Once again, Vista Outdoor, Inc. adjourned the scheduled special meeting of stockholders to vote and approve the merger with the Czechoslovak Group a.s. (CSG) to 9:00 am (Central Time) on October 9, 2024.

The company said it remains in active discussions with CSG and the private equity firm that partnered with MNC Capital, separate from MNC, to potentially reach an agreement regarding the sale of the company’s Revelyst outdoor products segment.

Vista Outdoor noted in a media release that October 9, 2024, is the last possible date it will hold the special meeting before the October 15, 2024 termination date in the merger agreement with CSG.

Vista’s Board said it remains committed to maximizing value for company stockholders and will continue to take all actions to achieve its objective.

The delay follows a media release from one of Vista’s largest stockholders, Gates Capital Management, Inc., announcing it would vote against the CSG deal. Gates is an event-driven alternative asset manager who beneficially owns 5,589,041 shares of common stock, or approximately 9.6 percent, of Vista Outdoor, Inc.

Gates said it is encouraging Vista to finalize negotiations for an all-cash offer for the company and reiterated its intention to vote against the proposed sale of The Kinetic Group ammunition-related businesses to CSG.

Gates’ recommendation follows the independent proxy advisory firm Institutional Shareholder Services (ISS) recommendation on Friday, September 20, that shareholders vote against the latest CSG proposal. Gates reported that it agreed with the ISS recommendation and supported its view that the “best outcome for shareholders would be attained by selling both The Kinetic Group and Revelyst in a revised all-cash transaction.”

“Recent public disclosures indicate that a private equity firm has recently offered $1.1 billion in cash for Revelyst, but that such a transaction would need to take place sooner rather than later since the firm would not have any interest in purchasing Revelyst after the closing of the currently proposed CSG transaction,” Gates wrote in a letter to the Vista Board. “We strongly believe that the currently proposed transaction with CSG to sell only The Kinetic Group is not in the best interest of shareholders as it would eliminate the possibility of subsequently selling Revelyst to this private equity firm. For this reason, we see no reason to support any transaction that doesn’t include a comprehensive sale of the entire company.”

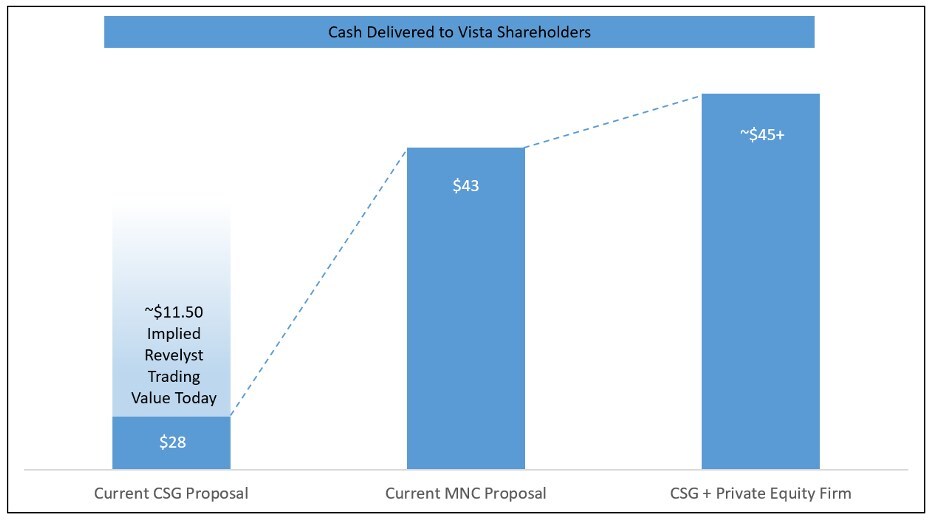

Gates developed a chart for the Vista Board that the investor said showed the current CSG proposal delivers the least amount of cash to existing Vista shareholders and is the only proposal that exposes Vista shareholders to the execution risks associated with a standalone, sub-scale, publicly traded Revelyst.

Morgan Stanley & Co., LLC is Vista Outdoor’s sole financial adviser. Cravath, Swaine & Moore LLP is its sole legal adviser. Moelis & Company, LLC is its sole independent directors’ financial adviser, with Gibson, Dunn & Crutcher LLP as its sole legal adviser.

Image courtesy Vista Outdoor, Inc.