Shimano, Inc. pointed to tight monetary policies designed to tame inflation that had been adopted mainly in Europe and the U.S. was projected to end during fiscal year 2023, but the pace of global economic recovery remained at a standstill with turmoil in Ukraine and the Middle East and a slowdown in China’s economic recovery exerted downward pressure.

In 2024, throw in the weakening economy in China, the prolonged “situation” in Ukraine, growing tensions in the Middle East, and a contentious U.S. election, and it does not lead Shimano to push the company’s forecasted results higher.

Regional 2023 Overview

In Europe, hikes in energy costs and raw material prices showed signs of easing, but the economy remained lackluster.

In the U.S., while inflation gradually slowed and the FRB continued to forego interest rate hikes, personal consumption driven by a favorable employment environment and household assets supported the economy.

In China, personal consumption after the lifting of restrictions on activities ended as a reaction after the pandemic, and economic recovery remained lackluster, affected by the prolonged downturn in the real estate market.

In Japan, while economic activities returned to normal and demand from inbound tourism recovered, wage growth hardly kept up with price hikes and personal consumption was sluggish, resulting in moderate economic recovery.

The company said that demand for bikes and fishing tackle continued to weaken in the 2023 market environment.

Fiscal full-year 2023 net sales decreased 24.6 percent from the prior year to ¥474.36 billion. Operating income decreased 50.5 percent to ¥83.65 billion, ordinary income decreased 41.5 percent to ¥103.37 billion, and net income attributable to owners of the parent company decreased 52.3 percent to ¥61.14 billion.

Bike Components

Although the booming popularity of bikes cooled, the company said that interest in the category continued to be high as a long-term trend. However, market inventory generally remained high, despite ongoing supply and demand adjustments.

- In the Japanese market, retail sales were sluggish, affected by the soaring price of completed bikes due to yen depreciation and pullbacks in consumer spending, and market inventories remained high.

- In the European market, the strong interest in bikes continued in its major markets (Germany and Benelux countries), and retail sales of completed bikes were strong. On the other hand, in other countries, consumer demand waned due to inflation and an economic slowdown, and market inventories remained at high levels.

- In the North American market, although interest in bikes was firm, retail sales of completed bikes remained weak partly due to a reaction from the cycling boom, and market inventories were at a consistently high level.

- In the Asian, Oceanian and Central and South American markets, although interest in bikes was strong, retail sales of completed bikes remained sluggish due to cooling consumer confidence from rising inflation and economic uncertainty, and market inventories were at a high level. However, in the Chinese market, sales remained strong, especially for road bikes, owing to the continued popularity of outdoor sports cycling, and market inventories remained at an appropriate level.

Under these market conditions, the Shimano Group said it received a favorable reception for its new products, including Shimano 105, equipped with a twelve-speed derailleur and a gravel-specific component Shimano GRX. As a result, net sales from this segment decreased 29.5 percent from the prior year to ¥364.68 billion, and operating income decreased 55.0 percent to ¥65.25 billion.

Fishing Tackle

With changes in global consumer trends, Shimano said demand for fishing tackle showed signs of cooling down, which led to an increase in market inventory and exerted no small effect on sales.

- In the Japanese market, sales were sluggish, with leisure options becoming diversified after the pandemic.

- North American market sales that had initially been weak became strong, assisted by rising demand for new products.

- In the European market, the company’s performance had been supported by stable demand in some areas, but sales were lackluster due to “an adjustment of market inventories.”

- In the Asian market, sales were “favorable” in China, but demand showed signs of a slowdown as consumer confidence waned with an uncertain outlook for business sentiment.

- In the Australian market, sales were strong due to favorable fishing conditions and stable weather conditions.

Under these market conditions, the Shimano’s spinning reels Stradic and its high-end model lure fishing rods World Shaula were well-received in the market. In addition, order-taking was brisk for the existing spinning reels Vanquish and other high-priced products. As a result, net sales from this segment decreased 1.6 percent from the prior year to ¥109.23 billion, and operating income decreased 23.8 percent to ¥18.41 billion.

Others

Net sales from the Others segment decreased 4.6 percent year-over-year to ¥457 million and an operating loss of ¥11 million was recorded, following an operating income of ¥1 million in the prior year.

Balance Sheet

Total assets as of the end of fiscal year 2023 amounted to ¥871.73 billion, an increase of ¥45.32 billion compared with the prior fiscal year-end. The principal factors included an increase of ¥63,50 billion in cash and time deposits, an increase of ¥7.40 billion in machinery and vehicles, an increase of ¥4,245 billion in construction in progress, an increase of ¥4.09 billion in investment securities, an increase of ¥3.17 billion in software, an increase of ¥2.97 billion in deferred income taxes, a decrease of ¥23.60 billion in notes and accounts receivable-trade, a decrease of ¥10.96 billion in work in process, and a decrease of ¥5.67 billion in merchandise and finished goods.

Total liabilities amounted to ¥69.33 billion, a decrease of ¥15.98 billion compared with the previous fiscal year-end. The principal factors included an increase of ¥14.62 billion in provision for product warranties, a decrease of ¥16.16 billion in income taxes payable, a decrease of ¥9.57 billion in accounts payable-trade, a decrease of ¥2.91 billion in others under current liabilities, and a decrease of ¥2.15 billion in short-term loans payable.

Net assets amounted to ¥802.40 billion, an increase of ¥61.30 billion compared with the figure as of the previous fiscal year-end. The principal factors included an increase of ¥39.02 billion in foreign currency translation adjustments, an increase of ¥11.65 billion in cancellation of treasury stock and an increase of ¥9.03 billion in retained earnings.

As a result, the shareholders’ equity ratio was 91.9 percent compared with 89.6 percent as of the previous fiscal year-end, and net assets per share were ¥8,905.21 compared with ¥8,166.35 as of the prior fiscal year-end.

Cash Flows for FY 2023

Net cash provided by operating activities amounted to ¥114.57 billion compared with ¥110.68 billion provided for the previous year. The primary cash inflows included income before income taxes amounting to ¥83.44 billion, notes and accounts receivable amounting to ¥25.14 billion, depreciation and amortization amounting to ¥23.94 billion, interest and dividend income received amounting to ¥20.32 billion, inventories amounting to ¥20.25 billion, and provision for product warranties amounting to ¥15.46 billion. The primary cash outflows included income taxes paid amounting to ¥43.20 billion and interest and dividend income amounting to ¥21.11 billion.

Net cash used in investing activities amounted to ¥31.76 billion compared with ¥33.38 billion used for the prior year. The primary cash inflows included proceeds from maturities of time deposits amounting to ¥9.76 billion. The primary cash outflows included the acquisition of property, plant, and equipment amounting to ¥24.78 billion, purchases of time deposits amounting to ¥7.89 billion, and the acquisition of intangible assets amounting to ¥6.53 billion.

Net cash used in financing activities amounted to ¥43,961 billion compared with ¥58.42 billion used for the prior year. The main cash outflows included cash dividends to shareholders amounting to ¥25.80 billion, acquisition of treasury stock amounting to ¥14.72 billion, and short-term loans payable, net amounting to ¥2.28 billion. As a result, cash and cash equivalents at the end of the year were ¥481.98 billion.

Outlook

Shimano said it sees soaring resource prices and stagnation of logistics stemming from geopolitical risks, such as the prolonged situation in Ukraine and growing tensions in the Middle East, that could disrupt global supply chains and put further downward pressure on the economy. In addition, the outcomes of elections scheduled in major countries and regions in 2024 and changes in interest rate policies in various countries could affect the economy.

While monetary tightening adopted mainly in Europe and the U.S. has shown signs of easing, it is expected in Europe that personal consumption will recover due to declining inflation rates and improvement in the employment environment, leading to moderate economic recovery.

Meanwhile, in the U.S., there is concern that the presidential election in 2024 could influence the economy.

In China, economic recovery could remain lackluster due to the prolonged stagnation in the real estate market.

In Japan, moderate economic recovery is expected as wage raises and the government’s economic policies support the normalization of economic activities. However, an unstable international situation and shifts in the government’s monetary policies could impact the economy.

In these circumstances, the company emphasizes not only striving to develop and manufacture “captivating products” while closely monitoring trends for bikes and fishing tackle but also moving forward as a “value-creating company” that continues to create a “shared value between corporations and society.” The company also said it “endeavors to further enhance management efficiency and strive for sustainable corporate growth by pursuing the creation of new cycling and fishing culture.”

Business Performance Forecast

(for the period ending December 31, 2024)

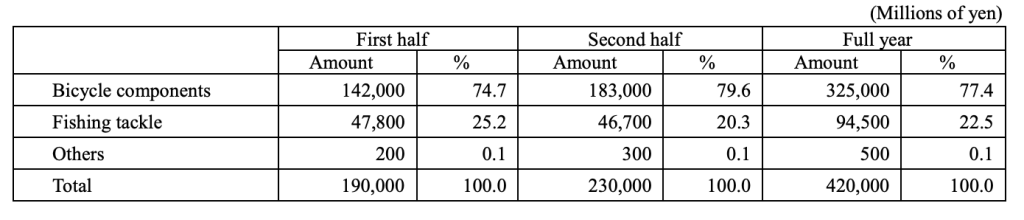

Business Segment Performance Forecast

(for the period ending December 31, 2024)

Image, data and charts courtesy Shimano