According to a CNBC/NRF Retail Monitor report released this week, retail sales bounced back strong in October with the economy remaining in good shape; consumers moved past concerns over a port strike and other issues that had slowed September sales.

The leaders in year-over-year growth included E-Commerce and catalog stores, Clothing, Footwear, and accessories stores, and Health and personal Care stores.

The Sporting Goods sector, which also includes Hobby, Music and Book stores, posted solid (+2.7 percent) month-over-month results but declined year-over-year.

“Healthy spending resumed in October as consumers continued to benefit from this year’s job gains and higher wages,” offered NRF President and CEO Matthew Shay. “Inflation is mostly limited to services at this point and prices for some retail goods are actually falling. October sales have set the stage for a good start to the holiday shopping season.”

SGB Media rounds all variance percentages to the closest tenth of a percent.

Total retail sales, excluding automobiles and gas, were up 0.7 percent seasonally-adjusted month-over-month (m/m) and up 4.1 percent unadjusted year-over-year (y/y) in October, according to the most recent Retail Monitor report. That compared with a decrease of 0.3 percent m/m and an increase of 0.55 percent y/y in September, when consumers showed caution due to geopolitical tensions, a strike at East and Gulf Coast ports and the end of student loan relief programs.

The Retail Monitor calculation of core retail sales, excluding restaurants, auto dealers and gas stations, was up 0.8 percent m/m in October and up 4.6 percent year-over-year. That compared with a decrease of 0.3 percent m/m and an increase of 0.94 percent y/y in September.

The year-over-year increase in total sales was said to be the largest since 4.2 percent growth in November 2023, while the year-over-year increase in core sales was the largest since 4.8 percent growth in August 2023.

Total sales were up 2.1 percent y/y for the first 10 months of 2024 and core sales were up 2.4 percent for the period.

Unlike survey-based numbers collected by the Census Bureau, the Retail Monitor uses actual, anonymized credit and debit card purchase data compiled by Affinity Solutions and does not need to be revised monthly or annually.

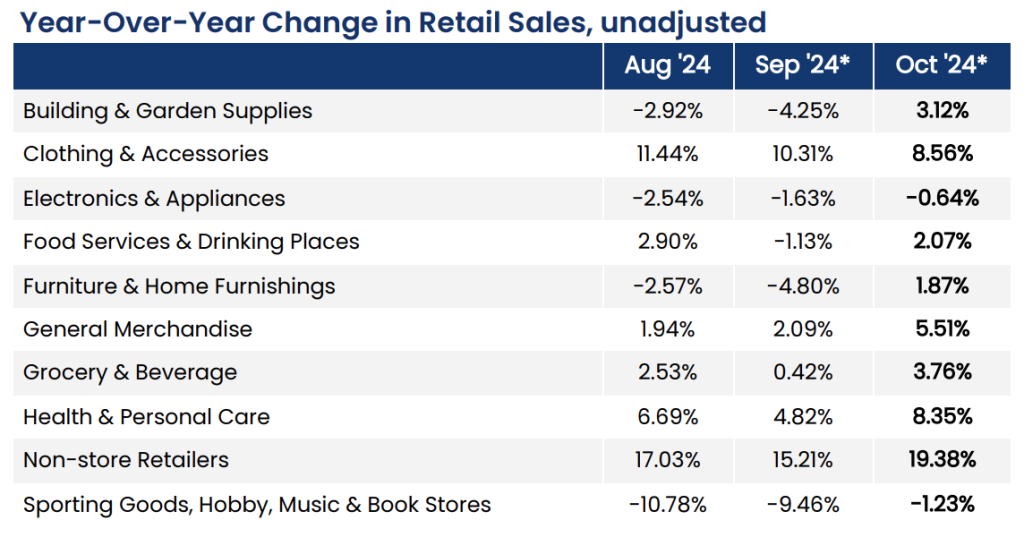

October sales were said to be up in seven out of nine retail categories on a yearly basis, led by Online sales, Clothing, Footwear and Accessories stores and Health and Personal Care stores. Sales were also reportedly up in seven categories on a monthly basis. Specifics from key sectors include:

Retail Sector Year-over-Year Variances

Please note: The Clothing & Accessories sector also includes Footwear retailers.

Please note: The Clothing & Accessories sector also includes Footwear retailers.

To access the full Retail Monitor report, go here.

Image courtesy Gorsuch