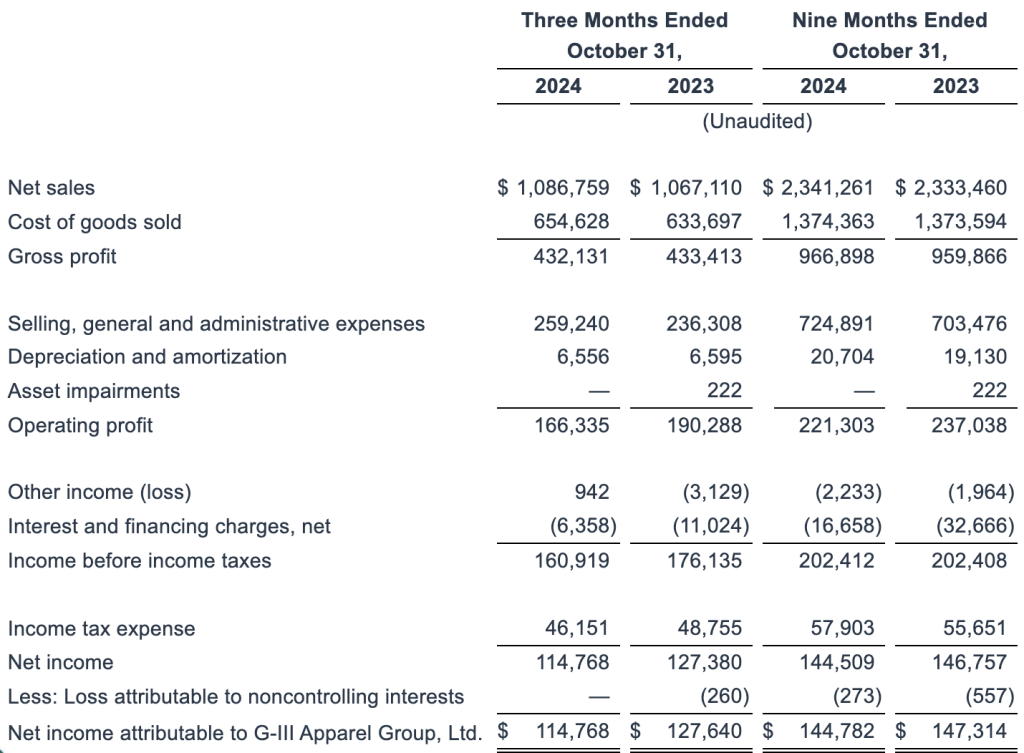

G-III Apparel Group, Ltd. reported net sales for the third quarter, which ended October 31, 2024, increased 1.8 percent to $1.09 billion compared to $1.07 billion in the prior-year Q3 period.

Net income for the quarter was $114.8 million, or $2.55 per diluted share, compared to $127.6 million, or $2.74 per diluted share, in the prior year’s third quarter.

Non-GAAP net income per diluted share was $2.59 for the third quarter ended October 31, 2024, compared to $2.78 in the Q3 period last year.

Non-GAAP net income per diluted share excludes:

- in the third quarter of fiscal 2025, a $1.6 million write-off of deferred financing costs related to the redemption of senior secured notes,

- in the third quarter of fiscal 2025, $0.5 million in one-time severance expenses related to a closed warehouse,

- in the third quarter of fiscal 2024, incentive compensation expenses of $1.8 million related to the Karl Lagerfeld transaction,

- in the third quarter of fiscal 2024, non-cash imputed interest expense of $0.7 million related to the note issued to the seller as part of the consideration for the acquisition of Donna Karan International, and

- in the third quarter of fiscal 2024, asset impairments of $0.2 million.

The aggregate effect of these exclusions was equal to 4 cents per diluted share in the third quarter of this year and 4 cents per diluted share in last year’s third quarter.

Balance Sheet Summary

Total debt decreased 52 percent to $224.2 million at the end of this year’s third quarter compared to $461.9 million at the end of the third quarter of last year. In August 2024, a $400.7 million payment was made to voluntarily redeem the entire $400 million principal amount of the notes at a redemption price equal to 100 percent of the principal amount of the notes plus accrued and unpaid interest. The payment was made with cash and borrowings from the revolving credit facility.

Inventories decreased 10 percent to $532.5 million at quarter-end, compared to $591.5 million at third quarter-end last year.

Outlook

The company updated its outlook for the fiscal year ending January 31, 2025. This outlook anticipates the current macroeconomic and consumer environment and the unseasonable weather. The outlook also includes approximately $55.0 million (before roughly $60.0 million) in incremental expenses, primarily associated with the launches of Donna Karan, Nautica and Halston. Approximately 60 percent of these expenses are related to marketing initiatives to support the Donna Karan and DKNY brands. The remaining costs are principally associated with talent and technology to expand operational capabilities.

Fiscal 2025

- Net sales are expected to increase by approximately 2 percent to ~$3.15 billion (prior ~$3.20 billion), compared to net sales of $3.10 billion for fiscal 2024.

- Net income is expected to be between $185.0 million and $190.0 million (prior range $179.0 million to $184.0 million) or diluted earnings per share between $4.08 and $4.18 (prior range $3.94 to $4.04). This compares to net income of $176.2 million, or $3.75 per diluted share, for fiscal 2024.

- Non-GAAP net income for fiscal 2025 is expected to be between $186.0 million and $191.0 million (prior range $180.0 million to $185.0 million), or diluted earnings per share between $4.10 and $4.20 (prior range $3.95 to $4.05). This compares to non-GAAP net income of $189.8 million, or diluted earnings per share of $4.04 for fiscal 2024.

- Adjusted EBITDA for fiscal 2025 is expected to be between $309.0 million and $314.0 million (prior range $305.0 million to $310.0 million) compared to adjusted EBITDA of $324.1 million in fiscal 2024.

- Net interest expense is expected to be approximately $20.4 million, including a $1.6 million non-GAAP charge related to the write-off of deferred financing costs associated with the redemption of the notes.

- The company is estimating a tax rate of 28.6 percent for fiscal 2025, ending January 31, 2025.

Image courtesy G-III Apparel Group/Donna Karan