Winnebago Industries, Inc. reported that revenues for the Fiscal 2024 first quarter were $763.0 million, a decrease of 19.9 percent compared to $952.2 million for the Fiscal 2023 first quarter, said to be primarily driven by lower unit sales related to market conditions, product mix, and higher discounts and allowances compared to the prior-year quarter, partially offset by carryover price increases related to higher motorized chassis costs.

Gross profit for the fiscal first quarter ended November 25, was $115.8 million, a decrease of 27.8 percent compared to $160.4 million for the prior-year corresponding quarter. Gross profit margin decreased 160 basis points from the prior-year quarter to 15.2 percent of sales, which was said to be primarily a result of volume deleverage and higher discounts and allowances.

Operating income was $39.1 million for the reported quarter, a decrease of 54.5 percent compared to $85.9 million for the prior-year corresponding quarter.

Net income was $25.8 million, or 78 cents per diluted share a decrease of 57.1 percent compared to $60.2 million, or $1.73 per diluted share, in the prior-year quarter. Adjusted diluted EPS was $1.06 for Q1, a decrease of 48.8 percent compared to Adjusted diluted EPS of $2.07 in the year-ago period. Consolidated Adjusted EBITDA was $54.1 million for the most recent quarter, a decrease of 44.2 percent compared to $97.0 million in the prior-year corresponding quarter.

“Winnebago Industries’ first quarter results underscore the resilience of our diversified portfolio and variable cost structure in navigating a sales environment influenced by challenging retail trends and intentional inventory management by dealers,” commented President and CEO Michael Happe. “Our steadfast commitment across our portfolio to production discipline that aligns with market conditions, and improving operational excellence continues to deliver solid profitability. Throughout the first quarter, we maintained our focus on recent and forthcoming multiple new product releases in the Towables RV segment, as well as a refreshed, entry-level Aria pontoon product in the Marine segment, that addresses vital considerations surrounding affordability while staying true to our reputation for outstanding quality and customer service. We also continued to strategically invest in critical long-term initiatives around advanced technology, digital transformation, and IT capabilities. The inauguration of our new Innovation Center represents an important milestone as we strive to cultivate and integrate emerging technology innovations, enhancing the overall value proposition and experience for our customers. Our unwavering commitment to investing in the future reflects our long-term confidence in driving sustained growth, expanding market share, and providing customers with a diverse array of compelling options – all while ultimately delivering value for our shareholders.”

Towable RV

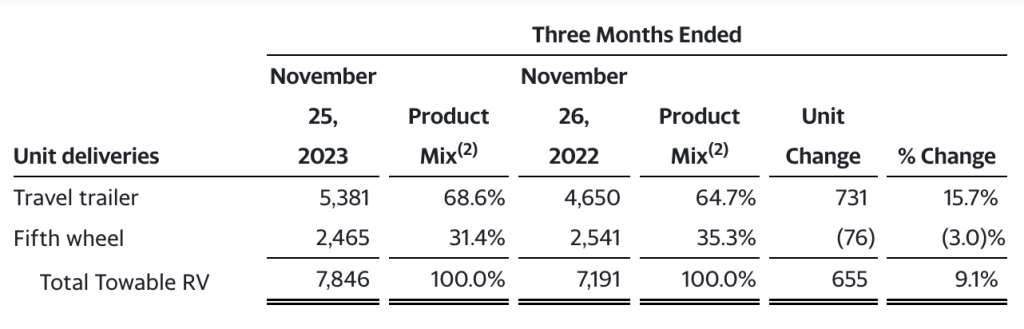

Revenues for the Towable RV segment were $330.8 million for Q1, down 4.8 percent compared to the prior-year Q1 period, said to be primarily driven by a reduction in average selling price per unit related to product mix and targeted price reductions, partially offset by unit volume growth.

Segment Adjusted EBITDA was reported $33.1 million for Q1, down 8.8 percent compared to the prior-year period. Adjusted EBITDA margin of 10.0 percent decreased 50 basis points compared to the prior-year quarter, said to be primarily due to deleverage and new product start-up costs.

Towable RV backlog at quarter-end was $199.8 million, a decrease of 54.0 percent compared to the prior-year quarter-end due to “continued softness in market conditions and a cautious dealer network.”

Motorhome RV

Revenues for the Motorhome RV segment were $334.4 million for Q1, down 28.0 percent from the prior-year period, said to be primarily driven by a decline in unit volume related to market conditions and higher levels of discounts and allowances, partially offset by product mix and price increases related to higher motorized chassis costs. Segment Adjusted EBITDA for Q1 was $21.3 million, down 57.6 percent compared to the prior-year period. Adjusted EBITDA margin of 6.4 percent decreased 440 basis points compared to the prior-year quarter, said to be primarily due to volume deleverage, higher discounts and allowances, and operational efficiency challenges.

Motorhome RV backlog decreased to $545.3 million at quarter-end, down 65.8 percent from the prior-year quarter-end due to “continued softness in market conditions and a cautious dealer network.”

Marine

Revenues for the Marine segment were $87.3 million for Q1, down 33.5 percent from the prior-year period, said to be primarily driven by a decline in unit volume related to market conditions and higher discounts and allowances, partially offset by carryover price increases. Segment Adjusted EBITDA for Q1 was $7.2 million, down 61.0 percent compared to the prior-year period, and Adjusted EBITDA margin was 8.2 percent, down 590 basis points compared to the prior-year period, said to be primarily due to volume deleverage and higher discounts and allowances compared to fiscal Q1 last year.

Marine backlog at quarter-end decreased to $140.4 million, down 55.9 percent from the prior-year period, primarily driven by “cautious dealer sentiment related to rising inventory levels.”

Balance Sheet and Cash Flow

As of November 25, 2023, the company had a total outstanding debt of $593.1 million ($600.0 million of debt, net of debt issuance costs of $6.9 million) and working capital of $587.3 million.

Cash flow used in operations was $21.4 million in the Fiscal 2024 first quarter.

“Despite continued pressure from macro headwinds, the outdoor recreation market is largely performing in-line with near-term expectations and Winnebago Industries’ innovation engine continues to develop and deliver products that anticipate and exceed the expectations of discerning customers across the outdoor lifestyle market,” Happe continued. “We expect our consistent focus on bringing the highest quality and most innovative products to the market at a variety of price points, will position Winnebago Industries to grow our market share and outperform expectations as the market recovers and levels of consumer confidence rise. We remain optimistic that the current cycle of RV dealer de-stocking is approaching its conclusion, and that market conditions in both retail and wholesale could begin to see improvement in mid to late calendar year 2024. Going forward, we will remain nimble and intentional as we prudently monitor and adapt in response to shifting market conditions, with a focus on profitability, maintaining competitiveness, further securing a preferred market position for our esteemed premium brands and making strategic investments to drive future growth.”

Photo and graphic courtesy Winnebago Industries