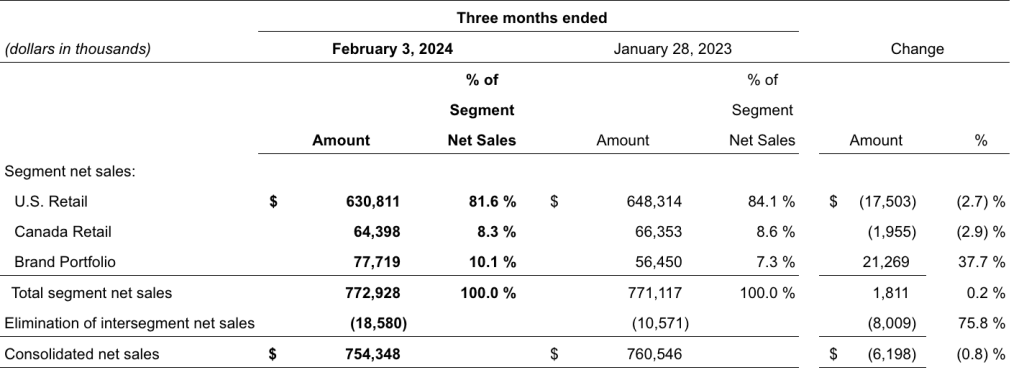

Designer Brands, Inc., parent company to the DSW, Topo, Keds, Hush Puppies, and other footwear brands, saw net sales decrease 0.8 percent to $754.3 million in the fiscal 2023 fourth quarter ended February 3, 2024.

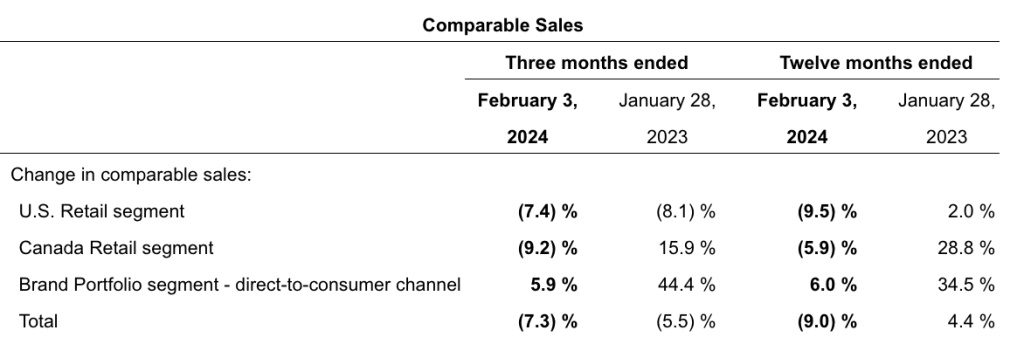

Total comparable sales decreased by 7.3 percent for the quarter, an apparent miss against Street estimates.

Fourth quarter gross profit decreased to $207.4 million versus $222.0 million last year, and gross margin declined 170 basis points to 27.5 percent of sales for the quarter, compared to 29.2 percent for the prior-year Q4 period.

The reported net loss attributable to Designer Brands, Inc. was $29.7 million, or 52 cents per diluted share. This includes net after-tax adjustments of $4.4 million, or 8 cents per diluted share, primarily related to impairment charges. This compares with net income of $45.1 million, or 66 cents per diluted share, in the prior-year Q4 period.

Analysts were looking for a loss of 45 cents per diluted share in the quarter.

The 2023 fourth quarter Adjusted net loss was $25.3 million, or a loss of 44 cents per diluted share.

“We ended the year strong, with a solid finish to the fourth quarter above the top end of our revised EPS guidance range, led by strength in our brand portfolio segment as a result of acquiring Keds, Topo and launching Le Tigre,” stated Doug Howe, CEO of Designer Brands, Inc. “Despite the results, 2023 was a difficult year as we were impacted by a softening footwear market, highly promotional retail environment, and the impact of unseasonably warm weather on our seasonal footwear business.”

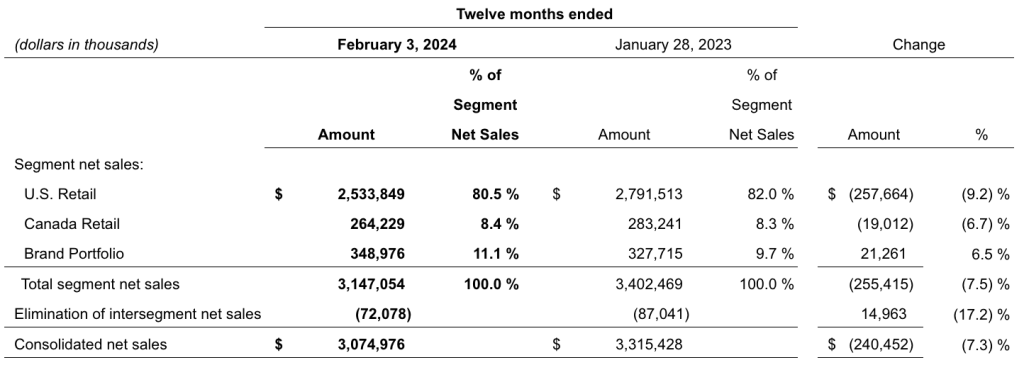

Full Year Sales

Balance Sheet and Cash Management

Cash and cash equivalents totaled $49.2 million at the end of 2023, compared to $58.8 million at the end of 2022, with $160.9 million available for borrowings under a senior secured asset-based revolving credit facility, as amended.

Debt totaled $427.1 million at the end of 2023 compared to $281.0 million at the end of 2022.

Net cash provided by operating activities was $162.4 million for 2023 compared to $201.4 million last year.

Inventories totaled $571.3 million at year-end 2023, compared to $605.7 million at the end of 2022.

Return to Shareholders

In 2023, the company repurchased 9.7 million Class A common shares at an aggregate cost of $102.2 million, including transaction costs and excise tax. As of February 3, 2024, $87.7 million of Class A common shares remained available for future repurchase under the share repurchase program.

A dividend of 5 cents per share of Class A and Class B common shares will be paid on April 12, 2024 to shareholders of record at the close of business on March 29, 2024.

Store Openings and Closings

During the fourth quarter of 2023, DBI opened one store and closed one store in the U.S. and closed one store in Canada, resulting in a total of 499 stores in the U.S. and 143 stores in Canada as of February 3, 2024.

Howe continued, “Looking ahead to 2024, we have an important transition year ahead as we plan to return to growth across our business. We are laser-focused on assembling a fresher and more trend-right assortment for our customers, providing an increasingly convenient shopping experience across our channels and executing operational improvements in our brand’s business bolstered by our new hires. We expect these initiatives will underpin improved financial performance throughout the year and, combined with disciplined cost savings, will lead to continued strong cash flow generation.”

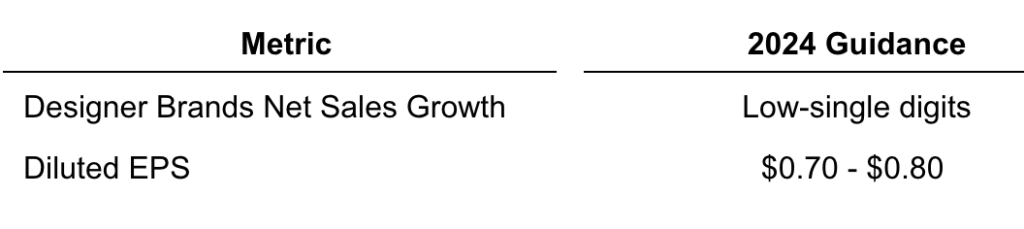

2024 Financial Outlook

The company announced the following guidance for the full year 2024:

DBI shares were down in double digits in pre-market trading on Thursday.

Image courtesy Topo Athletics