American Outdoor Brands, Inc. sent AOUT shares flying in the mid-teens in after-hours trading on Thursday afternoon after reporting results for the fiscal second quarter ended October 31 came in ahead of expectations and prompted the company to raise guidance for the full fiscal year. That trend continued throughout the day Friday, strengthening the company’s position for the year with shares up nearly 50 percent for the year-to-date period.

Company President and CEO Brian Murphy shared that the company’s fiscal second quarter performance surpassed their expectations, showcasing the strength of their strategy.

“More specifically, we believe our results validate the long-term commitment we’ve made to being an innovation company, yielding differentiation in a highly dynamic environment. We believe our ability to innovate year after year has given us a unique and compelling advantage,” Murphy said in prepared comments on an analyst conference call.

“Importantly, we delivered positive growth across every single sales channel, including traditional, e-commerce, domestic, and international,” Murphy continued. “And it is especially notable that our growth in the quarter was driven entirely by inline products, well ahead of the new product launches that we have planned for the second-half of our fiscal year.”

Murphy said the company achieved year-over-year net sales growth in both the Outdoor Lifestyle and Shooting Sports categories and achieved its highest ever shipping month in October from its Columbia, MO facility.

“Our ability to ship to this unprecedented level was made possible in part by efficiencies we gained by expanding our facility lease in January 2024,” added CFO Andrew Fulmer. “By controlling 100 percent of our Missouri facility, we’ve been able to optimize our floor plans, workflow, and shipping logistics, all of which combine to make October’s record-level shipments possible; great job to the distribution team.”

Fiscal Q2 net sales were $60.2 million, an increase of 4.0 percent compared with net sales of $57.9 million for the prior-year Q2 period.

- In the Outdoor Lifestyle category, products from the company’s B0g, Meat! Your Maker, and Grilla brands reportedly delivered strong hunting, meat processing and outdoor cooking performance during the quarter, with sales increasing 5.4 percent.

- In Shooting Sports, products from the company’s Caldwell Claymore family and Tipton brand drove strength in shooting accessories that more than offset weakness in personal protection products. Category net sales grew by nearly 2 percent compared to last year’s Q2 period.

“I’ll just add a reminder that while we don’t produce firearms, our shooting sports category tends to align with adjusted NICS background check results, which were up by about 1 percent for the same period,” offered Fulmer.

“Turning now to our distribution channels, increased and expanded distribution channel opportunities are one of the avenues that comprise our long-term strategic growth plan,” Fulmer expanded. “Specifically, we work to identify, secure, and expand opportunities to introduce our products to a broader consumer audience.”

Fulmer said the Traditional (wholesale to retail) channel net sales increased by 4.3 percent year-over-year in Q2, while E-commerce net sales increased by 3.5 percent compared to Q2 last year.

The E-commerce channel includes direct-to-consumer (DTC) sales from the company’s own websites, as well as sales by online retailers that do not have brick-and-mortar stores.

“We continue to expand our presence in the international markets as well,” noted the CFO. “Our brands are reaching more Canadian consumers than ever before, helping to deliver international net sales of $3.4 million, which comprised roughly 6 percent of our total net sales in the quarter and represented year-over-year growth of nearly 15 percent.”

Income Statement Summary

Second quarter gross margin was 48.0 percent, up 230 basis points compared with 45.7 percent for the comparable quarter last year. Fulmer said the increase was mainly due to expected favorable inbound freight costs and the timing of some promotional programs that occurred in Q2 last year that did not materialize in Q2 this year.

GAAP operating expenses for the second quarter were $25.8 million, compared to $26.5 million in Q2 last year. The improvement was said to be driven mainly by lower legal and advertising costs as well as a reduction in intangible asset amortization offset by an increase in compensation expense.

“Our OpEx reduction this quarter is a great demonstration of the disciplined cost management philosophy we employ in the ordinary course of business,” added Fulmer. “Specifically, our teams are always looking for ways to avoid building unnecessary costs into the business. It’s an approach that helps us maintain a lower level of expense over the long term, allowing us to be agile and asset light when responding to changes in our environment without resorting to large and sudden cost cuts. This approach supports the sustainability of our long-term model and will serve us well as we grow our top line.”

On a non-GAAP basis, operating expenses in Q2 were reportedly “up slightly” to $22.7 million in Q2, compared to $22.3 million in Q2 last year. Non-GAAP operating expenses exclude intangible amortization, stock compensation, and certain non-recurring expenses as they occur.

On a GAAP basis, net income was $3.1 million, or 24 cents per diluted share, compared with a GAAP net income of $77,000, or 1 cent per diluted share, in Q2 last year.

On a non-GAAP basis, net income was $4.9 million, or 37 cents per diluted share, compared with non-GAAP net income of $3.3 million, or 25 cents per diluted share, in fiscal Q2 last year.

GAAP to non-GAAP adjustments for net income reportedly exclude acquired intangible amortization, stock compensation, technology implementation, emerging growth status transition costs, and other costs.

Quarterly non-GAAP Adjusted EBITDAS was $7.5 million, or 12.4 percent of net sales, compared with Adjusted EBITDAs of $5.2 million, or 9.0 percent of net sales, for the prior-year Q2 period.

Fulmer also noted that on a trailing 12-month basis, adjusted EBITDAS was $12.9 million, up from $11.4 million for the trailing 12-month period a year ago.

“We believe these results demonstrate the success of our long-term strategy to leverage our innovation advantage to broaden our distribution opportunities, expand consumer and retailer awareness of our brands, and strengthen our margins,” said Murphy.

Balance Sheet and Cash Management Summary

Fulmer added that the company continued to demonstrate disciplined capital management in the second quarter, building inventory to support customer order strength, and repurchasing roughly $1.0 million of our common stock. AOUT ended the second quarter with cash of $14.2 million and no debt.

“We’ve talked in the past about the seasonal nature of our business where our highest quarterly net sales occur in Q2 and Q3,” said Fulmer. “This pattern typically results in the first-half of our fiscal year reflecting operating cash outflow from increases in accounts receivable and inventory, followed by operating cash inflow in the second-half of the year as we collect those receivables and lower our inventory levels.”

Operating cash outflow for the second quarter was $7.9 million, reportedly driven mainly by an increase in accounts receivable (AR) of approximately $17 million. The increase in AR was partially driven by the sequential increase in net sales in Q2 versus Q1, as well as by timing of shipments, which were said to be higher toward the end of the second quarter.

Fulmer reported that inventories increased by $4.9 million at quarter-end, as expected, to support the upcoming holiday season and to replenish levels for expected sales in the fiscal third quarter.

The CFO said the company spent $468,000 on CapEx in the second quarter, mainly for product tooling and patent costs.

“We’ve always been very disciplined when it comes to capital allocation, and Q2 was no exception,” Fulmer said. “We’ve invested first and foremost in organic growth, and the results we are delivering in the current fiscal quarter and year and our outlook for the year ahead demonstrate the importance of that priority.”

On the M&A front, Fulmer said the company continues to continue to seek out M&A opportunities that fit its criteria and can deliver growth. He said they will safeguard the strength of the balance sheet and identify opportunities to return capital to shareholders through buybacks.

The company’s Board of Directors approved a new $10 million share repurchase program, effective October 2024 through September 2025. In the second quarter, the company, repurchased roughly 111,000 shares for $1 million at an average price of $9 per share.

Updated Outlook for Fiscal 2025 and Preliminary Fiscal 2026

Both executives said they were very pleased with the success of recent line reviews with several key retailers. As a result, the company expects to receive “initial load-in orders” for some of its major new products from those retailers beginning in the fiscal fourth quarter and continuing into fiscal 2026.

“Accordingly, we would expect inventory to increase slightly in Q3 and then drop back to approximately $110 million by the end of fiscal 2025,” Fulmer noted. He said it is somewhat higher than discussed last quarter but it directly supports the growth outlook for fiscal 2026 net sales provided.

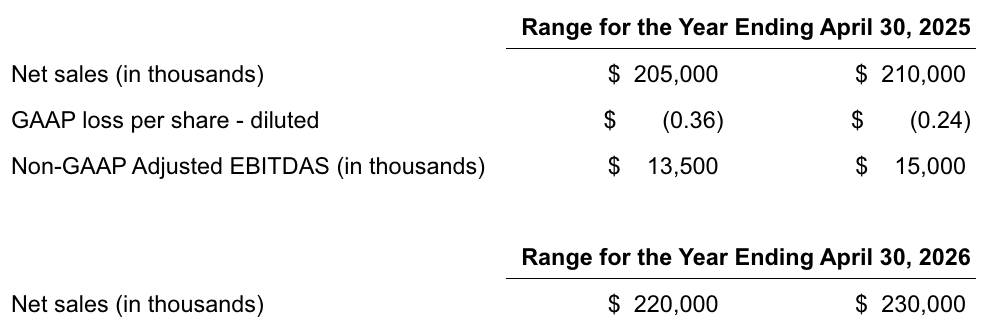

As a result of the strong quarter and strong feedback at retail, the company is increasing its guidance for fiscal 2025, and providing an initial net sales outlook for fiscal 2026, which begins May 1, 2025.

Fulmer said the indications received from retailers have enabled the company to increase expectations for growth, not only in the current year but into fiscal 2026 as well, driven by a combination of strength in existing product lines, key new product launches, and new distribution opportunities.

“We are increasing our net sales guidance to a range of $205 million to $210 million for fiscal 2025. Net sales at the midpoint of that range would yield growth of 3.2 percent for the full-year,” Fulmer shared with the call participants. “This compares to our original framework for net sales growth of up to 2.5 percent for the year.”

When looking at just Q3, AOUT expects net sales growth of “about 5 percent.”

Fulmer also said expectations for gross margins have improved, and they now expect gross margins for the full-year to be approximately 45.5 percent of sales compared to 44.0 percent for the prior fiscal year.

“As we discussed on our earnings call in early September, we expect gross margins in the second-half of fiscal 2025 to be lower than Q1 and Q2 due to increased amortization of tariff and freight variances related to higher inventory purchases that occurred in the first-half of the year,” the CFO explained. “Combined with the delayed Q2 promotions I mentioned earlier that are likely to materialize in the second-half of the year. As a result, we expect Q3 gross margins to be roughly 45 percent.”

With regard to operating expense, we expect overall OpEx in fiscal 2025 to increase slightly over the prior year due to higher variable selling and distribution costs driven by our higher net sales range.

Fulmer indicated that the company expects Q3 OpEx to be slightly higher than in Q3 last year.

“As a reminder, Q3 OpEx is typically higher than other quarters due to the cost of trade shows like Shot Show, in January,” he explained. “Based on all of these factors, we have increased our estimate of adjusted EBITDAS for fiscal 2025 from a range of 5.5 percent to 6.0 percent of net sales to a range of between 6.6 percent and 7.1 percent of net sales, or $13.5 million to $15 million.

“At the midpoint, this would represent year-over-year adjusted EBITDAS growth of roughly 46 percent,” the CFO noted.

“Lastly, while it’s a bit early in our cycle to provide an outlook for our next fiscal year, the early order indications we’ve received from retailers for both our inline products and our upcoming new products have given us greater visibility into the future,” he said said. “Therefore, we are able to share that, for fiscal 2026, we believe our net sales will be between $220 million and $230 million, which would represent growth of 8.4 percent at the midpoint.”

With respect to profitability in fiscal ’26, Fulmer said they don’t plan to provide that outlook until they get closer to the new fiscal year, when they may have a bit more clarity around the impact of the new administration, particularly as it relates to tariffs.

“For now, barring any new tariff impacts or other unforeseen changes, we know that our model yields roughly a 30 percent contribution on incremental net sales over current levels,” Fulmer summarized.

“Turning to capital expenditures, our operating model is designed to require annual CapEx of roughly 2 percent of net sales for patents, tooling, and maintenance investments, and our expectations for fiscal 2025 are right in line with that model,” Fulmer noted.

For full-year fiscal 2025, AOUT continues to expect to spend $3.5 million to $4.5 million on CapEx, including a small amount to build out the new factory outlet store in its Missouri facility, which is expected to open in the spring of 2025.

Image courtesy Bog/American Outdoor Brands, Inc.