JD Sports Fashion Plc, the parent of the JD, Hibbett, Finish Line, DTLR, and Shoe Palace retail brands in the U.S. and JD and others worldwide, reported revenue growth for the 26 weeks ended August 3 (first half, H1), was said to be impacted negatively 280 basis points due to prior-year H1 period revenue from disposals and 150 basis points from currency. There was also a 190 basis point benefit from the timing impact of the previous 53-week year. Against this adjusted base, like-for-like (LFL, Comp) sales growth was 0.7 percent, on the back of 2.4 percent growth in Q2 and there was a 5.7 percent benefit from new space and the annualization of new space in H2 2024, leading to organic sales growth of 6.4 percent year-over-year (y/y). Acquisitions added basis points to the total.

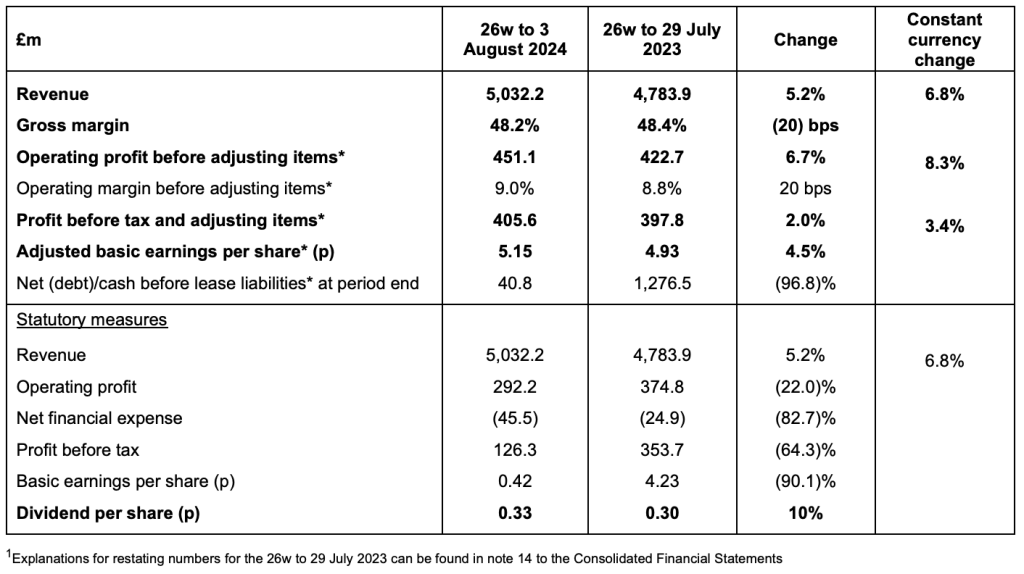

Consolidated revenue grew 5.2 percent to £5.03 billion in the first half, including £61 million from 10 days of Hibbett trading. JD Sports is using a conversion rate of $1.34 = 1 British Pound (£) or €1.20 = 1 British Pound (£) for current reporting.

Segment Summary

JD Brand segment revenue represented 71 percent of both the company’s total revenue and Profit Before Tax (PBT) and adjusting items in H1. JD revenue grew 7.1 percent y/y and achieved a gross margin of 49.5 percent of revenue. PBT and adjusting items was down 2.0 percent reflecting the ongoing investment in the whole Group’s future growth.

Complementary Concepts segment revenue grew 12.3 percent y/y with PBT and adjusting items increasing 15.7 percent y/y, both reflecting good performances from existing community nameplates, Shoe Palace and DTLR, and the contribution from Hibbett.

Sporting Goods & Outdoor segment revenue declined 4.5 percent y/y but PBT and adjusting items grew 16.2 percent y/y, reflecting partly disposals of loss-making stores in the period.

Region Summary

Europe and North America were reported as the company’s two fastest growing regions in the first half, reportedly due in large part to the rollout of the JD nameplate leading the growth in both regions.

Europe region delivered organic sales growth of 10.1 percent y/y in the first half.

North America saw organic sales growth of 10.7 percent y/y in the six-month period.

UK sales improved sequentially through H1, but year-over-year performance was reportedly held back by non-core divestments made during the prior-year H1 period and the UK’s higher weighting towards both online and apparel.

Asia Pacific region LFL sales were down versus the prior-year H1 period, said to be against tough comparatives. Still, the region posted double-digit y/y organic sales growth for the period.

The company said that the pivot toward becoming a more global business continued with North America generating 35 percent of revenue; Europe, 31 percent; the UK, 30 percent; and Asia Pacific, 4 percent.

Channel Summary

Online (e-commerce) revenue declined 140 basis points to 20.7 percent of total revenue, reportedly due to the post-Covid shift from online back to offline continuing in the H1 period. Still, the the company said it made “good progress” on its omni-channel initiatives in the half, including “click and collect” and “ship from store.”

Stores (brick & mortar) revenue increased in share of revenue to 78.0 percent of total revenue, on the back of 9.3 percent y/y growth in the first half.

Category Summary

JD Sports said Footwear continued to trade better than Apparel, although both categories grew in the period.

Footwear revenue in the lifestyle space was said to be a resilient, growth category driven by the continued growth in ‘sneakers around the world. Growth in the period was 9.6 percent y/y and Footwear’s share of total revenue increased 240 basis points to 59.8 percent of total revenue.

Apparel was said to again be held back by challenging weather conditions, particularly in the UK and Europe, where the spring/summer season was reportedly wetter than average. This reportedly had a knock-on effect on margin as the industry sold more stock at discounted prices in the summer sales season ahead of the back-to-school period and then into the autumn/winter season. Apparel revenue was up 0.7 percent y/y with its share of revenue falling 140 basis points to 29.8 percent of total revenue.

Gross margin amounted to 48.2 percent of revenue, or 48.3 percent excluding Hibbett, in the first half which was down 10 basis points y/y, reportedly driven by lower Q2 margin from elevated promotional activity across apparel and online.

Operating margin before adjusting items was 9.0 percent of net sales, or 8.8 percent excluding Hibbett, which was said to be in line with the prior-year H1 period, with good cost control offsetting future growth investment.

Profit before tax and adjusting items amounted to £405.6 million in H1, up 2.0 percent y/y, and up 3.4 percent on a constant-currency (cc) basis and flat excluding Hibbett.

Profit before tax of £126.3 million in the half reflected mainly non-cash adjusting items including updated Genesis put and call option valuation following the acquisition of Hibbett and the closure of the Derby distribution centre (DC)

Adjusted basic earnings per share (EPS) were up 4.5 percent for the first half, while basis EPS fell 90.1 percent year-over-year.

The company said it saw continued balance sheet strength in the first half, with net cash before lease liabilities of £40.8 million, after stores investment and the acquisitions of the ISRG/MIG NCIs and Hibbett.

The company os proposing an interim dividend of 0.33 pence, up 10 percent versus the prior-year H1 period.

JD Sports ended the first half with 4,506 stores, up 1,189 from the start of the year, reflecting store openings, ongoing disposal of non-core stores and the Hibbett acquisition. The increase reflects the inclusion of 1,179 stores from the Hibbett acquisition.

Excluding Hibbett, the company opened 117 stores and closed 107 stores in the first half, mainly from the planned rationalization of underperforming non-JD MIG stores, primarily in Poland, and both relocations and Macy’s closures in North America. The rationalization of the MIG portfolio was said to be another benefit from the NCI buyout last year as the company now has freedom to improve the profitability of the overall business.

The total square footage of our store portfolio at the period end was 18.9 m, equating to 4,199 ft2 per store, an increase of 1.1 percent from the start of the period.

Strategic Highlights

Continued strong progress across the company’s four key strategic pillars:

JD Brand First: Rolling Out the Company’s No.1 Nameplate

- Double-digit organic growth across Europe, North America and Asia Pacific

- Opened 83 new JD stores, including the largest ever JD store in Stratford, London in April, and on track to open around 200 new JD stores in the full year

- Transferred an additional 19 stores to JD from Finish Line in the U.S., MIG in Eastern Europe and ISRG in Iberia

Complementary Concepts:

- Completed acquisition of Hibbett and its 1,179 stores in the U.S.

- Completion of the Courir in France acquisition remains subject to clearance from the European Commission.

- JD Sports saw 3.4 percent LFL sales growth from existing U.S. community nameplates and 4.5 percent LFL sales growth from Sporting Goods nameplates.

Beyond Physical Retail:

- Good progress on omni-channel: ‘ship from store’ rolling out across Europe and successful ‘click and collect’ trial in France.

- Strong uptake in the JD STATUS loyalty program in the UK following its full launch in December 2023 with 1.4 million active members so far; STATUS also launched in France and Poland.

- Supply chain evolution continued: Heerlen operating manually with automation now anticipated in 2025 and

rationalizing UK operations around Kingsway, leading to the announced Derby closure.

People, Partners & Communities:

- First global partner of the Nike Connected program following U.S. launch demonstrates strength of long-term brand relationship.

- Expanded community outreach through the JD Foundation, hosting our first “JD UP” careers event in Manchester reaching 2,500 young people with plans to roll out further.

- JD saw 26 percent reduction in Scope 3 emissions on purchased goods.

Outlook and Guidance

The company said its trading performance in the first half was in line with its expectations and overall profit guidance range of £955 million to £1,035 million remains unchanged.

“As highlighted at our Q225 trading update, we are experiencing currency headwinds this year as the pound strengthens against the U.S. dollar and the Euro. Our guidance range of £955-1,035m was based on certain exchange rates,” the company noted in its report summary. The £955 million to £1,035 million guidance range was based on $1.25 for the U.S. dollar and €1.15 for the Euro.

Foreign exchange impacts reduced profit before tax and adjusting items by £6 million in H1 and, at current rates, JD Sports expects the H2 impact to be £20 million.

The company said it expects Hibbett to contribute about £25 million profit before tax and adjusting items for the full year, reflecting the business contribution from completion, acquisition accounting adjustments and a £25 million interest cost from the new acquisition facility.

Image courtesy Hibbett/JD Sports Fashion Plc