Genesco, Inc. (GCO) reported sales for the fiscal second quarter exceeded the anticipated levels, led by Journeys, which more than offset some of the pressure on Schuh and Johnston & Murphy, which continue to face robust multi-year comparisons.

The digital business was also said to be a “standout” with high-single-digit growth, and the company’s ongoing plan to optimize its store footprint and reduce costs contributed to the bottom line, allowing GCO to leverage expenses in what is historically one of the company’s lower volume quarters. But negative comps across the board for all brands were not great news for the company as other footwear retailers cautioned investors not to get too excited about the stronger fiscal second-quarter sales trend as it included a week of back-to-school (BTS) included in the fiscal third quarter last year.

Company CFO Tom George reported on a conference call with analysts that consolidated revenue for the second quarter ended August 3 was $525 million, which he said was better than anticipated and flowed through to better leverage. Sales inched up but flattish against the $523 million in the prior-year Q2 period.

Still, a weaker-than-expected full-year guide saw shares fall early in the day after reporting and sharply as the company provided more details during the conference call with analysts.

Journeys Group

Journeys Group sales were up 4 percent year-over-year (y/y) to $298.8 million in the second quarter, representing 56.9 percent of total GCO sales, up 2 full share points in Q2 last year.

“Our number one priority is and has been to improve performance at Journeys,” said company President, CEO and Board Chair Mimi Vaughn on the conference call. “Step one of our plan centered around efforts to inject our product assortment with more newness, excitement and storytelling to drive an inflection in Journeys’ comps and deliver that to our consumers through enhanced store, digital and social experiences. As we anticipated, our Q2 results demonstrated solid progress against that plan. Journeys’ assortment resonated well, driving strong sequential sales improvement, with comps turning positive in July, before the onset of back-to-school and accelerating into August.”

Vaughn said the company saw a notable pickup in attention to footwear, marked by growth in traffic from North American youth consumers as the quarter progressed.

“The Journeys customer has become more interested in a broader range of brands they buy and more diversified in the styles they wear. This shift plays well into Journeys’ proposition as the consummate curator of styles across both casual and fashion athletic brands,” Vaughn noted.

“New Journeys leadership accomplished a lot in a short time to seize the opportunity to meet these changing footwear preferences and deliver positive back-to-school results,” Vaughn added. “With greater depth on brand and styles teens want, we expect to be well-positioned to similarly drive demand for the important holiday season. We have more work to do to unlock Journeys’ full earnings potential, but our recent performance gives us confidence we’re on the right track and is a key first step toward achieving this critical goal.”

Still, Vaugh said the retailer continues to navigate a choppy environment.

“Faced with higher prices, the consumer remains very selective about what to buy and what not to buy, continuing to shop primarily for key footwear items and must-have products in Q2 and passing on others. They again showed a willingness to shop when there is a reason, like during the 4th of July and back-to-school, and retreat when there’s not. We expect these behaviors to carry on, particularly during non-peak shopping periods,” she articulated.

“During that holiday, at the end of last year, we faced increased pressure on Journeys’ core assortment, including vulcanized products and boots,” Vaughn shared. “With minimal ability to adjust right away given footwear lead times, we expected this dynamic to continue through much of the first half this year, despite easier compares, until we could deliver enough product to meaningfully impact the mix. Knowing our young customers’ preferences were shifting in favor of this more diversified offering, the team, led by our new chief merchant, took aggressive and quick action and successfully added significant newness and freshness across several major brands.”

Vaughn said the company’s key brand partners, who were very enthusiastic about Journeys’ unique customer proposition, stepped up with tremendous support of the retailer’s strategic direction to better serve this cohort through elevated assortments and depth of product.

“Following a more challenging May and June, receipt of this product in time to kick off a strong back-to-school drove positive comps in July and higher ASPs with solid results in early back-to-school markets and over tax-free holidays. The comp trend improved further in August when we entered the third quarter, as shoppers turned out in a bigger way during key back-to-school weeks,” she noted. “Importantly, store traffic nicely outpaced the broader market as it accelerated through the quarter, highlighting that Journeys remains a key footwear destination.”

Vaughn said Journeys’ digital business remained very healthy, posting another quarter of double-digit growth as the performance marketing, all-access loyalty incentives, CRM campaigns, and omni-channel delivery options enticed shoppers to purchase online.

“[Journeys President] Andy Gray and the team have made substantial progress on initiatives to rapidly accelerate Journey’s improvement and reinforce its leading market position for the longer term,” Vaughn said. “Product advantages are at the forefront of this effort initially, but ultimately it is about elevating our product brand and experience and putting the customer at the center of everything we do.”

Vaughn said a critical component has been strengthening the company’s leadership team, which began with the addition of Gray, then a new chief merchant Chris Santaella and a new leadership role for the SVP of strategy and transformation.

“Most recently, we strengthened the team further with the addition of Stacy Doren as Journeys’ new chief marketing officer,” Vaughn added. “An exceptional marketing leader, Stacy joins the team following an accomplished career at Levi’s. We’re excited for what her expertise and many achievements in consumer brand building will bring to Journeys.”

Vaughn said Journeys’ inventories remain very clean, enabling the company to drive full-price selling and keep markdowns below last year’s levels. “This positions us well to pull forward receipts to build inventory and maximize the demand in the back half,” the CEO suggested.

Schuh Group

Schuh sales rose 1 percent y/y on a constant-currency basis to $124.6 million, or 23.7 percent of total company sales. Schuh was up against a strong two-year stacked comp of 26 percent, it proved to be a tough summer season and quarter for Schuh.

Vaughn said the second quarter started on a good note, with pent-up demand from a late start to spring selling, but as the summer kicked in with the higher cost of living, consumers were generally not motivated to make purchases in the footwear category, and Schuh’s seasonal assortment did not resonate to the level the company expected.

“Like Journeys, Schuh’s customers have also been shifting away from vulcanized footwear,” Vaughn said, adding that the pressures prompted Schuh to increase promotional activity to clear slower-moving products and match activity in the marketplace.

While this reportedly helped drive a sequential improvement in comps and kept inventories in good shape, Vaughn said it affected gross margin in the quarter.

“E-com growth helped offset the weakness in stores, and Schuh’s digital business, a meaningful channel at almost 40 percent of sales, remains a key avenue for driving growth and engagement,” she noted. “Despite the challenging backdrop, according to Kantar, Schuh held its No.10 position in the UK footwear market versus last year, remaining a key destination for the youth shopper.”

Vaughn said many of the brands and styles working at Journeys are also resonating at Schuh for back-to-school, and while demand remains muted, Vaughn said the retailer expects less pressure on gross margin in this period, given the cleaner inventory.

“The kids’ business remains a highlight, outperforming the business as a whole for the quarter and during back-to-school to date,” she noted. “Looking ahead, the team is implementing several initiatives to improve the trend and sharpen its customer focus.”

The retailer reported that these efforts included gaining even greater access to the best brands and in-demand products, implementing its new customer segmentation based on its latest market research, revamping Schuh’s creative marketing content, accelerating signups for the Schuh Club Loyalty Program, which now represents nearly 35 percent of total sales, and deploying new campaigns to drive higher loyalty point redemptions and sales.

Johnston & Murphy

Johnston & Murphy (J&M) declined 9 percent y/y to $71.0 million, representing 13.5 percent of company sales versus 14.9 percent in the prior-year Q2 period.

Vaughn said the efforts to evolve and reimagine J&M as a more comfortable, casual, multi-category lifestyle brand led to years of solid growth and success emerging from the pandemic.

“During this time, J&M drove footwear market share gains by growing its physical and digital direct-to-consumer channels; however, the combination of robust 29 percent two-year stack comps and considerable softening in the men’s premium non-athletic footwear market pressured sales and caused de-leveraging Q2,” Vaughn said.

“On a positive note, new products and footwear franchises, including the Amherst 2.0, are resonating well, showing a great appetite for freshness and reinforcing the ongoing desire for innovation and distinctive products. J&M has responded by pulling forward new product launches like the Anders Sneakers program, fast-tracking programs like the Upton Dress Shoe Program, and rethinking its future development calendar to find places to inject more innovation and newness much more frequently into the assortment,” Vaughn summarized.

The CEO said another major opportunity is to build on the success of apparel and accessories, which now represent almost half of its direct-to-consumer business.

“Woven shirts, blazers, bags, and wallets have all been standouts this year in our mission to step up J&M affluent customers’ wardrobes, increase apparel purchase frequency and outfit them with confidence from head-to-toe,” Vaughn shared. “To accelerate progress for the rest of the year, we are looking forward to the arrival of more new fall product and franchise launches, which will pair with product story marketing and J&M’s new brand campaign.”

Vaughn said the company will increase its engagement with J&M’s most valuable customers by leveraging its Insiders Affinity Program, which now has roughly 900,000 members. The program is driving higher average transaction sizes and more purchases while, at the same time, nearly two-thirds of new customers are joining.

Genesco Brands

Genesco Brands sales declined 13 percent, or $4 million, year-over-year to $30.7 million, to comprise 5.9 percent of GCO sales, compared to 6.7 percent in the year-ago Q2 period.

Vaughn said the company continues to achieve success with the repositioning of the Genesco Brands Group. “Efforts to simplify the license portfolio to emphasize key brands and channels mean lower sales in the short term but more profit, which was evident once again in Q2 results and we expect will be for the future,” she explained.

Comp Sales Performance

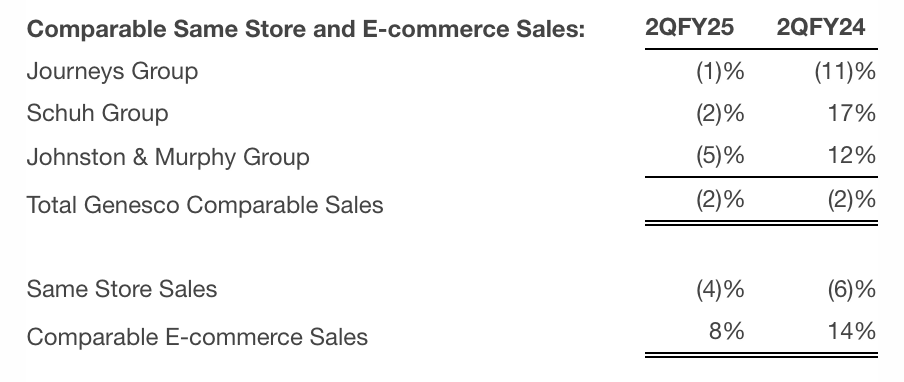

Total company comps were reportedly down 2 percent y/y, which George said was a healthy sequential acceleration compared the fiscal Q1 trend, which was down 5 percent y/y.

By channel, George said total Store comps were down 4 percent, while Direct comps were up 8 percent, with Digital sales accounting for 22 percent of total retail sales.

Income Statement Summary

Second quarter gross margin was 46.8 percent of net sales this year, compared with 47.7 percent in Q2 last year. Adjusted gross margin for the second quarter this year decreased 90 basis points y/y as a percentage of sales. The decrease as a percentage of sales compared to Q2 Fiscal 2024 was reportedly due primarily to a higher mix of sale products at Schuh and changes in the product mix at Journeys.

- Journeys Group’s gross margin was down 90 basis points y/y, reported to be due primarily to product mix and a higher mix of e-commerce sales.

- Schuh’s gross margin decreased by 210 basis points y/y, reportedly driven mainly by increased promotional activity.

- J&M gross margin was up 40 basis points y/y, due mainly to a comparison against increased inventory reserves last year, partially offset by increased retail markdowns and a lower mix of direct-to-consumer volume.

- Genesco Brands’ adjusted gross margin was down 20 basis points y/y, reportedly due primarily to a shift in brand sales mix.

Consolidated SG&A expense was reported at 48.6 percent of sales, leveraging 100 basis points over last year.

“The combination of our cost savings initiatives, closure of unproductive stores and some improvement in other expenses offset the increased variable expenses to support our direct-sales growth, as well as additional selling salaries,” George shared. He also said expenses benefited from some one-time items, including a royalty reversal and a favorable pickup in certain non-income taxes.

George said the company experienced increased appreciation from technology investments.

“Optimizing our store fleet to reduce occupancy cost and fixed expense levels in the store channel remains one of our key financial objectives,” he noted. “In Q2, we achieved a 9 percent reduction in straight-line rent expense on 45 lease renewals across the company with an average term of approximately four years; this brings our year-to-date renewals to 164 with a 9 percent reduction in straight-line rent expense. With over 50 percent of our fleet coming up for renewal in the next couple years we will continue to be opportunistic to capture rent reductions as appropriate.”

Genesco’s GAAP operating loss for the second quarter was $10.3 million, or 2.0 percent of sales this year, compared with $38.6 million, or 7.4 percent of sales, in the second quarter last year.

“In summary, for the second quarter, we incurred a better-than-expected adjusted operating loss of $9.3 million compared to an Adjusted operating loss of $10 million for Q2 last year,“ George noted. Adjusted operating margin was a loss of 1.8 percent of sales in the second quarter of Fiscal 2025 compared to a loss of 1.9 percent in the second quarter of last year.

GAAP loss from continuing operations was $9.9 million in the second quarter of Fiscal 2025 compared to $31.6 million in the second quarter last year.

Adjusted for the Excluded Items in all periods, the second quarter loss from continuing operations was $9.1 million, or 83 cents per share, in Fiscal 2025, compared to $9.6 million, or 85 cents per share, in the second quarter last year.

George said the year-over-year improvement was driven by the shift of a key back-to-school week into the second quarter from Q3, which added approximately $20 million to $25 million to the top line and roughly 40 cents a share to earnings per share.

Balance Sheet Summary

George noted that GCO ended the quarter in a net debt position of approximately $32 million, with clean inventories down 8 percent from last year. Total debt at the end of the second quarter of Fiscal 2025 was $77.8 million, compared with $131.5 million at the end of last year’s second quarter.

Cash at quarter-end was $45.9 million, compared with $37.4 million as of July 29, 2023.

Inventories decreased 8 percent on a y/y basis, reflecting decreased inventory for Journeys, Schuh and Johnston & Murphy, partially offset by an increase at Genesco Brands.

“Journeys’ inventory was down 9 percent, leaving us well-positioned for the fresh new receipts we were bringing in through the back half,“ the CFO said. “Overall, we plan to start building up our inventory level to drive sales, George continued. “Looking at our financial flexibility, strong balance sheet and free cash flow generation combined with our revolving line of credit provides us ample liquidity to pursue all our strategic objectives.“

Capital Expenditures

CapEx was $8 million in Q2, with investments reported to be primarily related to retail stores and the digital and omni-channel initiatives.

“After a cycle of investment in digital and omni-channel where we are currently getting the benefits, we are shifting the emphasis to refreshing our store base,“ George shared.

Depreciation and amortization was $13 million.

Share Repurchases

The company repurchased 381,711 shares during the second quarter of Fiscal 2025 for $9.3 million, or $24.49 per share. GCO has $42.8 million remaining on its expanded share repurchase authorization announced in June 2023.

“Over the past six years, we have repurchased nearly 50 percent of our outstanding shares,“ the CFO added.

Store Closing and Cost Savings Update

GCO continues to gain traction on its plan to reduce cost by $45 million to $50 million on an annualized basis by the end of fiscal 2025 before reinvestment with savings from all divisions and across the entire organization. Initiatives include lowering occupancy costs and increasing selling salary productivity to improve store profitability.

“In addition, the Journeys stores we closed over the last year, which drove a roughly 4 percent reduction in the size of our total fleet, resulted in improved overall productivity and had only a 1 percent net impact on total sales,“ Goeorge said. “The progress we’ve made in our digital business helped overcome the top-line pressure on our stores and wholesale business.”

The company opened five stores and closed 12 Journeys stores in Q2, ending the quarter with 1,314 total stores. Square footage was down 3 percent on a y/y basis.

Year-to-date, GCO closed 29 Journeys stores, primarily mall-based locations.

“We continue to evaluate up to 50 potential Journeys closures in total this year. We expect these closures to eliminate approximately $14 million of annualized SG&A cost, which is incremental to the roughly $25 million of annualized savings we realized from the stores we closed last year and the $45 million to $50 million of run-rate savings we are targeting for this year,“ the CFO detailed.

“We are also working to optimize our inventory marketing spend, warehouse freight logistics cost, and other procurement efficiencies,“ George highlighted. “These actions to reshape our cost structure are designed to strengthen the economics of our store channel and enable investment in other strategic areas such as marketing and technology.”

Fiscal 2025 Outlook

“Turning now to our outlook, we’re very encouraged by the positive reaction to Journeys’ improved back-to-school assortment, and optimistic we will be well-positioned to drive similar results for the holiday,“ Vaughn commented. “But in addition, we’re taking a more cautious view for Schuh and J&M over the remainder of the year. While we now expect higher sales in total, we are maintaining our full-year guidance.

“We look forward to building on Journeys’ momentum going forward to unlock the considerable growth and value here and across the rest of our company in fiscal 2026 and beyond,” she concluded, handing the mic to George.

Genesco now expects total sales to decrease 1 percent to 2 percent compared to fiscal 2024, or flat to down 1 percent excluding the 53rd week in fiscal 2024 versus prior expectations for a total sales decrease of 2 percent to 3 percent, or down 1 percent to 2 percent excluding the 53rd week in fiscal 2024 and continues to expect adjusted diluted earnings per share from continuing operations in the range of 60 cents to $1.00.

Guidance assumes no further share repurchases and a tax rate of 27 percent.

Although Q2 results were better than expected, George said the company continues to maintain a cautious outlook and reiterated its most recent full-year EPS outlook of 60 cents to $1.00 per share.

That soft guidance sent shares lower for the day. GCO shares were down as much as 17 percent in early trading but had climbed back to down in the low-teens by the end of the trading day.

“I’d like to quickly recap that despite a challenging first half, our comp sales trends showed nice sequential improvement from Q1 to Q2, led by Journeys, with overall comps turning positive in July. This momentum accelerated in August, driving comps further into positive territory, Q3 to date,“ George shared.

“Given this progress, we remain optimistic that our assortment and consumer engagement initiatives have Journeys‘ positioned to deliver a solid holiday season,“ he continued. “However, as we’ve seen over the past couple years, the peaks and valleys of consumer shopping patterns have gotten more pronounced, marked by higher peaks and deeper troughs. As such, we expect trends to moderate over the remainder of Q3.“

George said the company adopted a more cautious view for J&M and Schuh, given its current trends and the uncertain operating environment, and expects that to continue to offset the strength at Journeys.

“We expect Q3 comps to be up low single digits versus last year, with sales down slightly due to the 53rd week shift. For additional color, we expect an overall gross margin decrease of approximately 60 to 80 basis points in Q3, mostly due to IMO pressure from product mix shift at Journeys and Schuh and some increased levels of promotional activity at Schuh,“ George said. “In addition, the sales decline on our largely fixed cost base will result in SG&A deleverage of roughly 10 to 40 basis points, leading to earnings per share approximately 35 cents lower than Q3 last year.“

George reminded the call participants that the timing of back-to-school sales shifted approximately 40 cents of earnings per share out of Q3 and into Q2.

“Looking at Q4, we are assuming comps at a similar level to Q3; however, given the higher sales volumes in Q4, we can generate much more operating leverage on our expense structure to drive earnings,“ he noted.

“Taking this all into account for the year, we now expect higher sales and higher leverage, but more pressure in gross margin,“ George offered. “Therefore, we now expect fiscal 2025 total sales to decrease 1 percent to 2 percent or flat to down 1 percent when excluding the 53rd-week last year, versus our prior guidance for a total sales decrease of 2 percent to 3 percent. We now expect adjusted gross margin rates to be down 10 to 20 basis points for the year versus flat up 10 basis points prior, primarily due to product mix and the higher expected promotional activity at Schuh, along with some product and channel mix pressure at Journeys,” continued George.

As a percentage of sales, George said the retailer now expects SG&A to be in the range of flat to leverage 20 basis points versus a range of flat to deleverage the 20 basis points prior.

“Our guidance assumes no additional share repurchases, which results in fiscal 2025 average shares outstanding of approximately $11 million, and we expect the tax rate to be approximately 27 percent,“ George said.

“To sum up, we’re pleased with our progress at Journeys and confident that the measures we’re implementing will position the business for even stronger long-term growth. Supporting that are the many other initiatives across our businesses that will collectively enable us to unlock considerable earnings potential, return to growth, and create meaningful shareholder value,“ the CFO concluded.

Images courtesy Journeys Group