Gap Inc., parent of the Athleta, Banana Republic, Gap, and Old Navy retail brands, reported that third quarter net sales grew for the fourth consecutive quarter and said it gained market share across all brands while meaningfully expanding operating margin.

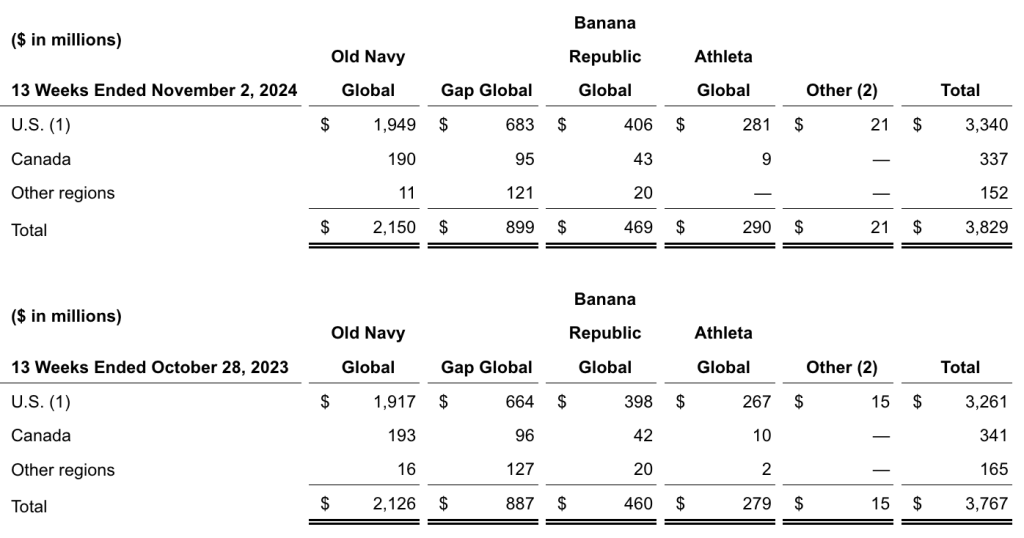

Consolidated net sales across all banners totaled $3.8 billion in Q3, up 2 percent year-over-year (y/y) compared to the 2023 Q3 period. Comparable sales were up 1 percent year-over-year.

“Due to the 53rd week in fiscal 2023, in order to maintain consistency, comparable sales for the third quarter of fiscal 2024 are compared to the 13 weeks ended November 4, 2023,” the company said.

“Consistent execution of our strategic priorities, including the rigor and repetition we’re applying to our brand reinvigoration playbook, is making us a stronger company and demonstrates our continued progress in unlocking Gap Inc.’s full potential,” said company President and CEO Richard Dickson in a media release.

“Holiday is off to a strong start and we remain focused on executing with excellence in the fourth quarter,” Dickson continued. “Our performance year-to-date gives us the confidence to raise our full year outlook for sales, gross margin and operating income growth.”

Channel Summary

- Store sales decreased 2 percent y/y in the quarter.

- Online sales increased 7 percent y/y, representing 40 percent of total net sales for the quarter.

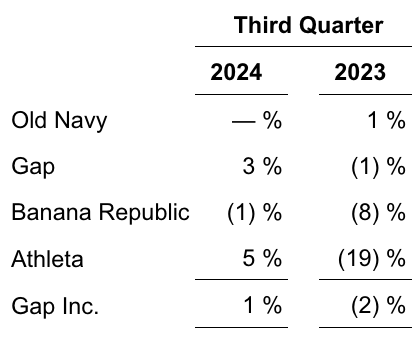

Comparable Sales

Athleta

Athleta third quarter net sales of $290 million were up 4 percent compared to Q3 last year. Comparable sales were up 5 percent year-over-year. The brand returned to positive comparable sales in the quarter as its new product and marketing are resonating with customers.

“We’ve been eagerly anticipating the return to growth for Athleta,” commented Dickson on a conference call with analysts. “While the team has been working hard to improve the product, marketing and stores. This quarter, we reached an inflection point with a positive plus 5 percent comp and we’re feeling increasingly confident in the trajectory of the brand.”

Dickson said they are building their Athleta customer file and have implemented a new marketing methodology and media mix model, which is driving compelling social narratives and attracting new higher-value customers.

“We still have work to do to increase traffic, but we’re pleased our brand communication is beginning to resonate with customers in a more meaningful way,” he said. “The momentum Athleta has had growing new followers on TikTok is noteworthy with the brand becoming one of the platform’s fastest-growing sportswear retailers since its launch in February.”

But Dickson attributed the Q3 success primarily to, and built around, the efforts the team has been working around product, marketing, in-store experience.

“All of this really came together in the quarter and it showed up in the results,” he said. “It’s also important to note that we had share gains as well in a category that has been really important for us collectively to grow. We saw great success with our new product, particularly in core bottoms and our limited edition drops. We’ve also seen continued strength in other key categories in the brand. Our marketing is resonating. We’ve begun to really broaden our customer base as our marketing and media continue to gain traction. We’ve had meaningful acceleration in our new follower growth on TikTok. And we’ve been seeing great amplification of the Power of She through our culturally relevant activations that are happening all over the country.”

Dickson said for Q4 they really believe they have a much stronger product and visual presentation.

“We’re expanding the distribution of the limited edition drops I mentioned that are working really well and we’re, of course, advancing and implementing innovative media strategies that are really driving at the speed of culture. I’m really very, very confident in the progress that we’re seeing in Athleta. It’s encouraging. The team has energy and momentum and we’re feeling increasingly confident in the trajectory of the brand,” he shared.

Banana Republic

Banana Republic reported third quarter net sales of $469 million, a 2 percent y/y increase. Comparable sales were down 1 percent year-over-year. The brand saw strength in its men’s business during the quarter and remains focused on fixing the fundamentals.

Gap

Gap banner third quarter net sales amounted to $899 million for the quarter, up 1 percent y/y compared to Q3 last year. Comparable sales were up 3 percent y/y, representing the fourth consecutive quarter of positive comparable sales at the brand. Gap’s strong product and marketing execution have helped drive continued momentum and consistent results at the brand.

Old Navy

Old Navy saw third quarter net sales inch up 1 percent y/y to $2.2 billion. Comparable sales were said to be flat for the period. The company said the brand’s continued focus on operational rigor and brand reinvigoration drove solid performance in the quarter, despite lapping tougher compares and facing weather-related headwinds.

Income Statement Summary

- Gross margin amounted to 42.7 percent of sales in Q3, a 140 basis point improvement versus the 2023 Q3 period. Merchandise margin increased 90 basis points y/y, primarily driven by improved inventory management.

- Rent, occupancy, and depreciation (ROD), as a percent of sales, leveraged 50 basis points versus last year’s Q3 period.

- Operating expense was $1.3 billion.

- Operating income was $355 million, resulting operating margin of 9.3 percent for the period.

- The effective tax rate was 24 percent in Q3.

- Net income was $274 million for the third quarter, or diluted earnings per share of 72 cents, for the third quarter.

Balance Sheet Summary

- Gap Inc. ended the quarter with cash, cash equivalents and short-term investments of $2.2 billion, an increase of 64 percent from the prior-year Q3 period.

- Year-to-date net cash from operating activities was $870 million.

- Year-to-date free cash flow, defined as net cash from operating activities less purchases of property and equipment, was $540 million.

- Inventory was $2.33 billion at quarter-end, down 2 percent from the third quarter-end last year.

- Capital expenditures were $330 million for the quarter.

Gap Inc. paid a third quarter dividend of 15 cents per share, totaling $57 million. The company’s Board of Directors approved a fourth quarter fiscal 2024 dividend of 15 cents per share.

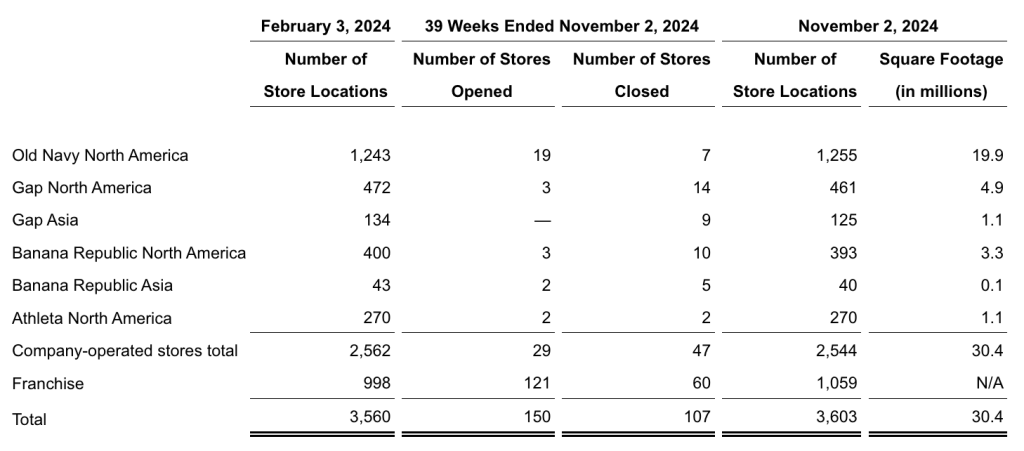

Store Breakdown

The company ended the quarter with 3,603 store locations in roughly 40 countries, of which 2,544 were company operated doors.

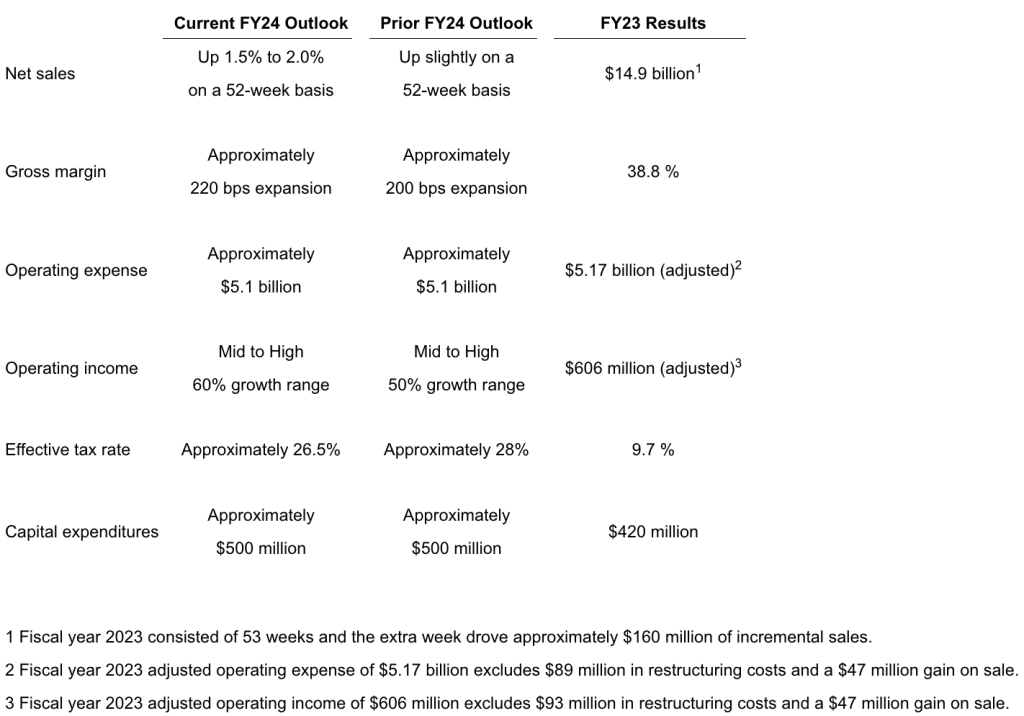

Fiscal 2024 Outlook

As a result of the company’s strong third quarter results, the Gap Inc. is raising its full year outlook for net sales, gross margin and operating income growth compared to prior expectations.

The company noted that full year fiscal 2023 adjusted operating income, which excludes $93 million in restructuring costs and a $47 million gain on sale of a building.

Image courtesy Athleta/Gap Inc.