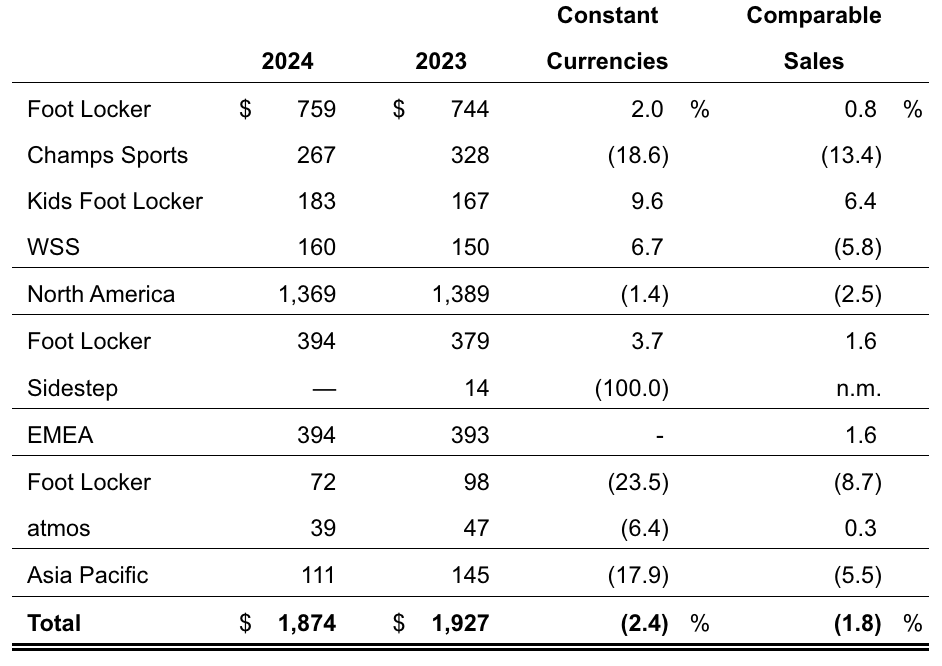

Foot Locker, Inc. reported total sales for the first quarter decreased 2.8 percent to $1.87 billion, compared with sales of $1.93 billion in the first quarter of 2023. Excluding the effects from foreign exchange rate fluctuations, total sales for the first quarter decreased by 2.4 percent.

Comparable sales decreased by 1.8 percent, including a 220 basis-point impact from the continued repositioning of the Champs Sports banner. Global Foot Locker and Kids Foot Locker comparable sales increased 1.1 percent.

First Quarter Sales by Banner

(In millions)

Gross margin declined by 120 basis points year-over-year, with markdowns sequentially moderating compared to the fourth quarter of 2023, partially offset by occupancy leverage.

SG&A amounted to $361 million in the quarter, compared to $431 million in the year-ago Q1 period. SG&A as a percentage of sales increased by 220 basis points compared with the prior-year period, with investments in technology and brand-building as well as higher inflation, partially offset by savings from the cost optimization program, ongoing expense discipline, and a shift in the timing of expenses into the second quarter from the first quarter of 2024.

First quarter net income was $8 million, or 9 cents per diluted share, compared with net income of $36 million, or 38 cents per diluted share, in the corresponding prior-year period.

On a non-GAAP basis, net income was $21 million, or 22 cents per diluted share, compared with $66 million, or 70 cents per diluted share, in the corresponding prior-year period.

Reaffirming 2024 Financial Outlook

The company’s full-year 2024 outlook, representing the 52 weeks ending February 1, 2025, is summarized in the table below.

The full-year Non-GAAP EPS guidance of $1.50 to $1.70 includes an approximate 10 cents a share non-recurring charge in the second quarter of 2024 from the anticipated rollout to the rest of North America of the company’s enhanced FLX loyalty program. This charge is expected as the company converts loyalty points into additional benefits for the its customers.

See below for more detailed SGB Media coverage of Foot Locker’s Q1 results.

EXEC: Inside the First Quarter Foot Locker Call with Senior Execs