Walmart Inc. shares were up in the mid single digits on Thursday morning, Aug. 15 and assisted in driving the stock market up as a whole as analysts heralded strong retail numbers. But the fact that more people are shopping at Walmart while mid-tier and luxury retail suffers may not be the leading indicator Wall Street hopes.

“Our team delivered another strong quarter,” said Doug McMillon, president and CEO, Walmart. “They work hard every day to help our customers and members save time and money. Each part of our business is growing – store and club sales are up, eCommerce is compounding as we layer on pickup and even faster growth in delivery as our speed improves. Our newer businesses like marketplace, advertising, and membership, are also contributing, diversifying our profits and reinforcing the resilience of our business model.”

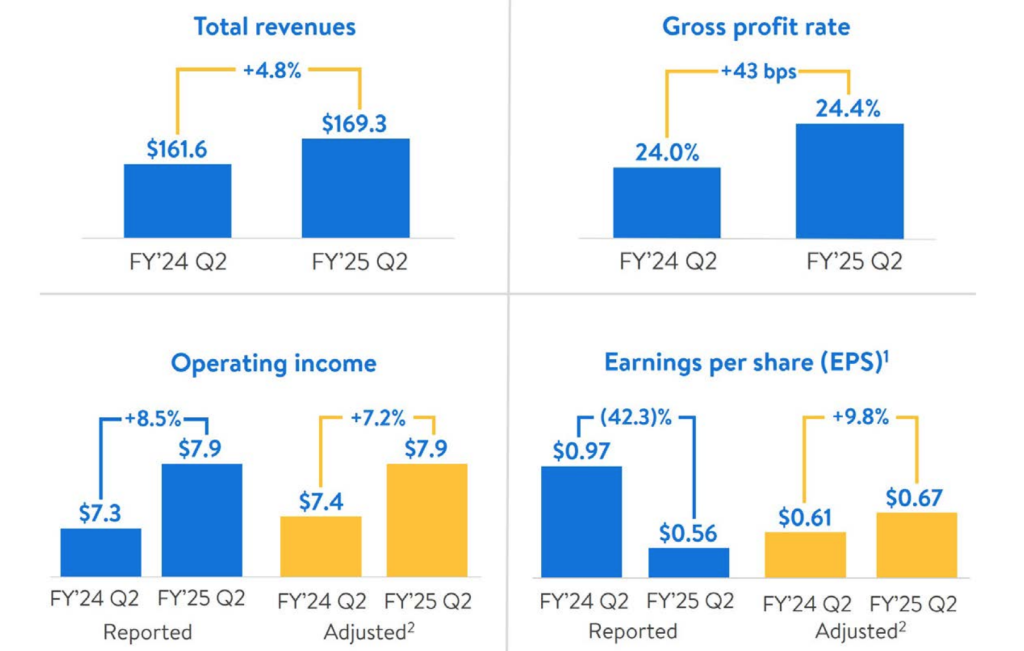

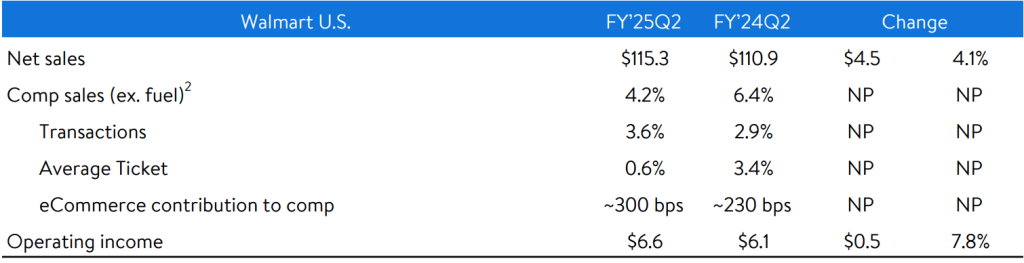

Walmart reported consolidated revenue of $169.3 billion for the quarter, up 4.8. percent, or 5.0 percent in constant-currency (cc) terms. Walmart U.S. comp sales up 4.2 percent. Global e-commerce sales grew 21 percent year-over-year, reportedly led by store-fulfilled pickup and delivery and marketplace.

Consolidated gross margin rate improved 43 basis points, led by Walmart U.S. and Walmart International.

Consolidated operating income was up $0.6 billion, or 8.5 percent, while Adjusted operating income increased 7.2 percent due to higher gross margins and growth in membership income, but also benefiting from reduced e-commerce losses.

ROA came in at 6.4 percent and ROI at 15.1 percent, up 230 basis points year-over-year.

The global advertising business grew 26 percent, including 30 percent for Walmart Connect in the U.S.;

GAAP EPS amounted to 56 cents a share in Q2. Adjusted EPS of 67 cents for the quarter excludes the effect, net of tax, from a net loss of 11 cents on equity and other investments.

Global inventory was down 2.0 percent, including a decrease of 2.6 percent for Walmart U.S., with in-stock levels healthy.

Key Financial Metrics

(Dollars are in billions, except for per-share data. Dollar and percentage changes may not recalculate due to rounding.)

Balance Sheet and Liquidity

- Cash and cash equivalents of $8.8 billion;

- Total debt of $47.0 billion;

- Operating cash flow of $16.4 billion, a decrease of $1.8 billion;

- Free cash flow of $5.9 billion, a decrease of $3.1 billion; Repurchased 33.4 million shares YTD, or $2.1 billion;

- Inventory of $55.6 billion, a decrease of $1.1 billion.

Business Highlights and Strategic Initiatives

(Dollars are in billions, except as noted. Dollar and percentage changes may not recalculate due to rounding.)

Walmart U.S.

- Sales reflected strength in transaction counts and unit volumes across stores and e-commerce channels;

- Value-convenience proposition continues to resonate with customers and members; share gains across income cohorts primarily driven by upper-income households;

- Strong momentum in e-commerce with growth of 22 percent, led by store-fulfilled pickup and delivery;

- Walmart Connect advertising sales grew 30 percent; strong growth in ad counts, including marketplace sellers;

- Gross profit rate increased 51 bps, membership income increased and operating expense deleveraged 41 bps; and

- Inventory declined 2.6 percent while maintaining healthy in-stock levels.

Walmart International

- Balanced sales growth with stores and e-commerce evenly contributing and increased transaction counts and unit volumes;

- E-commerce sales up 18 percent, led by store-fulfilled pickup and delivery and marketplace with penetration up across markets;

- Advertising business grew 23 percent, led by Flipkart and Walmex;

- Strength in food and consumables, as well as improved growth in general merchandise;

- Gross profit rate increased 44 bps due to improved e-commerce margins and growth in higher-margin businesses;

- Operating income cc up 15.7 percent with strength across markets and benefiting from lower losses in e-commerce.

Sam’s Club U.S.

- Strong comp sales, led by food, health and wellness, as well as increases in transactions and unit volumes;

- Gained dollar and unit market share in grocery and general merchandise categories, including apparel and electronics

- Growth in e-commerce sales of 22 percent;

- Strong growth in membership income, up 14.4 percent, with record total membership and increased penetration at quarter end;

- Gross profit rate increased 22 bps; operating expense deleveraged 26 bps;

- Inventory declined 1.7 percent with sustained strong sales and in-stock levels.

Guidance

The following guidance reflects Walmart’s expectations for the third quarter and fiscal year 2025 and is provided on a non-GAAP basis as the retailer cannot forecast certain elements in reported GAAP results, such as the changes in fair value of its equity and other investments. Growth rates reflect an adjusted basis for results from the prior year.

Third Quarter

Walmart based its fiscal third quarter guidance on the following FY24 Q3 figures:

- Net Sales: $159.4 billion

- Operating Income: $6.2 billion

- Adjusted EPS: $0.51

The company’s guidance considers the impact of the timing of festive events in the company’s international segment and the timing of planned expenses.

Fiscal Year 2025

Walmart based its fiscal year guidance on the following FY24 figures:

- Net Sales: $642.6 billion

- Adjusted Operating Income: $27.1 billion

- Adjusted EPS: $2.22

The company’s full-year guidance assumes a generally stable consumer and continued pressure from its global mix of products and formats.

Image courtesy Walmart