Newell Brands, the parent company of Marmot, Ex Officio, Stearns, Bubba, Coleman, and Contigo, among others, reported that its third quarter was the fifth full quarter since the company deployed its new corporate strategy. Based on reported results, management said Newell Brand’s business transformation is underway.

Newell Brands reported that its Outdoor & Recreation segment generated net sales of $183 million in the third quarter, a 20.8 percent decline compared with $231 million in the prior-year Q3 period. This reflects a core sales decline of 16.8 percent and the impact of unfavorable foreign exchange and certain business exits.

On a reported basis, the operating loss for the Outdoor & Rec segment was $23 million, a reduction from a year-ago loss of $42 million, which included an impairment charge of $22 million in the prior year period. The normalized operating loss for the segment was $15 million, slightly below an adjusted loss of $16 million in the prior year period.

The Outdoor & Recreation segment’s normalized operating loss was reported to be $15 million, or negative 8.2 percent of sales, in the period, compared with a loss of $16 million, or negative 6.9 percent of sales, in the prior-year period.

Newell Brands President and CEO Chris Peterson reported that the segment is making progress under new management, but is expected to require a lengthy turnaround.

“While performance has been challenged, and we believe it will take additional time before we fully unlock the potential of iconic brands such as Coleman, we believe the business bottomed earlier in the year, and it is encouraging to see our trends improve sequentially starting in the third quarter,” Peterson told analysts on a Friday quarterly conference call.

In brief comments on the segment, Peterson noted that the negative 16.8 percent year-over-year in the third quarter marked slight improvement versus 18.2 percent year-over-year decline in the second quarter.

He highlighted progress at Coleman, which is being repositioned with a broader outdoor focus under the direction of Nicolas Duran, who took over as CEO of the Outdoor & Recreation segment in January. Before joining Newell, Nico served in several leadership roles at Dorel Industries, Reebok International and Adidas Group.

Peterson said, “Some of you may have seen that Coleman launched a new campaign on Thursday Night Football on Amazon Prime, marking the first time Coleman has done a TV spot in more than 10 years. The early measurable results are encouraging, with a strong double-digit increase in sales in the days after the ad aired versus year ago. The new campaign focuses on addressing the broader outdoor market instead of the traditional camping subsection, consistent with our strategy reset for the brand.”

Peterson also talked about the Contigo travel mugs and water bottle brand’s debut of a limited-edition water bottle collection designed in partnership with fitness expert Ally Love. He said, “This collaboration comes as the first of many as Contigo is adding Ally to its c-suite as the brand’s first-ever chief hydration officer. In this role, Ally will bring her love for fitness, fashion and hydration to Contigo to create an unbeatable hydration experience. Over the next three years, Ally will serve as Contigo’s head product stylists collaborating closely with the brand to develop trendy, reliable water bottles that encourage healthy hydration habits.”

Asked further about turnaround prospects for the Outdoor & Rec segment in the Q&A section of the analyst call, Peterson elaborated that the segment “is going to take the longest to turn around because that’s the one where we feel good about progress we’ve made. We’ve recapped the team. We’ve reset the strategy to move Coleman, which is the largest brand from a camping focus to more of outdoor focus. We talked about the television spot that we just put on Amazon, which has been good traction. The Contigo partnership with Ally Love, which is off to a great start. And I think the team that we built in Outdoor & Rec is building a very positive innovation pipeline that is going to be coming to market in 2026. And so that is the one that will take the longest.”

In the nine months, sales in the Outdoor & Rec segment reached $642 million, down 23.0 percent on a reported basis and 18.5 percent on a normalized basis. The operating loss in the segment in the nine months on a reported basis was $52 million against a loss of $38 million a year ago. On a normalized basis, the operating loss for the segment was $25 million versus a loss of $5 million the prior year.

Consolidated Results

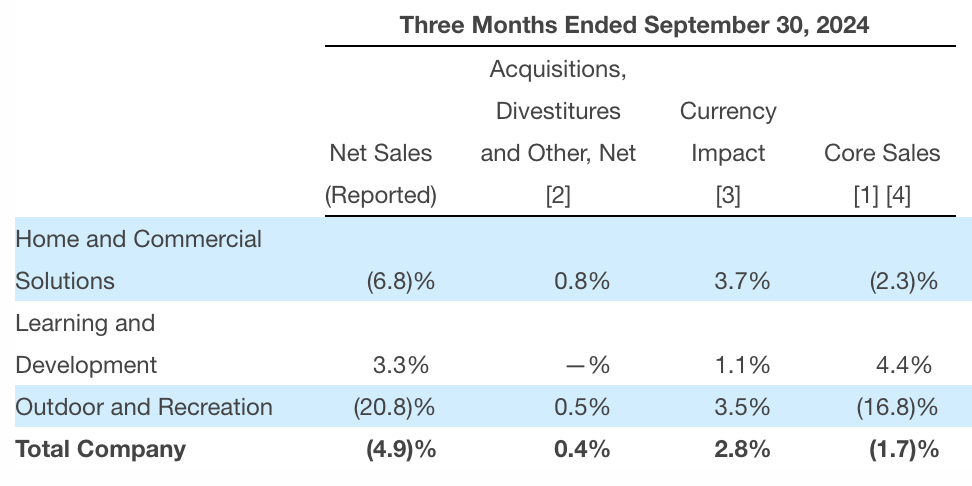

Consolidated net sales were $1.9 billion in Q3, a 4.9 percent decline compared with the prior-year period, reflecting a core sales decline of 1.7 percent and the impact of unfavorable foreign exchange and business exits. Pricing in international markets to offset inflation and currency movements contributed to the company’s core sales performance.

Core Sales Growth by Segment

Income Statement Summary

Reported gross margin was 34.9 percent of net sales in the quarter, compared with 30.3 percent in the prior-year Q3 period, as the positive impact from productivity savings and lower restructuring-related charges more than offset the headwinds from lower sales volume, inflation and foreign exchange.

Normalized gross margin was 35.4 percent compared with 30.7 percent in the prior year period. This represents the fifth consecutive quarter of year-over-year improvement.

Reported operating loss was $121 million in Q3, compared with $159 million in the prior-year Q3 period. Non-cash impairment charges of $260 million and $263 million were incurred in the current- and prior-year periods, respectively, related to goodwill and intangible assets. Reported operating margin was negative 6.2 percent compared with negative 7.8 percent in the prior year period, mainly reflecting benefits from higher gross profit and savings from restructuring actions that were partially offset by higher incentive compensation expense, advertising and promotions costs and additional amortization of certain tradenames.

Normalized operating income was $185 million, or 9.5 percent of sales, compared with $152 million, or 7.4 percent of sales, in the prior year period.

Net interest expense was $75 million compared with $69 million in the prior-year period.

Third quarter reported tax benefit was $7 million compared with a benefit of $80 million in the prior-year period. The normalized tax provision was $34 million compared with a benefit of $79 million in the prior year period.

Reported net loss was $198 million in the quarter, compared with $218 million in the prior year period. Normalized net income was $69 million in Q3 compared with $154 million in the prior-year Q3 period. Normalized EBITDA was $250 million compared with $218 million in the prior year period.

Reported diluted loss per share was 48 cents in Q3, compared with 53 cents in the prior-year Q3 period. Normalized diluted earnings per share were 16 cents in Q3 this year, compared with 37 cents in the prior-year Q3 period. Normalized diluted earnings per share included a negative 2 cents impact associated with a change in the company’s normalization practice.

Image courtesy Marmot, Chart courtesy Newell Brands