Frasers Group, the UK-based parent of the Sports Direct, Flannels, Jack Wills, House of Fraser, and Gieves and Hawkes retail brands, saw shares fall over 10 percent on the London Stock Exchange on Thursday, December 5, following the Mike Ashley-owned global sports and lifestyle retail giant issuing a profit warning for the full year after reporting first- half (H1) results.

The company said, “Both ahead of and after the recent Budget, consumer confidence has weakened, and recent trading conditions have been tougher.” The Budget reference is to the Budget put in place by the new UK Labour Party, while the other concerns follow a recent British Retail Consortium (BRC) report for October sales in the country.

Frasers Group, which dropped off the FTSE 100 on Thursday, said it expects costs to increase by £50 million in the next financial year due to higher employer National Insurance bills and other measures announced in the government’s Budget. The company said it is “working hard to mitigate these to maintain our profitable growth ambitions.”

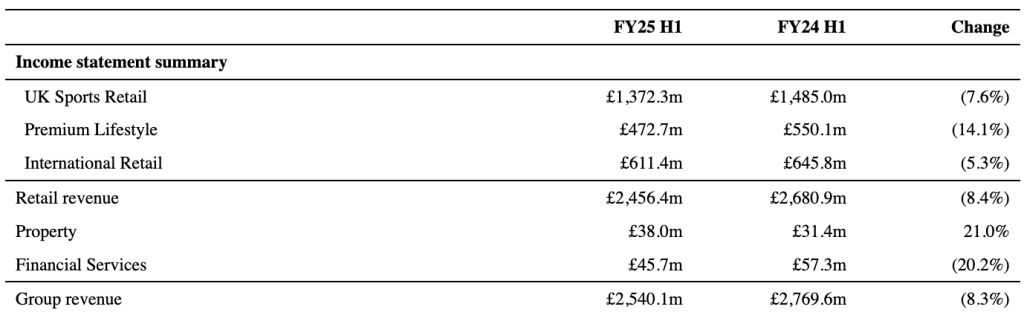

Frasers Group trades and reports in the British pound (£) currency. Group revenue fell 8.3 percent to £2.54 billion in the fiscal 2025 first half ended October 27, compared to £2.77 billion in the prior-year first half.

Michael Murray, CEO of Frasers Group, said continued sales growth from Sports Direct, reflecting the ongoing success of the Elevation Strategy and strengthening brand relationships, was more than offset by planned declines in Game UK, Studio Retail, the companies acquired from JD Sports and SportMaster in Denmark as these previously unprofitable businesses were right-sized and put on a more sustainable footing, as well as a challenging luxury market.

Group gross margin increased to 43.4 percent of sales in the H1 period, compared to 43.0 percent in the fiscal 2024 H1 period, reportedly due to an improved mix effect, as the lower margin percent businesses reduce as a proportion of total revenue and the higher margin Sports Direct business increases its share.

UK Sports Retail

(54.0 percent of total group revenue)

UK Sports revenue decreased 7.6 percent year-over-year (y/y for the first half. Murray said continued sales growth from Sports Direct reflected the ongoing success of the Elevation Strategy and strengthened brand relationships, which was more than offset by planned declines in Game UK and Studio Retail.

Gross profit decreased £35.8 million due to the sales decline, but gross margin reportedly increased by 100 basis points to 45.4 percent of sales, reflecting the fact that the higher-margin Sports Direct business now makes up a greater proportion of this segment.

Operating costs in the segment declined by £44.3 million in H1 as the benefits of integrating and right-sizing the lower-margin businesses were reported realized. Murray said this contributed to an £8.5 million (3.4 percent) increase in the segment’s profit from trading.

Premium Lifestyle

(18.6 percent of total group revenue)

Murray said the company continues to develop and invest in its unique luxury position, including the recent opening of flagships Flannels in Leeds and Frasers in Sheffield, and right-sizing the premium businesses such as House of Fraser and JD Sports acquisitions.”

“Our long-term ambitions for the luxury business remain unchanged, although it is likely that progress will remain subdued for the short- to medium-term in the face of a challenging market,” Murray noted in his letter to investors. “However, we continue to view this as an opportunity for consolidation to further strengthen our position.

Premium Lifestyle segment revenue decreased 14.1 percent y/y for the first half as the company continued to optimize its store portfolio in House of Fraser and the businesses acquired from JD Sports. The number of stores was reduced from 66 doors at the end of October 2023 to 37 doors at the end of October 2024, and the company reduced square footage from 2.3 million square feet to 1.5 million square feet.

Segment profit from trading increased £16.4 million y/y, with a £38.5 million decrease in gross profit, driven by the revenue decline and a 210 basis-point decline in gross margin from 36.9 percent in H1 last year to 34.8 percent in H1 this year. Murray said this was helped by inventory cleared in closing stores as a result of continuing luxury market softness. This was more than offset by a £54.9 million decrease in operating costs as the company realized the benefits of integrating and right-sizing the Premium Lifestyle businesses.

International Retail

(24.1 percent of total group revenue)

Revenue reportedly decreased 5.3 percent y/y as growth from the Sports Direct International business was more than offset by declines in revenue from Game Spain, which has now reached the end of its games console cycle, and Sportmaster, which the company integrated in fiscal 2024 second half.

Segment profit from trading decreased £24.0 million y/y. Gross profit decreased by £9.7 million as a result of the revenue declines for the first half, although gross margin increased by 60 basis points to 40.6 percent of sales as the higher margin Sports Direct International business grows as a proportion of the segment. Overhead costs increased £14.3 million y/y due to inflationary pressures and acquisition-related costs.

“We continue to explore opportunities for international expansion and have completed the acquisition of Twinsport in the Netherlands, invested in Australia/New Zealand group Accent, and invested in Maltese/North Africa retailer/Nike distributor Hudson,” Murray noted. “After the period ended, we announced the acquisition of Holdsport in South Africa/Namibia.”

See SGB Media‘s coverage of the Holdsport acquisition at the bottom of this report.

Property

(1.5 percent of total group revenue)

Murray said that property investment remains a key focus for the Group. It unlocks occupational demand for the retail business while delivering strong property returns that can be recycled at the appropriate time.

Revenue increased by £6.6 million, or 21.0 percent, year-over-year, primarily due to the impact of the prior-year acquisitions, such as the Castleford shopping center and acquisitions in the reported period.

Segment profit from trading increased £12.6 million y/y, with the additional rental income supplemented by lower operating costs.

Financial Services

(1.8 percent of total group revenue)

Murray said the company sees an excellent opportunity for Frasers Plus as a new revenue stream and a key pillar of its compelling brand ecosystem. “Frasers Plus has made good early progress towards our long-term ambition of delivering £1 billion-plus in sales, £600 million in credit balances, a greater than 15 percent yield, and over 2 million active Frasers Plus customers (excluding any third-party partnerships),” Murray noted in his letter.

The business reportedly added 272,000 new customers in the reported H1 period and ended the first half with an active customer base of 377,000, at which point Frasers Plus accounted for 13.7 percent of UK online sales.

The company reportedly continues to prioritize the growth of its new Frasers Plus credit offering and reduce the Studio Retail receivables book. As a result, revenue decreased by £11.6 million (20.2 percent) compared to the prior-year first half.

Segment profit from trading decreased £25.4 million y/y, reportedly due to the revenue decline, partially offset by a moderate decrease in the impairment charge and an increase in overhead costs arising from the dual running of Frasers Plus. The prior-year H1 period also benefited from an £11.8 million gain regarding exiting a legacy property lease.

“The strategic partnership with THG has gotten off to a positive start. After period end, we announced a second Frasers Plus partnership with Hornby plc,” Murray said.

Looking at the balance of the financial reports, Frasers Group reported Adjusted profit before tax (APBT) of £299.2 million, a 1.5 percent decline for the year-ago H1 period. The company said it is on track to achieve another year of profitable growth.

Image courtesy Sports Direct/Frasers Group