VF Corporation President and CEO Bracken Darrell said the fiscal second quarter delivered “another quarter of really good progress,” marking the third straight quarter of sequential top-line improvement in the decline rate and witnessing moderating sales declines at its two most challenged areas: Vans and the Americas region.

Other positives he noted on the company’s quarterly conference call with analysts included gross margins inflecting positively, SG&A expenses coming in better than expected, and VF making “strong strides in advancing our priorities” under its Reinvest transformation plan. Earnings on an adjusted basis were down slightly and sales fell 6 percent, but both topped analyst targets in the quarter and VF forecast further improvement sequentially over the next two quarters.

Darrell held back from making specific remarks on VF’s progress, saving them for its Investor Day set for October 30. However, Darrell did say results were “consistent with the guard rails we provided last quarter” and provided a few updates on progress being made on the four priorities under its Reinvest program, including reducing costs, strengthening the balance sheet, fixing the Americas region and turning around Vans.

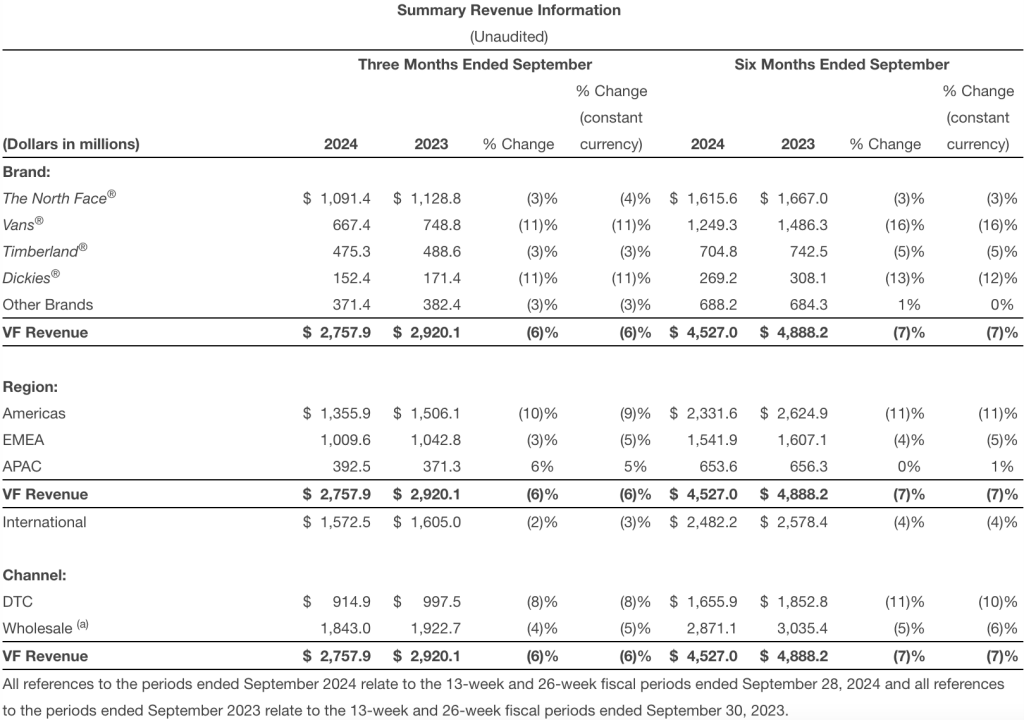

Revenue Summary

In the Americas region, sales were down 9 percent on a currency-neutral basis in the quarter, improving sequentially from being down 13 percent in the first quarter. Darrell said, “The new fully operational regional platform is starting to deliver tangible results, driven by a greater emphasis on brand elevation and full-price sales. Importantly, we continue to improve our forecasting accuracy and have now delivered 10 consecutive months on our internal plan.”

Vans brand revenue fell 11 percent to $667.4 million in the fiscal second quarter, a clear sequential improvement from the 21 percent decline seen in the first quarter. Vans benefited from inventory cleanup actions taken over the past few quarters, helping drive improvement in profitability as the brand’s cost structure has also been right-sized.

From a growth standpoint for Vans, Darrell was encouraged by a number of early signs of product successes under the guidance of Sun Choe, who was appointed Vans’ global brand president at the start of July. She was reviously Lululemon’s chief product officer.

“From a product standpoint, Knu Skool continues its strong momentum and further strengthened its position as the number two franchise globally,” said Darrell. “We’re seeing some encouraging results from other new product franchises launched over the summer, particularly Upland and Hylane.”

From a brand-elevation standpoint, Vans “is starting to resonate too,” thanks to its OTW (Off the Wall) premium label, efforts to connect with influencers and early adopters, and product collaborations. Darrell said, “During New York City Fashion Week a few weeks ago, the brand engaged with fashion influencers and made a significant cultural impact by spotlighting the Satoshi and Paralyzed OTW Classics, which we sold through at 100 percent levels.”

He added, ‘The Old Skool 36 Pearlized collaboration was sold out in five minutes upon launch in September, and our consumer search interest has trended positive in Q2 in key markets.”

The North Face saw revenues decline 4 percent on a currency-neutral basis to $1.09 billion, worse sequentially-as expected-than the 2 percent decline seen in the first quarter. TNF reportedly faced tough comparisons against a 17 percent gain in the year-ago second quarter that was boosted by the timing of shipments tied to supply chain disruptions. Strong momentum in Greater China in the latest quarter was still offset by ongoing pressures in the Americas’ region.

“During the quarter, we saw a particularly strong performance from backpacks during back to school,” said Darrell. “The brand also continued to have strong growth in APAC, driven by Summit Series. We had some big wins in EMEA too, where we delivered our strongest month ever in September and where our athlete, Katie Schide broke a course record and won the famous Ultra Trail du Mont Blanc race in August, wearing head-to-toe the North Face.”

TNF also launched its first global brand campaign in over three years, generating a strong response on digital media, particularly from women. At the store level, a North Face store opened on Sixth Street in Brooklyn’s Williamsburg section that includes its first-ever shop-in-shop featuring North Face’s Renewed program that refurbishes, recycles and resells North Face products. TNF also announced plans to open a Fifth Ave. location in fall 2025.

Timberland revenues were down 3 percent on a currency-neutral basis to $475.3 million, improving sequentially from being down 9 percent in the first quarter. Said Darrell, “The yellow boot continues to perform well globally with ongoing momentum enhanced by the new ‘Iconic’ campaign launched in September, which is driving traffic to our stores and online, and also contributing to the growth of the boot.”

Dickie’s revenues were down 11 percent in fiscal Q2 to $152.4 million, improving from a decline of 14 percent in the first quarter. Sales in its Other Brands segment (Smartwool, Altra, Icebreaker, Kipling, Napapijri, Eastpak, JanSport) were down 3 percent on a currency-neutral basis to $371.4 million. In the fiscal first quarter, the segment’s sales had improved 10 percent.

In other regions outside the Americas, sales in EMEA were down 5 percent on a currency-neutral basis in the quarter, although September marked the biggest month ever for the region. Wholesale trends weighed on EMEA’s performance. The APAC region was up 5 percent on a currency-neutral basis in Q2, led by strength by The North Face in China, In China, VF saw sequential improvement in both global DTC and wholesale. DTC improved to down 8 percent after contracting 13 percent in Q1 while wholesale declined 5 percent after being down 7 percent in Q1.

Companywide, sales were down 6 percent year-over-year on both a reported and currency-neutral basis, to $2.76 billion, but marked sequential improvement from being down 10 percent in Q1. Results were slightly ahead of analysts’ consensus estimate of $2.7 billion.

Income Statement Summary

Gross margins rose 120 basis points to 52.2 percent, which is in line with expectations and inflecting positively, primarily due to product cost tailwind. SG&A as a percent of sales was down 180 basis points to 40.8 percent, above plan due in part to a shift in some spending to the third quarter.

Darrell said VF generated another $65 million in cost savings during the fiscal second quarter ended September 30, having now fully executed all actions to reach the promised $300 million in cost savings by the end of this fiscal year. “We fully intend to go beyond this initial savings target,” said Darrell while indicating VF continues to reinvest some of the savings into key focus areas of product and brand building.

Operating margin reached 9.9 percent, down 210 basis points versus last year. On an adjusted basis, operating margin declined 60 basis points from last year to 11.4 percent.

Earnings per share reached 52 cents against a loss of $1.16 a year ago. On an adjusted basis, earnings totaled 60 cents, down from 63 cents a year ago but well ahead of analysts’ consensus estimate of 37 cents.

Balance Sheet Summary

As part of its push to strengthen its balance sheet, VF reduced its inventories by 13 percent at the end of the quarter versus last year and reduced its debt by nearly $450 million year over year. After the quarter’s close, VF concluded the divestiture of Supreme International with a sale to Oakley parent EssilorLuxottica raising $1.5 billion in net proceeds. The funds were reportedly used to repay a billion-dollar term loan after the quarter closed. Darrell added, “We’re on track to pay the next term loan of $750 million by the end of the year.”

Outlook

Looking ahead, VF sees further sequential improvement across the business in the third quarter. Sales are projected to be down 1 percent to down 3 percent on a reported basis, reflecting the continued stabilization of revenue trends and driven by wholesale improvements compared to last year. The year-ago period included inventory actions that impacted the third and fourth quarter.

Gross margins are expected to be up, benefiting from lower product costs and fewer reserves fewer inventory reserves. SG&A expenses is expected to be up modestly year over year, mainly a result of the reintroduction of incentive compensation.

For the fourth quarter, another quarter of second sequential improvement is expected with gross margins and SG&A rates expected to increase at a similar rate as the third quarter.

In the Q&A session, Darrell noted that there’s still some cautious ordering patterns from wholesale partners, particularly in regions where winter came late last year. However, he’s optimistic about the overall wholesale business. He said, “On the overall wholesale business, I feel good about it. I think we’re really on the right trajectory. We’re really on the comeback trail here across the board. And in the Americas, the creation of this Americas region has really had a strong impact, especially with our key accounts there where we’re starting to see good strong momentum.”

Image courtesy Vans