owned basis and down 1.3 percent on an owned-plus-licensed-plus-marketplace basis. Sales growth at Macy’s First 50 locations, Bloomingdale’s, and Bluemercury was offset primarily by weakness in Macy’s other non-First 50 locations as well as its digital channel and cold weather categories.

Macy’s, Inc. go-forward business comparable sales were down 2.0 percent on an owned basis and down 0.9 percent on an owned-plus-licensed-plus-marketplace basis. By nameplate:

- Macy’s net sales were down 3.1 percent in the third quarter, with comparable sales down 3.0 percent on an owned basis and down 2.2 percent on an owned-plus-licensed-plus-marketplace basis. Fragrances, dresses and men’s and women’s active apparel were said to be strong. Macy’s go-forward business comparable sales were down 2.6 percent on an owned basis and down 1.8 percent on an owned-plus-licensed-plus-marketplace basis.

- First 50 locations comparable sales were up 1.9 percent on both an owned basis and on an owned-plus-licensed basis as investments in staffing, merchandising, visual presentation and eventing continued to resonate with the customer.

- Bloomingdale’s net sales were up 1.4 percent, with comparable sales up 1.0 percent on an owned basis and up 3.2 percent on an owned-plus-licensed-plus-marketplace basis. Key drivers included strength in contemporary apparel, beauty and digital.

- Bluemercury net sales were up 3.2 percent and comparable sales were up 3.3 percent on an owned basis, representing the fifteenth consecutive quarter of comparable sales growth. Customers continued to respond well to the breadth of skincare offerings.

Other revenue of $161 million decreased $17 million, or 9.6 percent. Within Other revenue:

- Credit card revenues, net decreased $22 million, or 15.5 percent, to $120 million. Net credit losses contributed to the year-over-year decline and were in-line with the company’s expectations.

- Macy’s Media Network revenue, net rose $5 million, or 13.9 percent, to $41 million, reflecting higher advertiser and campaign counts.

Asset sale gains of $66 million were $61 million higher than last year due to the monetization of non-go-forward assets, as part of the company’s Bold New Chapter strategy. Higher asset sale gains reflect the pull-forward of the monetization of certain non-go-forward assets into the third quarter from the fourth quarter, at better-than-expected valuations.

“Our third quarter results reflect the positive momentum we are building through our Bold New Chapter strategy,” said Tony Spring, chairman and CEO, Macy’s, Inc. “We are encouraged by the consistent sales growth in our Macy’s First 50 locations and the strong performance of Bloomingdale’s and Bluemercury. Quarter-to-date, comparable sales continue to trend ahead of third quarter levels across the portfolio. Looking ahead, we remain committed to achieving sustainable, profitable growth for Macy’s, Inc.”

Income Statement Summary

Gross margin2, 3 of 39.6 percent decreased 60 basis points year-over-year. Merchandise margin declined 70 basis points due to product mix and the conversion to cost accounting. The decline in merchandise margin was partially offset by efficiencies in the company’s fulfillment network and lower shipped sales volume.

Selling, general and administrative (SG&A) expense of $2.1 billion increased $24 million year-over-year. SG&A expense growth reportedly reflected strategic customer-facing investments, partially offset by continued cost controls. As a percent of total revenue, SG&A expense increased 160 basis points to 42.1 percent due to lower total revenue.

Asset sale gains of $66 million were $61 million higher than the Q3 period last year due to the monetization of non-go-forward assets, as part of the company’s Bold New Chapter strategy. Asset sale gains reflect the pull-forward of the monetization of certain non-go-forward assets into the third quarter from the fourth quarter.

GAAP diluted earnings per share (EPS) was 10 cents a share and Adjusted diluted EPS was 4 cents per share, compared to GAAP diluted EPS of 15 cents a share and Adjusted diluted EPS of 21 per share in the third quarter of 2023.3

Balance Sheet and Liquidity

Merchandise inventories2 increased 3.9 percent year-over-year. The conversion to cost accounting was estimated to account for approximately half of the increase from the prior year. The company believes its merchandise inventories reflect the appropriate level of newness.

The company ended the third quarter of 2024 with cash and cash equivalents of $315 million and $2.8 billion of available borrowing capacity under its asset-based credit facility reflecting current borrowings and letters of credit.

Total debt of $2.9 billion at quarter-end included $86 million of short-term borrowings under the company’s asset-based credit facility and no material long-term debt maturities until 2027. The company voluntarily retired $220 million of debt during the quarter through a previously disclosed tender offer.

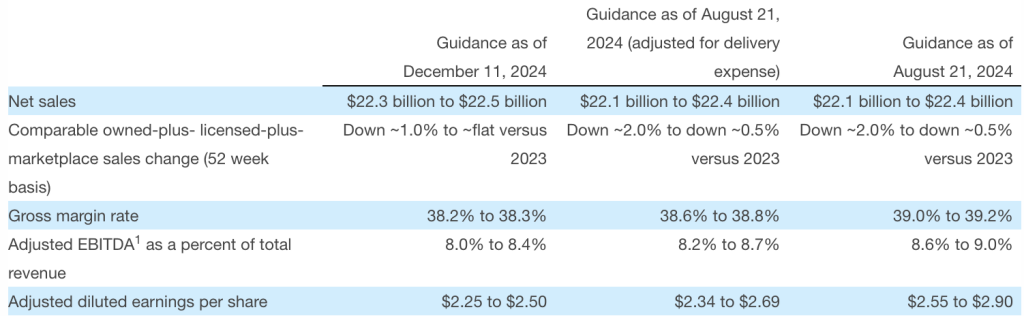

2024 Guidance

The company updated its annual outlook.

Gross margin as a percent of net sales, adjusted EBITDA, and adjusted diluted EPS guidance as of December 11, 2024 includes the impact from the aforementioned $13 million adjustment to delivery expense in the third quarter of 2024 as well as an updated estimated delivery expense impact of $66 million for the fourth quarter of 2024, for a full year estimated impact of $79 million. These impacts were not included in the company’s previously provided guidance. Additionally, for comparison purposes, the company has presented guidance as of August 21, 2024 both as provided and adjusted for the third and fourth quarter of 2024 delivery expense impacts.

Adjusted diluted EPS excludes any potential impact from the credit card late fee ruling, which was stayed on May 10, 2024. Additionally, the impact of any potential future share repurchases associated with the company’s current share repurchase authorization is also excluded.

Image courtesy Macy’s Inc.

Macy’s, Inc. Delays Q3 Results After Employee Hid More Than $132M of Delivery Expenses