Smith & Wesson Brands, Inc. reported a considerable lift from its long gun business in the fiscal third quarter ended January 31, pushing total consolidated revenues up 6.5 percent year-over-year to $137.5 million.

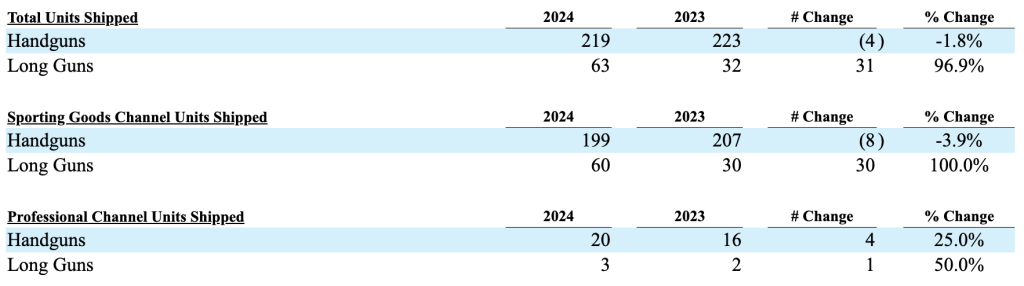

Handgun revenues decreased 7.4 percent in the quarter, primarily due to lower demand for several older handgun products and products that were introduced in the prior year, partially offset by increased shipments of new product introductions, the impact of targeted promotions on certain polymer frame pistols and a 2 percent to 5 percent price increase on select products that took effect in the quarter.

Newly introduced products, defined as any new SKU not shipped in the comparable quarter in the prior year, reportedly represented 17.2 percent of handgun sales in the period.

Long Guns sales increased 110.5 percent compared to the prior-year comp quarter due to increased shipments of newly introduced products, representing 35.7 percent of long gun sales in the period and a 3 percent price increase on select products that became effective in the quarter.

Handgun unit shipments into the sporting goods channel decreased by 3.9 percent from the prior-year comp quarter, while overall consumer handgun demand decreased 3.5 percent (as indicated by adjusted background checks reported in the National Instant Criminal Background Check System (NICS).

Long gun unit shipments into the sporting goods channel increased 100.0 percent over the prior-year comp quarter, while overall consumer demand for long guns increased 4.8 percent (as indicated by NICS).

Other products and services revenue decreased 8.3 percent from the prior-year comp quarter due to decreased sales of component parts and decreased licensing revenue, partially offset by increased sales of handcuffs.

Newly introduced products represented 20.2 percent of sales for the three months ended January 31, 2024 and included one new pistol, two new long guns and new product line extensions.

Gross margin was 28.7 percent of sales in the third quarter, compared with 32.4 percent in the prior-year Q3 period, primarily from an increase in overhead related to operating manufacturing facilities in Massachusetts and Tennessee, inefficiencies from the start-up of operations in Tennessee, the impact of inflation on raw materials and finished parts, which increased approximately 5.8 percent over the prior-year comparable quarter, the impact of inflation on labor costs (particularly as it relates to entry-level positions), partially offset by the impact of higher sales volume, decreased relocation spend, and a price increase that became effective during the quarter.

GAAP net income was $7.9 million, or 17 cents per diluted share, compared with net income of $11.1 million, or 24 cents per diluted share, for the prior-year Q3 period.

Non-GAAP net income was $8.7 million, or 19 cents per diluted share, compared with $11.6 million, or 25 cents per diluted share, for the prior-year Q3 period. GAAP to non-GAAP adjustments for income exclude costs related to moving the company’s headquarters and significant elements of its operations to a new facility in Maryville, Tennessee, or the relocation, and other costs.

Non-GAAP Adjusted EBITDA was $21.4 million, or 15.6 percent of net sales, compared with $25.1 million, or 19.5 percent of net sales, for the prior-year Q3 period.

Inventory balances decreased $23.6 million between April 30, 2023 and January 31, 2024.

While inventory levels, internally and in the distribution channel, were above demand, they could negatively impact future operating results. The company said it is difficult to forecast the potential impact of distributor inventories on future revenue and income as many factors, including seasonality, new product introductions, news events, political events, and consumer tastes, impact demand. The company expects inventory levels to remain relatively flat during the fourth fiscal quarter.

Cash and cash equivalents, measured at fair value on a recurring basis, totaled $47.4 million and $53.6 million as of January 31, 2024 and April 30, 2023, respectively. The carrying value of the company’s revolving line of credit approximated the fair value as of January 31, 2024.

Cash generated by operations was $25.4 million, $18.5 million, better than the prior-year Q3 period, primarily due to receivables remaining relatively flat to last quarter while inventory declined by $9.8 million.

“We repurchased nearly 71,000 shares during the third quarter, utilizing $916,000 of our $50 million authorization, and paid $5.5 million in dividends,” shared company EVP and CFO Deana McPherson. “Consistent with our capital allocation strategy, our board of directors authorized a 12 cents per share quarterly dividend, which will be paid to stockholders of record on March 21, 2024, with payment on April 4, 2024.”

“Our team delivered another strong quarter on both the top and bottom line,” commented Mark Smith, president and CEO of Smith & Wesson Brands, Inc. “We believe we gained market share as our shipments outpaced the overall firearm market, reflecting the continuing robust demand for our best-in-class, innovative new products and sustained momentum in our core product portfolio. We continue to expect the firearm market to experience healthy demand through the 2024 election cycle. With our deep pipeline of new products, leading brand, new state-of-the-art facility in Tennessee, strong balance sheet, and most importantly, world-class dedicated employees, we are well positioned to continue delivering value for our stockholders.”

Image and charts courtesy Smith & Wesson