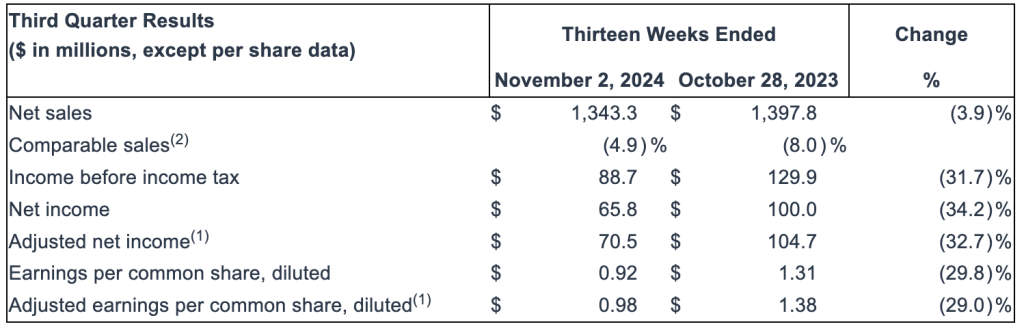

Academy Sports and Outdoors, Inc. missed third-quarter Wall Street estimates for the 13-week period ended November 2, as sales for the quarter declined 3.9 percent year-over-year to $1.34 billion and comparable store sales fell 4.9 percent on top of an 8.0 percent decrease in the year-ago Q3 period. Analysts were reportedly expecting a 1.7 percent decline in sales year-over-year.

The company’s bottom line was a more significant miss, as diluted EPS fell 29.8 percent year-over-year to 92 cents a share. Analysts were forecasting a flat year-over-year performance at $1.31 per diluted share. Adjusted earnings per diluted share were down 29.0 percent year-over-year to 98 cents per diluted share.

Over the last 30 days, there has been a downward revision of 1.1 percent in the consensus EPS estimate for the quarter, leading to its current level.

“We delivered third-quarter sales in line with expectations and were encouraged to see an improvement in comp sales trends versus the first half of the year,” said Steve Lawrence, CEO of Academy Sports and Outdoors, Inc. “In our Outdoor division, the team drove a sales increase in the quarter of 7 percent compared to fiscal third quarter last year. We are excited that the 16 new stores that we have opened this year are exceeding our expectations and that our prior year vintages continue to grow. The team has made tremendous progress refining our new store opening process and pipeline, as well as improving our website experience, expanding our targeted marketing capabilities with our new loyalty program and streamlining our supply chain. The fundamentals of our business continue to strengthen, and we look forward to building on this momentum throughout the fourth quarter and beyond.”

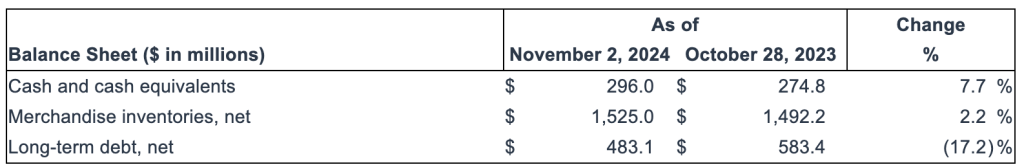

Balance Sheet Summary

Inventory and Cash Flow Management

Academy generated $97 million and $388 million in GAAP operating cash flow and $34 million and $252 million in adjusted free cash flow during the third quarter and year-to-date in fiscal 2024, respectively, which is an increase of 126 percent and 67 percent versus the third quarter and year-to-date in fiscal 2023, respectively.

2024 Outlook

“We are looking forward to a strong fourth quarter and holiday season as our team continues to focus on execution and serving our customers,” said Ford. “Based on our third quarter performance and expectations for the remainder of fiscal 2024, we are narrowing our full-year sales and earnings guidance.”

Image courtesy Academy Sports + Outdoors

See below for more SGB Media coverage of Academy Sports and Outdoors and executive insights on trends and initiatives.

EXEC: Academy Execs Talk Q3 Results, Q4 Hopes and 2025 Initiatives, Including Big Nike Boost