SGB Media last week took a look inside the first part of a recent study from the International Council of Shopping Centers (ICSC), analyzing the data from the trade associations’s third survey regarding the so-called Halo Effect, or the impact that new stores and closing stores have on online retailers, or what was referred to as the cannibalization of retailer’s own business.

ICSC’s first report on the Halo Effect in 2018 reportedly established that new stores serve as a billboard for brands, fostering brand recognition that builds customer loyalty (read the report here). The trade association followed up that report in 2019 with a study that quantified how much shoppers spend online after visiting a brick-and-mortar store and vice versa (read the report here).

ICSC’s latest research digs into hundreds of market areas to provide a hyperlocal analysis of how a new store could drive online awareness, reinforcing the brand’s sales cycle. While new stores continue to billboard brand awareness, they also directly correlate to increased online and in-store sales.

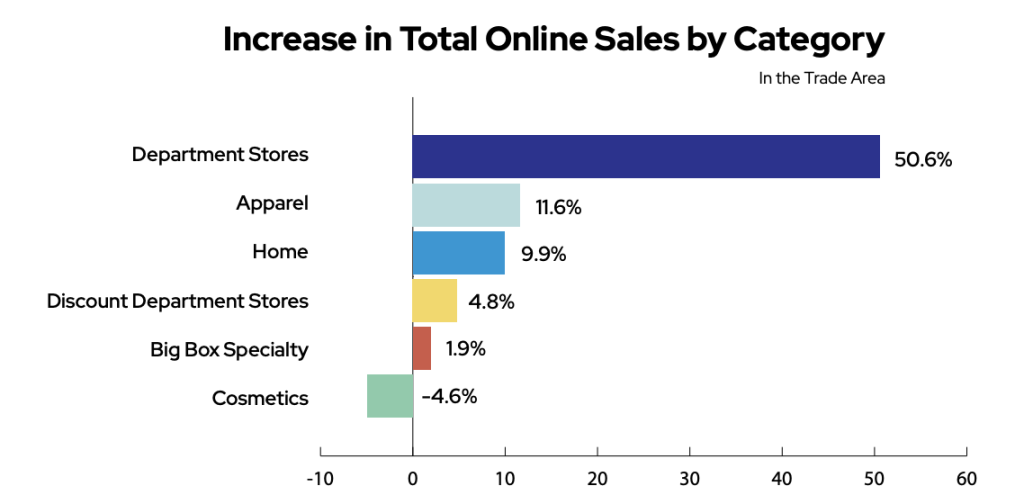

Categories Capture Mindshare

In ICSC’s sample, nearly all retail categories saw boosted online sales following the opening of a new brick & mortar store. The positive halo effect reportedly varied by category, according to the ICSC analysis, with department stores experiencing a 50.6 percent increase in online spending, followed by apparel retailers, which saw an 11.6 percent rise in e-commerce sales. Only cosmetics brands saw a dip in online sales (down 4.6 percent) after they opened a brick & mortar location in a new market area, according to the survey data.

ICSC noted that apparel brands came in second among established categories in creating a positive online halo effect when opening new stores, but the analysts also examined sales at these brands based on their momentum — those that were expanding their total number of stores versus those that were shrinking their total number of stores. ICSC found that apparel brands that were expanding their total number of stores experienced a boost in online sales at more than twice the rate (+12 percent) compared to those reducing their total number of stores (+5.5 percent).

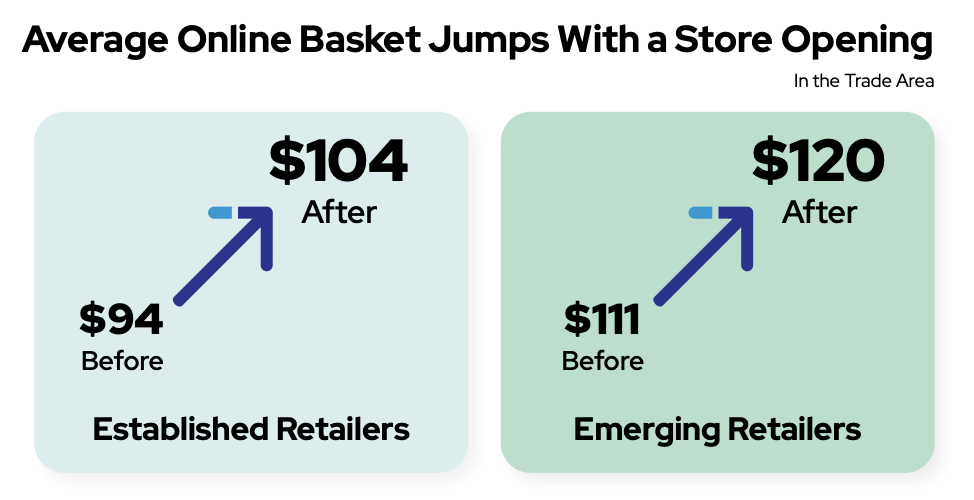

Bigger Baskets

ICSC’s analysis of credit card data also shows that when retailers open a new location within a designated market area, their average online basket grows. For instance, among established retailers, the analysts at ICSC noted that the average online basket was $94 prior to opening a store but increased to $104 after opening a physical location. ICSC reported a similar bump among emerging retailers, with the average online basket rising from $111 to $120.

Two categories reportedly saw the biggest increase in the average online basket after opening a store – big box specialty retailers and home goods. The average online basket among big box specialty retailers increased from $85 to $111 following the opening of a brick & mortar store, according to the survey data. The spread was even greater among retailers that specialize in home goods — driving the average online basket from $194 to $243 following the opening of a physical store, ICSC said.

R5 Capital Founder and CEO Scott Mushkin said retailers must balance multiple elements to secure maximum sales.

“First, retailers need to ensure that the consumer shopping experience is comfortable and convenient by focusing on the basics, including adjusting labor schedules to flex with in-store demand, maintaining orderly stores, and managing the checkout process,” he said. “For certain retailers, layering in services such as health care offerings at physical stores and promoting experiential attractions such as sports are two ways to keep the brick & mortar offerings fresh and dynamic.”

But he added that these aren’t silver bullets when it comes to maintaining a healthy store fleet.

“Everyone is competing for mindshare,” Mushkin says. “The challenge is how to maintain the store experience and run a very good omni-channel operation. The bar has to be raised in-store.”

Methodology

An analysis by the strategy and research firm Alexander Babbage for ICSC examined $848.1 billion of in-store and online spending by zip code to quantify the impact of opening and closing stores. The analysis covered in-store and online sales of 69 retailers, including 2,103 stores in 50 states plus Washington, D.C., from 2019 to 2022. The data was computed by reviewing the 13 weeks following the opening or closing of a store. The study excluded the two weeks before and after the week of the store closing or opening to minimize any final sales for closing or honeymoon periods following the opening of a store. The study included established retailers across six categories: apparel, big box specialty, cosmetics, department stores, discount department stores, and home stores. The study also included emerging retailers identified from a list of 140-plus direct-to-consumer brands across multiple categories. The ICSC analysis of the apparel category highlighted a difference based on momentum. Where applicable, the study highlighted two apparel sub-groups—brands that were mostly expanding their total number of stores and brands that were mostly shrinking their total number of stores.

For more information on ICSC’s latest report, go here.

Photo courtesy Adobe, Graphic courtesy ICSC