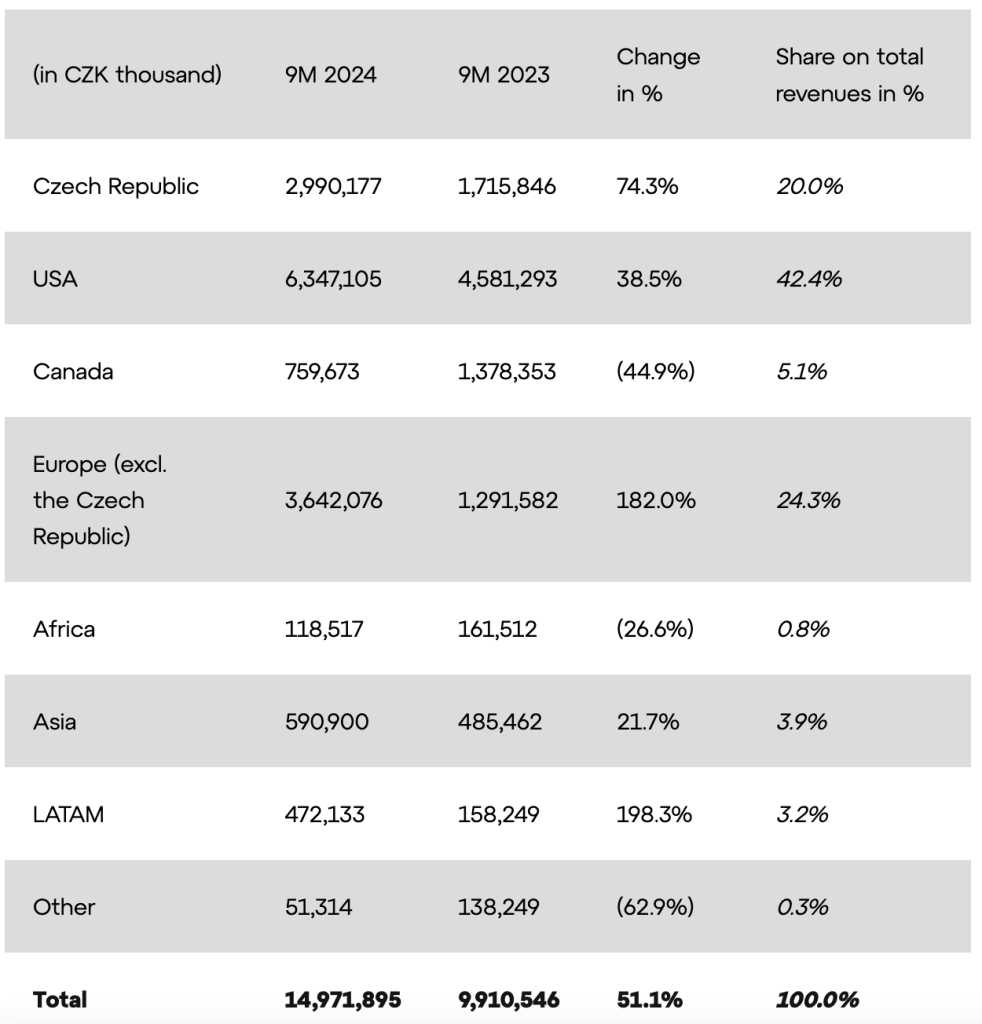

Colt CZ Group SE is reporting that Group revenue in the first 9 months of 2024 (YTD 2024) amounted to CZK 14,971.9 million, up 51.1 percent year-over-year (y/y), said to be due to both the organic growth and the consolidation of Sellier & Bellot in May 2024. The increase in sales was recorded in both the military and law enforcement segment and the commercial segment, as well as in all regions except Canada and Africa.

Colt CZ Group SE reports in the Czech Koruna (CZK) currency.

Geographically, the growth was recorded mainly in Europe including the Czech Republic and also in the USA.

- Czech Republic revenues were up 74.3 percent y/y to CZK 2,990.2 million as of September 30.

- United States region revenues increased 38.5 percent y/y to CZK 6,347.1 million for YTD 2024 thanks to the stabilization of the U.S. commercial market and the consolidation of revenues of the new acquisition Sellier & Bellot in May 2024.

- Canada revenues reached CZK 759.7 billion in YTD 2024, down 44.9 percent y/y, driven by a higher comparable base (one-off delivery to the Canadian government in connection with aid for Ukraine last year) and seasonality of deliveries to the local customer.

- Europe revenues (excluding the Czech Republic) increased 182.0 percent y/y to CZK 3,642.1 million for the nine months ended September 30, due to the consolidation of revenues of acquisitions in the ammunition segment – Sellier & Bellot in May 2024 and swissAA in Switzerland.

- Africa revenues decreased 26.6 percent to CZK 118.5 million for the nine months ended September 30, said to be primarily due to the lack of larger M&LE contracts which tend to be relatively seasonal.

- Asia revenues increased 21.7 percent y/y to CZK 590.9 million for the 2024 YTD period.

- Colt CZ started reporting revenues for the new Latin America region, where sales for the YTD 2024 period amounted to CZK 472.1 million, which is up 198.3 percent year-over-year.

- Revenues from sales to other parts of the world reached CZK 51.3 million in YTD 2024, down by 62.9 percent year-over-year.

Breakdown of Group Revenue by Regions

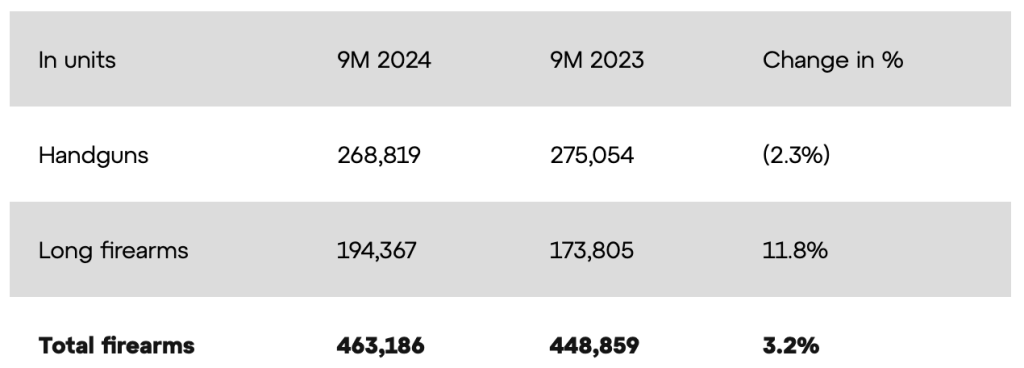

Firearms and Accessories Segment

The firearms and accessories segment includes the design, production, assembly and sale of firearms, tactical accessories and optical mounting solutions for the military and law enforcement, personal defense, hunting, sport shooting, and other commercial use.

In the 2024 YTD period, the company said there was an increase of 3.2 percent y/y in the number of firearms sold, which amounted to 463,186 units. Higher sales of long firearms were recorded, which rose 11.8 percent y/y to 194,367 units, while sales of handguns recorded a slight decrease of 2.3 percent y/y. The company said it is also registering a recovery in the U.S. commercial market in the handguns segment.

Year-to-Date Units Sold by Firearm Type

Revenue from the firearms and accessories segment increased 11 percent y/y in YTD 2024, to a total of CZK 11.0 billion, primarily based on growth in the number of firearms sold and a favorable sales mix.

Ammunition Segment

The ammunition segment consists of the design, production and sale of small-caliber ammunition, including pistol and rifle ammunition, together with shotgun shells for hunting, sport shooting, and military and law enforcement, as well as the production and sale of grenades and other military material. It also includes the development and production of ammunition manufacturing machinery and tools.

Starting from the first half of 2024, the company reports for the ammunition segment in accordance with IFRS. In the ammunition segment, the company includes revenues from its subsidiaries Sellier & Bellot (from May 2024), swissAA, and the relevant part of revenues of Colt CZ Defense Solutions. In the newly reported ammunition and munitions segment, the Group achieved revenues of CZK 4.0 billion in YTD 2024.

EBITDA and Adjusted EBITDA

In the 2024 YTD period, EBITDA went up by 31.5 percent to CZK 2,244.3 million compared with the YTD period last year, primarily thanks to the organic sales growth, especially in the second quarter of this year, the recovery of the US commercial market, a better sales mix of products with higher added value (higher share of orders from the M/LE segment), as well as the consolidation of the new acquisition of Sellier & Bellot in May 2024.

The adjusted EBITDA went up by 56.1 percent to CZK 3,020.9 million compared with the same period of last year. The most significant one-off items were expenses related to the employee stock option plan and one-off expenses connected with the acquisition of Sellier & Bellot – inventory step-up and commodity hedging.

Profit Before Tax

Profit before tax decreased by 51.3 percent y/y to CZK 920.9 million for YTD 2024, due to the impact of financial operations, cost associated to share based payment related to the employee stock option plan, the increase in depreciation and amortization related to the acquisition of Sellier & Bellot and the revaluation of inventory also related to this acquisition.

Net Profit / Adjusted Net profit

Profit for the 2024 YTD period decreased by 54.0 percent to CZK 708.7 million compared with the same period of last year, due to the impact of financial operations cost associated to share based payment related to the employee stock option plan, the increase in depreciation and amortization related to the acquisition of Sellier & Bellot and the revaluation of inventory also related to this acquisition.

Profit for YTD 2024, adjusted for extraordinary items, decreased by 12.8 percent to CZK 1,292.7 billion compared with the same period in 2023.

Investments

The Group’s cash capital expenditures were CZK 655.6 million in YTD 2024, up 54.7 percent y/y, representing 4.4 percent of total revenues in this period which is in line with the 2024 guidance (approximately 5 percent of 2024 revenues). Approximately 56 percent of investments went to the Czech Republic, 31 percent to North America and approximately 13 percent to subsidiaries in other countries, especially Switzerland.

2024 Guidance

In the context of financial results for YTD 2024, and development as of the date of this report, the company confirmed its guidance for the rest of 2024, including the results of this year’s acquisition of Sellier & Bellot.

The capital expenditures of the Group in 2024 may reach CZK 1-1.2 billion which represents a 5 percent share of the 2024 expected revenues and is in line with the medium-term target of the company.

Completion of the sale of shares through an accelerated bookbuilding in October 2024

In October 2024, the company successfully completed ABB of 3,900,000 new registered book-entry shares. In the offering, the price per share was set at CZK 575, which at the time of the offering represented only a 7 percent discount to the market price. Investor demand at this price exceeded the number of shares sold by roughly 1.5x. The ABB attracted a number of new institutional investors and Colt CZ successfully diversified its shareholder base. The transaction volume of CZK 2.24 billion (approx. EUR 90 million) was the largest ABB on the Czech capital market since 2016.

The settlement took place on October 18, 2024. The capital increase resulted in a change in the ownership structure. The stake of the majority owner Česká zbrojovka Partners SE, after the sale, equaled 51.8 percent, the stake of CBC Europe S.à r.l. was 24.4 percent and the free float was 23.8 percent. The company intends to use the sale proceeds for investments in further growth and reduction of existing debt.

Image courtesy Colt CZ