Shimano, Inc. reported its first sales increase in several quarters, as a recovery in bike components offset a slight decline in its fishing tackle business.

Extrapolating six-month results from nine-month results shows sales in the third quarter ended September 30 reached ¥117,992 million against ¥112,014 million a year ago, representing a gain of 5.3 percent.

Sales had fallen 15.2 percent in the second quarter and 20.2 percent in the first quarter.

Operating income in the third quarter improved 8.4 percent to ¥19,696 million from ¥18,178 million a year ago.

In the nine months, Shimano’s sales declined 10.8 percent to ¥334,879 million compared to ¥375,264 million a year ago. Operating income decreased 29.7 percent to ¥50,651 million, ordinary income dropped 39.4 percent to ¥58,262 million, and net income attributable to owners of parent decreased 31.3 percent to ¥41,343 million.

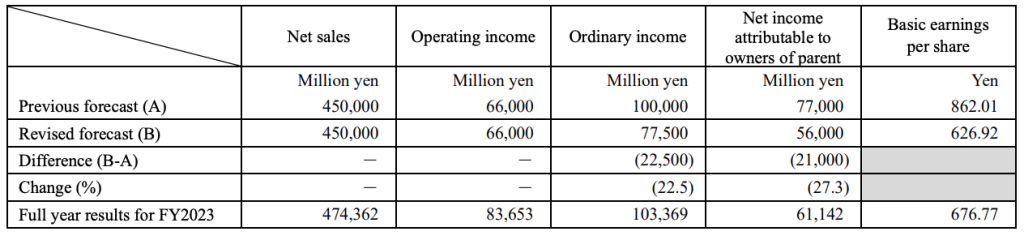

Shimano maintained its guidance for sales and profits for the full year but lowered its net profit forecast due to currency fluctuations.

In its nine-month report, the Japanese-based company noted, “During the first nine months of fiscal year 2024, geopolitical risks caused by the prolonged invasion of Ukraine and rising tensions in the Middle East, as well as stagnant Chinese economy, among other factors, exerted downward pressure on the economic climate. However, mainly on the back of subsided high inflation, the global economy emerged from the stagnant period and started to show signs of a pickup.

“In Europe, the impact of cumulative tightening of monetary policies had lessened. As a result, personal consumption continued to pick up, and the economy started to show some signs of recovery. In the U.S., although firm personal consumption supported the economy, the pace of economic expansion was moderate due to a slowdown in the labor market. In China, the economy was lackluster due to the prolonged recession in the real estate sector and sluggish personal consumption. In Japan, the economy continued to recover moderately, backed by a pickup in personal consumption in tandem with the improved income environment and rising Demand from inbound tourists.”

Bicycle Components

In the Bicycle Components segment, net sales rose 8.1 percent in the quarter to ¥91,267 million from ¥84,457 million a year ago. Segment sales slid 18.9 percent in the second quarter and 22.6 percent in the first quarter.

Operating income in the quarter climbed 23.1 percent to ¥17,014 million from ¥13,824 million a year ago.

In the nine months, Bicycle Components’ sales decreased 12.3 percent from the same period of the previous year to ¥253,861 million, and operating income fell 26.1 percent to ¥41,342 million.

Shimano commented on the nine-month performance of the segment, “While the strong interest in bicycles continued as a long-term trend, retail inventories at retailers started to show signs of progress. However, market inventories of completed bicycles remained high. Overseas, retail sales of completed bicycles in the European market remained weak due to unfavorable weather conditions in early spring, and market inventories of completed bicycles remained at a somewhat high level.

“In the North American market, retail sales softened, although interest in bicycles was firm and adjustments of market inventories of completed bicycles were progressing. In the Asian, Oceanian and Central and South American markets, personal consumption continued to be sluggish, retail sales of completed bicycles were weak, and market inventories were at a high level. In the Chinese market, the popularity of cycling in general continued, retail sales of completed bicycles were favorable, especially for road bikes, and market inventories remained at an appropriate level. In the Japanese market, retail sales were sluggish as affected by the soaring price of completed bicycles, and adjustments of market inventories continued.

“Under these market conditions, the Shimano Group received a favorable reception for its products, including Shimano 105, a component for road bikes, and a gravel-specific component Shimano GRX.”

Fishing Tackle

In the Fishing Tackle segment, sales reached ¥26,621 million in the third quarter versus ¥27,445 million a year ago, representing a decline of 3.0 percent. Sales were down 2.2 percent in the second quarter and 5.4 percent in the first quarter.

Operating income in the third quarter was off 38.7 percent to ¥2,672 million from ¥4,357 million the prior year.

Net sales in the nine months decreased 5.6 percent from the same period of the previous year to ¥80,690 million, and operating income slumped 42.4 percent to ¥9,323 million.

Shimano said, “Demand for fishing tackle that had been overly strong globally cooled down and sales remained weak. Meanwhile, adjustments of market inventories started to show signs of progress. In the Japanese market, buying motives among fishing enthusiasts were firm. On the other hand, adjustments of market inventories continued, and sales were lackluster as affected by extreme heat and adverse weather conditions.

“Overseas, in the North American market, sales were strong, backed by stable Demand, and market inventories progressed toward an appropriate level. In the European market, sales continued to be weak, but there was progress in adjustments of market inventories. In the Asian market, sales were lackluster, as affected by a slowdown in personal consumption and adverse weather conditions, and market inventories remained high.

“In the Australian market, backed by favorable weather and fishing conditions, sales were favorable and market inventories remained at an appropriate level. Under these market conditions, the new baitcasting reels Ocea Conquest CT and the new spinning reels BB-X Technium Fire Blood were well-received in the market. In addition, order-taking continued to be brisk for the spinning reels Twinpower.”

Others Segment

Net sales from the Others segment in the nine months decreased 5.9 percent from the same period of the previous year to ¥327 million and operating loss of ¥14 million was recorded, following an operating loss of ¥31 million for the same period of the previous year.

Balance Sheet Review

Total assets as of the end of the first nine months of fiscal year 2024 amounted to ¥896,089 million, an increase of ¥24,357 million compared with the figure as of the previous fiscal year-end. The principal factors included an increase of ¥15,904 million in construction in progress, an increase of ¥4,205 million in work in process, an increase of ¥3,797 million in notes and accounts receivable trade, an increase of ¥3,247 million in buildings and structures, a decrease of ¥3,536 million in merchandise and finished goods, and a decrease of ¥1,993 million in machinery and vehicles.

Total liabilities amounted to ¥71,295 million, an increase of ¥1,960 million compared with the figure as of the previous fiscal year-end. The principal factors included an increase of ¥4,322 million in accounts payable-trade, and a decrease of ¥2,093 million in provision for product warranties.

Net assets amounted to ¥824,793 million, an increase of ¥22,397 million compared with the figure as of the previous fiscal year-end. The principal factors included an increase of ¥22,822 million in foreign currency translation adjustments, and a decrease of ¥1,086 million in retained earnings.

Outlook

The consolidated business performance forecasts were revised in light of factors such as non-operating expenses that were recorded due to the appreciation of Asian currencies caused by the weaker U.S. dollar during the first nine months of fiscal year 2024.

Image courtesy Shimano