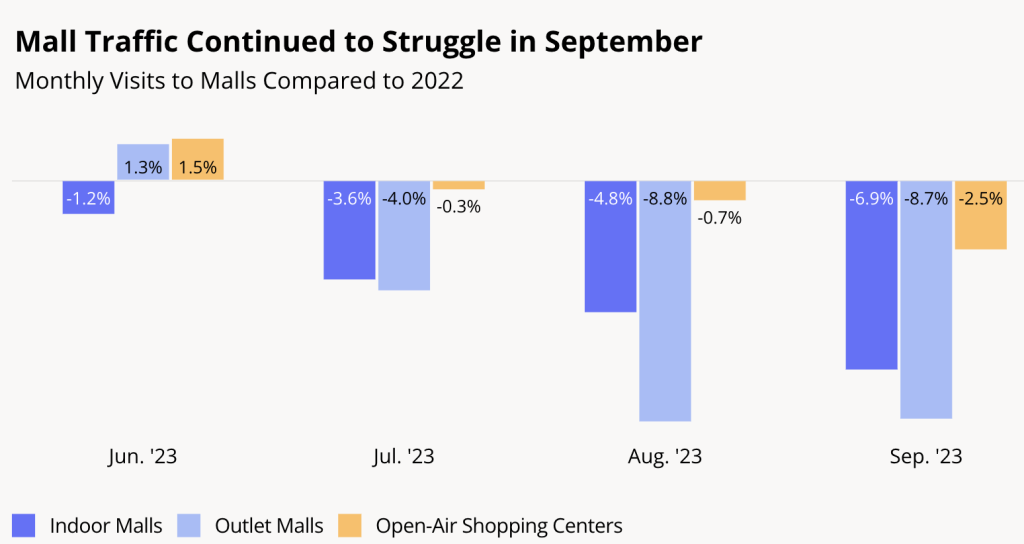

A recent report from Placer.ai revealed that visits to malls in September mostly fell once again and have been trending down since July. The research firm, which measures foot traffic at shopping formats, restaurants and stores, said there were some signs of life toward the end of September, which could indicate that consumers are heading to shopping malls. The company said the tough month for malls came as consumer confidence took a tumble and many U.S. consumers continued channeling their limited discretionary budgets toward services instead of retail goods.

Placer.ai reported that the year-over-year (YoY) visit gap to indoor malls and open-air shopping centers widened, following the negative foot traffic trends in the wider retail sector. The company said outlet malls, which continued to lag behind the other retail formats in YoY visits, saw visit gaps remaining steady.

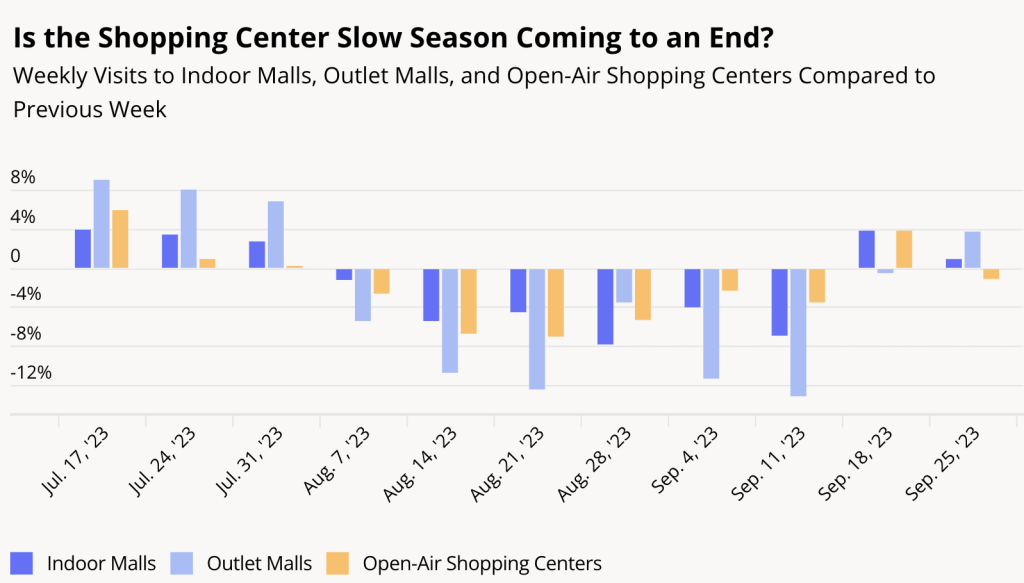

However, towards the end of the month, the challenges appeared to be easing. During the last full week of September (September 18 to 24), week-over-week (WoW) foot traffic increased at Indoor Malls and Open-Air Shopping Centers for the first time since the week of July 31, 2023, and during the week of September 5 to October 1, WoW visits to Indoor Malls rose once more, while traffic to Open-Air Shopping Centers stayed level.

Outlet Malls, where WoW visits during the last full week of September remained steady after six weeks of steady dips, saw WoW visit growth between September 5 and October 1. Still, Placer.ai said these are just two weeks, and looking at the data on a YoY basis shows that visits are still behind 2022 levels. But the WoW increase could indicate that the difficulties facing the wider retail sectors are moderating, just in time for tje critical holiday selling season.

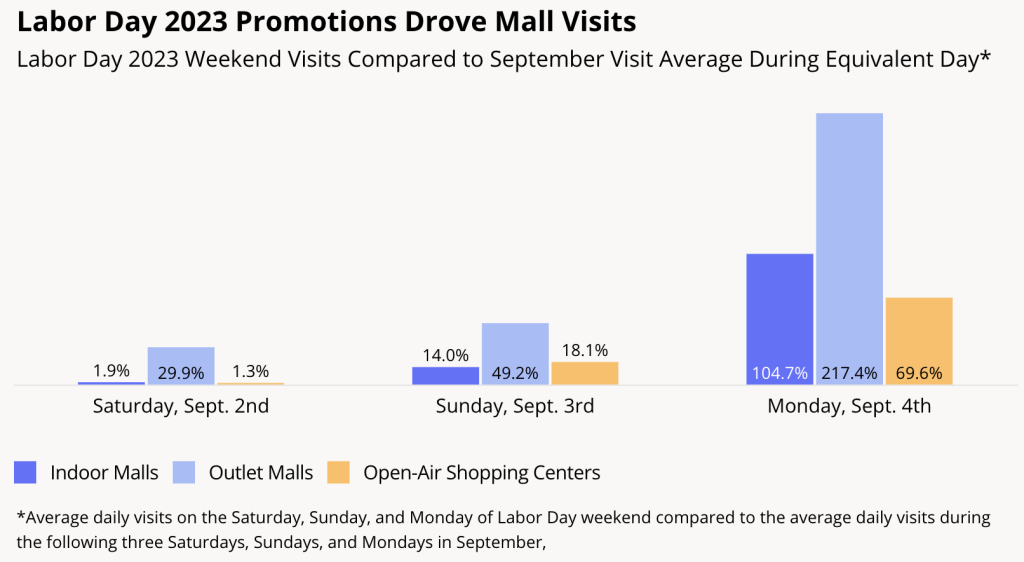

Labor Day foot traffic data also provided a reason for optimism ahead of Black Friday, according to the report. Consumers shopped at all mall formats over the 2023 weekend, with the Monday holiday seeing a significant spike. The report said that Outlet Malls saw a 29.9 percent, 49.2 percent and 217.4 percent increase in visits over the Saturday, Sunday and Monday of the holiday weekend, respectively, relative to average Saturday, Sunday and Monday visits in September 2023. The format tends to see the largest visit boosts in promotional events, and Labor Day 2023 showcased once again shoppers’ willingness to shop at physical stores for discounts.

Indoor Malls and Open-air Shopping Centers saw more modest increases on Saturday, followed by a 14.0 percent and 18.1 percent increase in visits, respectively, on Sunday, September 3. On Monday, Labor Day foot traffic to Indoor Malls (+104.7 percent) and Open-Air Shopping Centers (+69.6 percent) was higher on average than it was during the subsequent Mondays in September, another sign that promotional events still have the potential to drive retail traffic.

Critical Holiday Season Ahead

Even though U.S. mall visits fell relative to 2022 and foot traffic throughout September generally remained lower than it had been earlier in the summer, the Labor Day weekend data showed that consumers have not given up on shopping at malls. With many retailers launching promotions in October, and as the holiday shopping moves up earlier and earlier into the season, the next several months will be critical to understanding where malls stand in today’s retail landscape.

The Placer.ai Mall Index analyzes data from 100 top-tier Indoor Malls, 100 Open-Air Shopping Centers (not including outlet malls) and 100 Outlet Malls across the country, in both urban and suburban areas. Placer.ai uses de-identified location information from a panel of tens of millions of devices and processes the data using industry-leading AI and machine learning capabilities to make estimations about overall visits to specific locations. For more data-driven retail insights, go here.

Illustration courtesy Placer.ai