Columbia Sportswear Company Chairman and CEO Tim Boyle sees the company’s third quarter financial results as a continuation of the trends it has experienced all year as the North American outdoor marketplace remains challenged and the company works to maximize sales in a soft consumer demand environment. Outside of North America, Boyle said the company continues to experience positive momentum in most direct and distributor businesses led by its China and Europe direct business.

“Third quarter net sales declined 5 percent year-over-year and came in at the low end of our guidance range,” Boyle shared on a conference call with analysts. “Despite this, we were able to exceed our diluted earnings per share guidance range through a better than planned gross margin and disciplined expense management.” And Boyle said that the company’s financial position remains strong.

“We exited the quarter with cash and short-term investments of over $370 million and no debt,” he continued. “We are on track to generate over $300 million in operating cash flow this year. In addition to investing in our business to drive long-term profitable growth, we are returning free cash flow to shareholders via dividends and share repurchases.”

But as the company its peak sales season, Boyle admitted there’s no shortage of uncertainty, especially with the warm temperatures in the market. One analyst pointed out that it was 75 to 80 degrees in New York this week, hardly the kind of weather that drives outerwear sales.

“We await the arrival of colder weather in many regions of the world,” Boyle said. “With this in mind, we are taking a more cautious net sales outlook for the remainder of the year. Despite the top line pressure, we are slightly raising the bottom end of our diluted earnings per share guidance.”

But Boyle is also focused on the Columbia brand’s recently announced initiative entitled “Accelerate,” which is a growth strategy intended to elevate the brand and attract younger and more active consumers.

“Over the past 86 years, we’ve built an extraordinary company and one of the largest outdoor brands in the world. Our top strategic priority is to accelerate profitable growth, and I know our company is capable of growing rapidly,” Boyle commented.

The Accelerate growth strategy is reportedly centered around several consumer-centric shifts and enhanced ways of working.

First, Columbia has strengthened its consumer segmentation framework to clearly define the growth opportunities ahead. Boyle said the brand will continue to serve its existing consumers with accessible outdoor essentials while also focusing on bringing new, younger active consumers into the brand.

“We know that this consumer segment is the largest and fastest-growing part of the outdoor market,” Boyle noted. “We already successfully serve this consumer outside the U.S. where we are seeing strong growth in markets like China and Europe. In the coming seasons, our brand, product and marketplace strategies in the U.S. will focus on reaching younger, more active consumers. We know that when we deliver the right product to the right consumers at the right time, we win in the marketplace.”

During the Q&A portion of the call, Boyle added that the company believes the younger consumers are already in the brand. “We know they’re in the brand internationally; we just need them to be more involved in the brand domestically,” he said.

He said the expectation is that with new marketing leadership and help from a new creative agency the Columbia brand is going to be returning to a more differentiated approach to a humorous, irreverent brand personality where it can be really quite different and be more important to these consumers that it is trying to attract.

“We believe that they’re already in the brand and they know the brand well,” he reiterated. “It’s just a question is that we’re don’t have enough of them. So that’s the plan is to spend more to get those folks to spend it more efficiently and to get the messaging properly.”

When asked how much the demand creation line would increase under this new program, Boyle did not have a firm percentage or value yet.

“We haven’t settled on a firm number yet but we know we need to spend more and we’re building those additional costs into other parts of the business so that we can offer growth and expanding operating margin as well,” he responded.

Accelerate’s second shift is to elevate consumers’ perception of the brand.

“We’re doing this with a refreshed creative strategy that brings Columbia’s unique brand personality to life,” Boyle explained. “We’re embracing the spirit of the brand that our one tough mother, Gert Boyle, made famous. We engineer exceptional products for whatever life throws at you, helping to keep consumers warm, dry, cool and protected. And at the same time, we don’t take ourselves too seriously. The Columbia brand is fun, irreverent and authentic, and this will become increasingly evident in our marketing.”

Accelerate’s third shift is around product.

“The foundation of our success is creating iconic products that are differentiated, functional and innovative,” Boyle continued. “Under the leadership of Woody Blackford, our product teams have a new product construct to drive growth with targeted consumer segments.”

He said that consumers already trust the Columbia brand for its quality, value and reliability.

“In the coming seasons, we will be emphasizing innovation and style with new products as well as updates to our most iconic styles,” he shared. “We’re reducing our assortment to focus our efforts on fewer, more powerful collections with clear purpose.”

Accelerate’s fourth shift is elevating the position of the Columbia brand in the U.S. marketplace.

“To activate our brand and product strategies, we will invest alongside our best-in-class strategic retail partners to elevate in-store presentations and bring our unique brand and products to life,” Boyle committed.

“In our direct-to-consumer e-commerce business, we’ve already begun to evolve columbia.com to be the best expression of the brand. We want visitors to come to the site to see our latest products and innovations with enriched brand storytelling,” he said. “In our brick & mortar stores, we’re focusing on enhancing our assortments and in-store presentations to tell better brand stories and drive sales.”

Accelerate’s fifth shift in is an integrated full funnel marketing strategy.

“We’ll have a greater emphasis on the consistent year ’round share of voice in the market,” Boyle explained. “Not only are we planning to invest more into marketing but we’re also going to be more efficient with how and where we activate these demand creation investments.”

He said they will be more differentiated with creative marketing activations and immersive ways to experience the brand.

“Combined, our Accelerate product, marketing, and marketplace strategies are engineered to get the right product to the right consumers at the right place in time,” Boyle said, utilizing an age-old strategy on a new program. “This will enable us not only to meet our consumers where they are but inspire them to go further with us.”

He said the company is excited to bring Accelerate to life.

“This will be a multi-year strategy that steadily builds momentum in the seasons ahead. As 2025 progresses, the changes we’re making will be increasingly evident to consumers,” he concluded. “While we are not prepared to provide financial metrics for the Accelerate growth strategy at this point, I firmly believe these actions will drive brand-right profitable growth. We will seek to balance brand investments with disciplined expense management to achieve our goal of profitable growth with operating margin expansion over time.”

Third Quarter Sales Summary

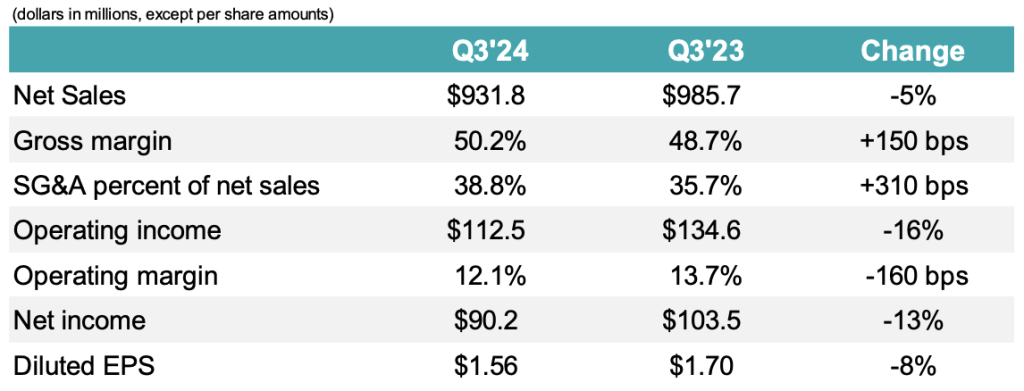

Consolidated net sales decreased 5 percent (-5 percent constant-currency) to $931.8 million in the third quarter, compared to $985.7 million for the comparable period in 2023, driven by a 9 percent decline in global Wholesale net sales, partially offset by 2 percent direct-to-consumer (DTC) growth. The company said the decline in net sales reflects lower Fall ’24 wholesale orders, as well as weak consumer demand in the U.S. partially attributable to warm weather and outdoor category headwinds.

Regional Sales Summary

U.S. Region net sales decreased 10 percent to $571.3 million, compared to $635.4 million in Q3 2023, said to be primarily driven by a mid-teens percent decrease in U.S. Wholesale.

As previously reported, the Fall 2024 order book in the U.S. was down in mid-single digits.

“While still very early in the season, Wholesale sell-through has gotten off to a slow start,” Boyle shared. “We expect sell-through to pick up with the arrival of cold weather.

U.S. DTC net sales were said to be “relatively flat.” Brick & mortar was reportedly up in mid-single digits, driven by a contribution from the temporary clearance locations, increased store productivity and new stores opened over the last year.

U.S. e-commerce net sales were down in the high-teens, said to reflect challenging outdoor market conditions as well as a shift in Columbia.com digital marketing strategies.

Latin America Asia Pacific (LAAP) region net sales increased 17 percent (+18 percent cc) to $135.0 million.

China net sales increased in the low-20s with healthy growth across Wholesale and DTC. Despite broader economic headwinds in China, the outdoor category continues to grow, Boyle shared. He said Colombia is capitalizing on this trend with localized product lines like Transit and unique brand activations that highlight Colombia’s heritage and innovation.

“Columbia had an incredibly successful Super Brand Day on Tmall ranking third in sales volume across all outdoor brands,” Boyle noted. “On TikTok, Columbia’s first footwear store launched and is off to a strong start. It’s exciting to see the Columbia brand realize its full growth potential in this important region, and it remains on track to be one of our fastest-growing markets this year.”

Japan net sales increased in double digits for the quarter, said to be aided by continued strength in international tourism.

Korea net sales increased in mid-single digits. “During the quarter, we appointed Jeff McPike as the new General Manager of Columbia Sportswear Korea,”Boyle added. “Jeff is a 25-year industry veteran with a passion for building innovative omni-channel consumer experiences. His marketplace expertise will be instrumental in building the right strategy to drive our business forward in Korea.”

LAAP Distributor markets were up in the mid-20s, said to primarily reflect robust Fall 2024 orders.

Europe, Middle East and Africa (EMEA) region net sales increased 10 percent in both reported and constant-currency terms to $148.8 million.

Europe direct net sales increased in low-single digits, led by a robust DTC growth.

“The European team is doing an exceptional job of creating brand visibility and relevance with unique marketing activations like the Hike Society,” Boyle said. “This season, we hosted 90 hike Society events, creating grassroots connections with young hikers and introducing them to Columbia Technologies.”

Boyle said the Europe DTC business remains on track to be one of the company’s fastest-growing markets this year. The EMEA distributor business increased ~130 percent, reportedly driven by a shift in timing of shipments as well as higher Fall 2024 orders on the strength of the Columbia brand in many distributor markets.

Canada net sales decreased 21 percent (-21 percent cc) to $83.7 million, reportedly driven by lower Wholesale sales. Boyle said the Columbia brand remains well positioned in Canada with high brand awareness and consumer trust.

Brand Sales Summary

Columbia Brand net sales decreased 1 percent to $799.7 million in the third quarter, said to primarily reflect a challenging marketplace in the U.S. and Canada, partially offset by a continuation of healthy trends in most international markets.

“This fall, we have several innovations that are integral to our product and marketing strategies. Omni-Heat Infinity remains our largest innovation platform and one of the fastest-growing parts of our business,” Boyle said. “Our newest cold weather innovation, Omni-Heat Arctic, will be prominently featured in our DTC channels.”

Mountain Hardwear net sales increased 2 percent (+3 percent cc) $29.6 million, driven by DTC growth.

“The brand has several exciting brand and product activations for the balance of the year including an expanded Ghost Whisperer collection, new snow sports offerings and a soon to be announced Product Collab Mountain Hardwear’s product line and brand positioning are on track and the team is focused on accelerating growth,” Boyle said.

Prana net sales decreased 7 percent in both reported and constant-currency terms to $28.6 million in the quarter.

“I’m encouraged by the progress the Prana leadership team has made in recent months activating Wholesale distribution, refreshing marketing and recruiting new talent to the team. I’m confident these actions position the brand for growth starting with a positive order book for Spring 2025,” Boyle added.

Sorel brand net sales decreased 39 percent in both reported and constant-currency terms to $73.9 million, said to be driven by lower fall 2024 orders and elevated clearance and promotional sales activity in the prior year.

Boyle said the Sorel team is focused on building brand, product and marketplace strategies to drive the long-term growth potential that he knows the brand is capable of, adding “this process will take time and I expect sales trends will remain under pressure in the Spring 2025 season.”

Income Statement Summary

Gross margin expanded 150 basis points to 50.2 percent of net sales in Q3, compare to 48.7 percent of net sales for the comparable period in 2023, said to primarily reflect lower inbound freight costs and favorable channel and region net sales mix, partially offset by unfavorable FX hedging rates.

SG&A expenses were $361.2 million, or 38.8 percent of net sales, in the quarter, compared to $351.6 million, or 35.7 percent of net sales, for the comparable period in 2023. The largest changes in SG&A expenses were said to be higher direct-to-consumer (DTC) and incentive compensation expenses, partially offset by lower supply chain and demand creation expenses.

Operating income was $112.5 million, or 12.1 percent of net sales, in Q3, compared to operating income of $134.6 million, or 13.7 percent of net sales, for the comparable period in 2023.

Interest income, net of $5.4 million, compared to $1.9 million for the comparable period in 2023, reflects higher yields on increased levels of cash, cash equivalents, and investments.

Income tax expense of $29.0 million resulted in an effective income tax rate of 24.4 percent, compared to income tax expense of $32.6 million, or an effective income tax rate of 24.0 percent, for the comparable period in 2023.

Net income was $90.2 million, or $1.56 per diluted share, compared to net income of $103.5 million, or $1.70 per diluted share, for the comparable period in 2023.

“Third quarter results reflect ongoing strength in most international markets, offset by continued softness in North America,” offered company Chairman, President and CEO Tim Boyle. “While warm weather has curbed early season demand for Fall 2024 cold weather product, I’m excited about the differentiated innovations we are offering consumers, including Omni-Heat Infinity and Omni-Heat Arctic, as well as the lightweight comfort provided by our Omni-Max footwear platform.

Balance Sheet Summary

- Cash, cash equivalents, and short-term investments totaled $373.9 million at quarter-end, compared to $214.8 million as of September 30, 2023.

- The company had no borrowings as of either September 30, 2024 or September 30, 2023.

- Inventories decreased 10 percent to $798.2 million, compared to $885.2 million as of September 30, 2023.

Cash Flow for the Nine Months Ended September 30, 2024

- Net cash used in operating activities was $76.6 million, compared to net cash provided from operating activities of $22.2 million for the same period in 2023.

- Capital expenditures totaled $41.7 million, compared to $41.4 million for the comparable period in 2023.

Share Repurchases for the Nine Months Ended September 30, 2024

- The company repurchased 2,916,970 shares of common stock for an aggregate of $230.9 million, or an average price per share of $79.15.

- At September 30, 2024, $114.5 million remained available under our stock repurchase authorization.

- On October 24, 2024, the Board of Directors authorized a $600 million increase to the company’s share repurchase authorization, which does not obligate the company to acquire any specific number of shares or to acquire shares over any specified period of time.

Quarterly Cash Dividend

The Board of Directors approved a regular quarterly cash dividend of 30 cents per share, payable on December 4, 2024 to shareholders of record on November 20, 2024.

Outlook

Full Year 2024 Financial Outlook

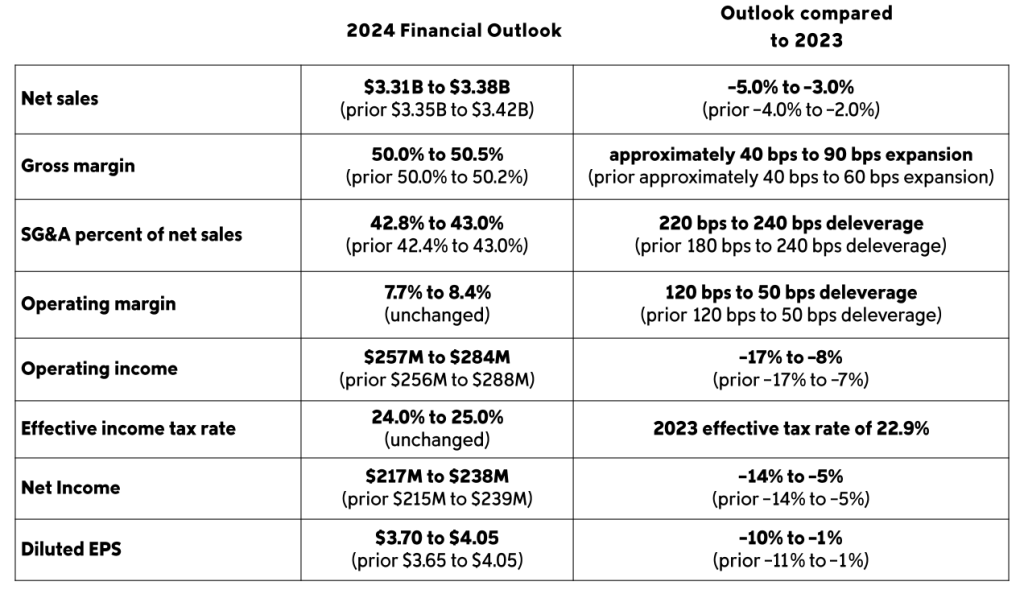

Net sales are expected to decrease 5.0 percent to 3.0 percent (prior decrease of 4.0 to 2.0 percent), resulting in net sales of $3.31 to $3.38 billion (prior $3.35 billion to $3.42 billion), compared to $3.49 billion in 2023

Gross margin is expected to expand 40 basis points to 90 basis points (prior 40 basis points to 60 basis points) to 50.0 percent to 50.5 percent of net sales (prior 50.0 percent to 50.2 percent) from 49.6 percent of net sales in 2023.

SG&A expenses, as a percent of net sales, are expected to be 42.8 percent to 43.0 percent (prior 42.4 percent to 43.0 percent), compared to SG&A expense as a percent of net sales of 40.6 percent in 2023.

Operating income is expected to be $257 million to $284 million (prior $256 million to $288 million), resulting in operating margin of 7.7 percent to 8.4 percent (unchanged), compared to operating margin of 8.9 percent in 2023.

Interest income, net is expected to be approximately $30 million (prior $28 million).

Effective income tax rate is expected to be 24.0 to 25.0 percent (unchanged).

Net income is expected to be $217 million to $238 million (prior $215 million to $239 million), resulting in diluted earnings per share of $3.70 to $4.05 (prior $3.65 to $4.05). This diluted earnings per share range is based on estimated weighted average diluted shares outstanding of approximately 58.7 million (prior 59.3 million).

Foreign Currency

Foreign currency translation is expected to have a modestly unfavorable impact on full year net sales.

Foreign currency is expected to have an approximately 1 cent negative impact on diluted earnings per share (prior 7 cents) due to negative foreign currency transactional effects from hedging of inventory production, partially offset by favorable foreign currency translation impacts.

Cash Flows

Operating cash flow is expected to be at least $300 million (prior $350 million).

Capital expenditures are planned to be in the range of $60 to $70 million (prior $60 to $80 million).

Fourth Quarter 2024 Financial Outlook

Net sales are expected to be $1.04 billion to $1.11 billion, representing a decline of 2 percent to growth of 5 percent from $1.06 billion for the comparable period in 2023.

Operating income is expected to be $123 million to $151 million, resulting in operating margin of 11.8 percent to 13.6 percent, compared to operating margin of 10.7 percent in the comparable period in 2023.

Diluted earnings per share is expected to be $1.68 to $2.03, compared to $1.55 per diluted share for the comparable period in 2023.

Preliminary First Half 2025

Based on the company’s Spring ‘25 order book, Columbia Sportswear Company is forecasting mid-single-digit percent growth in global wholesale net sales in first half 2025. This reflects growth across all regions, and in the Columbia, Prana and Mountain Hardwear brands.

Image, data and tables courtesy Columbia Sportswear Company