It’s that time of year again when assessments of the retail back-to-school shopping season turn to though of the next big retail shopping period for Holiday 2024.

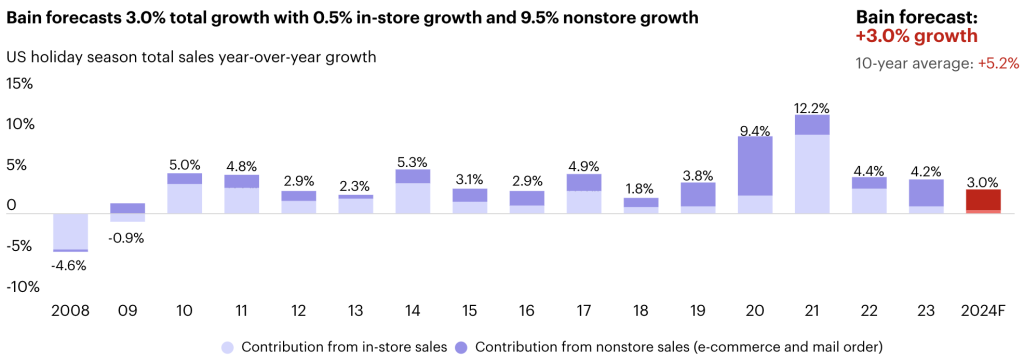

Bain & Company issued its forecast for Holiday 2024, suggesting that the season will see nominal 3 percent growth year-over-year in U.S. retail sales, reaching just over $940 billion for the period. Bain said the potential rate cut this week could spur consumer confidence and sales may also benefit as some consumers feel wealthier from rising disposable income and strong stock market gains this year.

Bain Holiday 2024 Forecast – Total Measured Retail

“Despite challenges including economic concerns and changing consumer behavior, retailers are adapting through increased online and in-store efficiency, personalized marketing, and a focus on fulfilling digital demand,” Bain said in its a media statement. “This season, Bain anticipates retailers will leverage expanded store capacities and online strategies to meet the evolving preferences and convenience demands of shoppers.”

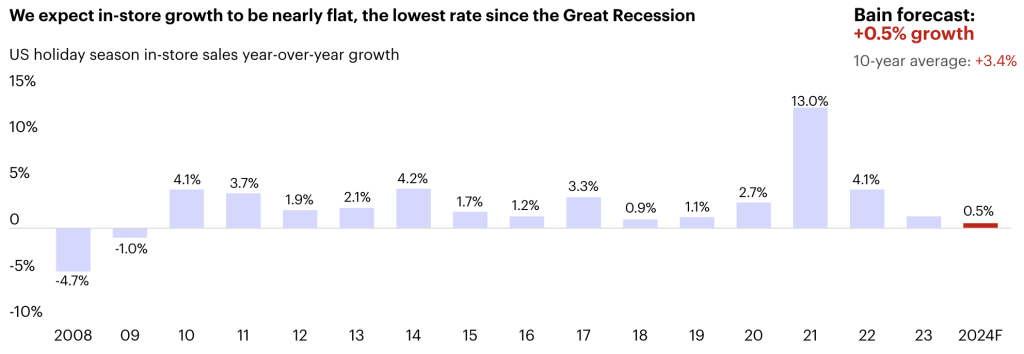

Brick & mortar store growth is expected to remain relatively flat at 0.5 percent y/y uptick, with the strongest in-store growth coming from general merchandise (excl. department stores), clothing & accessories, and grocery.

Bain Holiday 2024 Forecast – Brick & Mortar (In-Store)

The company said U.S. retail sales have been relatively slow thus far in 2024 – up 3.5 percent y/y overall, with growth coming largely from e-commerce sales and select in-store categories, including General Merchandise (excluding department stores), Clothing & Accessories, Health & Personal Care, and Grocery. The U.S. Census Bureau and National Retail Federation, which track these sales, measure footwear retail as part of the Clothing & Accessories sector. See below for additional SGB Media coverage on year-to-date sales trends by sector.

Other brick & mortar categories have seen largely flat or declining sales growth thus far in 2024.

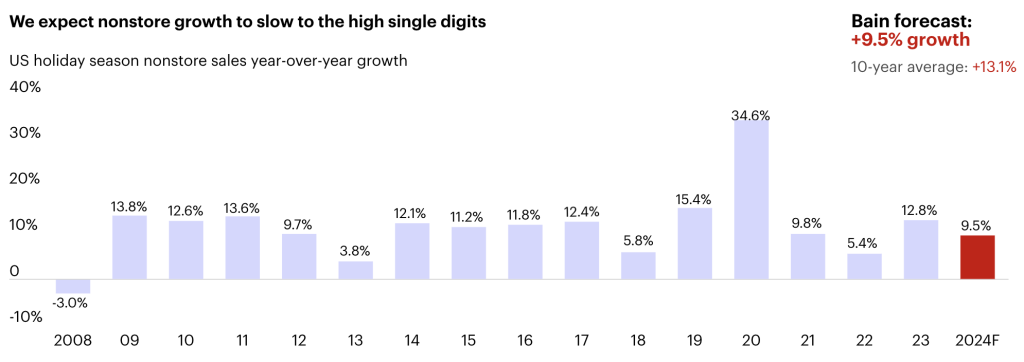

For the Holiday selling season, Bain is forecasting by sector that the Department Stores sector and the Sporting Goods, Hobby, Book and Music stores sector will each decline in a range of down 5 percent to down 1 percent. Electronics and Appliance stores are seen flat (down 1 percent to up 1 percent). Clothing, Footwear and Accessories stores and General Merchandise stores (excluding Department Stores) are expected to see low-single-digit growth in the 1 percent to 5 percent range. Bain expects non-store (e-commerce) sales to grow 9.5 percent y/y and drive ~90 percent of the growth for the season.

Bain Holiday 2024 Forecast – E-Commerce (non-Store)

Deloitte’s Annual Holiday Retail Forecast sees Holiday selling season sales increasing in the 2.3 percent to 3.3 percent range in 2024, while e-commerce Holiday sales projected to grow between 7 percent and 9 percent, compared to 2023 season.

Overall, Deloitte’s retail and consumer products practice projects Holiday sales will total $1.58 trillion to $1.59 trillion during the November to January timeframe. Retail sales between November 2023 and January 2024 (seasonally-adjusted and excluding automotive and gasoline) grew 4.3 percent y/y and totaled $1.54 trillion according to the U.S. Census Bureau.

Deloitte said a key driver of overall retail sales growth in the upcoming season is expected to be e-commerce. The company forecasts e-commerce will likely grow between 7 percent and 9 percent, year-over-year, during the 2024-2025 holiday season to between $289 billion and $294 billion this season. E-commerce sales between November 2023 and January 2024 (seasonally-adjusted and excluding gasoline stations, motor vehicles and parts dealers, and food services) grew 10.1 percent last Holiday season, totaling an estimated $270 billion.

“Although the pace of increase in holiday sales will be slower than last year, we expect that healthy growth in disposable personal income (DPI), combined with a steady labor market, will support a solid holiday sales season,” said Akrur Barua, economist, Deloitte Insights. “Meanwhile, inflation is both a headwind and tailwind to holiday sales. While declining inflation aids consumers’ purchasing power, it also is expected to negatively impact the nominal rise in the dollar value of sales. In addition, rising credit card debt and the possibility that many consumers have exhausted their pandemic-era savings will likely weigh on sales growth this season compared to the previous one.”

“Following a sharp rise in spending post-pandemic, this season’s retail sales are expected to moderately increase in line with trends over the past decade,” said Michael Jeschke, principal, Deloitte Consulting LLP, and Retail & Consumer Products leader. “Our forecast indicates that e-commerce sales will remain strong as consumers continue to take advantage of online deals to maximize their spending. While this holiday season reflects a return to trend levels of growth, retailers who focus on building loyalty and trust with consumers could be well positioned for success.”

Bain is offering a few ideas for retailers to improve their Holiday selling season this year:

- Emphasize value, no matter your price point

- Entice consumers with intuitive search tools, personalized marketing, relevant gift lists, and timely promotions

- Showcase exclusive products, collections, brands, and partnerships

- Delight shoppers during a stressful season with up-skilled holiday staff and more fulfillment options, including fast shipping and easy returns

- Make omni-channel easier—utilize excess store capacity to meet digital demand

Bar Charts and related data courtesy Bain

See below for additional SGB Media coverage on year-to-date sales trends by sector:

CNBC/NRF Retail Monitor Sees Strong Clothing, Footwear and Online Increases in August

Report: August Retail Sales Growth Slowed Sequentially from July Trend