Yue Yuen Industrial (Holdings) Limited, the manufacturer of footwear for most major outdoor and athletic brands, recorded revenue of US$4.16 billion in the six months ended June 30, 2023, representing a decrease of 11.8 percent compared with the corresponding period of last year, which was mostly due to weakness in its manufacturing business resulting from softer global demand for footwear amid the current inventory digestion cycle taking place across the industry. Yue Yuen reports in U.S. dollars with the exception of its Pou Sheng retail subsidiary.

The profit attributable to owners of the company was $83.6 million, a decrease of 52.2 percent compared to a profit attributable to owners of the company of $175.0 million recorded for the corresponding period of last year. The profit attributable to owners of the manufacturing business decreased by 67.7 percent to $56.0 million, which was partly offset by the decent recovery momentum of Pou Sheng during the period with the profit attributable to owners of Pou Sheng increasing by 1,654.2 percent to RMB305.5 million. The basic earnings per share for the first half of 2023 was 5.19 cents, compared to the basic earnings per share of 10.87 US cents for the corresponding period of last year.

The Board has resolved to declare an interim dividend of HK$0.20 per share (2022: HK$0.40 per share) for shareholders whose names appear on the register of members of the company on Thursday, September 14, 2023. The interim dividend shall be paid on Friday, October 6, 2023. The Group said its commitment to upholding a relatively steady dividend level over the long term remains intact.

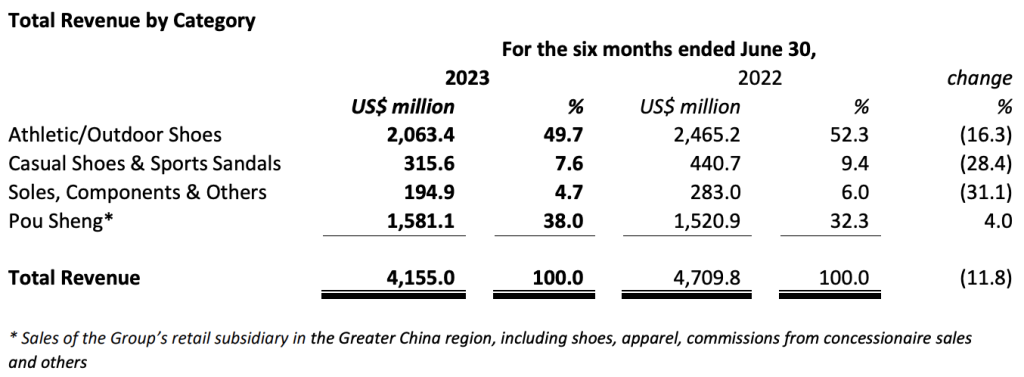

First-half revenue attributed to footwear manufacturing activity (including athletic/outdoor shoes, casual shoes and sports sandals) decreased by 18.1 percent to $2.38 billion, compared with the corresponding period of last year. The volume of shoes shipped during the period decreased by 23.8 percent to 109.8 million pairs due to soft global demand and a high base effect. The average selling price increased by 7.5 percent to $21.67 per pair, led by relatively resilient demand for the Group’s high-end footwear.

The Group’s total revenue with respect to the manufacturing business (including footwear, as well as soles, components and others) was $2.57 billion, representing a decrease of 19.3 percent as compared to the corresponding period of last year.

First-half revenue attributed to Pou Sheng increased by 4.0 percent to $1.58 billion, compared to $1.52 billion in the corresponding period of last year. In RMB terms (Pou Sheng’s reporting currency), revenue increased by 11.1 percent to RMB10,960.0 million, compared to RMB9,864.8 million in the corresponding period of last year. The increase in revenue was mainly attributed to a recovery of purchasing intent and foot traffic at its retail stores across mainland China, the resilient performance of its omni-channels, particularly its Pan-WeChat Ecosphere, as well as a low base effect.

As of June 30, 2023, Pou Sheng had 3,723 directly operated retail outlets across the Greater China region, representing a net closure of 370 stores as compared with the 2022 year-end. The net closure is in line with Pou Sheng’s retail refinement strategy that focuses on streamlining and refining store networks to enhance efficiency. It is also leveraging its operational expertise and taking a more holistic approach in prioritizing selective high-quality openings with business partners. As a result, the contribution of quality larger-format stores (above 300 m2) to Pou Sheng’s directly-operated store count rose to 19.7 percent (first half of 2022: 16.9 percent).

Gross Profit

During the H1 period, the gross profit of the manufacturing business decreased by 19.5 percent to $448.2 million. The gross profit margin of the manufacturing business during the period remained largely stable, declining by just 0.1 percentage points to 17.4 percent compared to the corresponding period of last year, which was mainly attributed to the Group’s cost-reduction and efficiency-improvement efforts, flexible production scheduling,

Selling & Distribution Expenses, Administrative Expenses and Other Income/Expenses

The Group’s total selling and distribution expenses for the period decreased by 12.1 percent to $473.4 million, equivalent to approximately 11.4 percent of revenue. Administrative expenses for the period decreased by 4.0 percent to $286.3 million, equivalent to approximately 6.9 percent (first half of 2022: 6.3 percent) of revenue.

Other income for the period increased by 8.4 percent to $66.5 million, equivalent to approximately 1.6 percent (first half of 2022: 1.3 percent) of revenue. Other expenses increased by 19.3 percent to $130.2 million, equivalent to approximately 3.1 percent (first half of 2022: 2.3 percent) of revenue. During the period, the Group made necessary adjustments to its manufacturing business to combat volatile capacity utilization and as part of its long-term capacity allocation plan. The related severance expenses amounted to approximately $20.5 million.

Recurring Profit Attributable to Owners of the Company

In the period under review, the Group recognized a non-recurring profit attributable to owners of the company of $3.7 million. The decrease was mainly due to the decline in gains on fair value changes on financial instruments at fair value through profit or loss (FVTPL) and no gain on disposal during the period, unlike in the corresponding period of last year. In the same period of 2022, the Group recognized a nonrecurring profit attributable to owners of the company of $10.1 million, due to a gain of $7.0 million on fair value changes on financial instruments at FVTPL, as well as a gain of $3.6 million on the disposal of a joint venture.

Excluding all items of non-recurring nature, the recurring profit attributable to owners of the company for the period under review, was $79.9 million, compared to a recurring profit attributable to owners of the company of $165.0 million for the corresponding period of last year.

Financial Position

The Group’s financial position remained solid. As at June 30, 2023, the Group had net borrowing of $239.5 million (December 31, 2022: $416.7 million) and a net gearing ratio (net bank borrowings to total equity) of 5.3 percent (December 31, 2022: 9.0 percent). Net free cash inflow amounted to $281.0 million (first half of 2022: net free cash outflow $102.7 million). Overall net decrease in cash and cash equivalents amounted to $87.5 million (first half of 2022: net decrease of $53.6 million).

Share of Results of Associates and Joint Ventures

For the period under review, the share of results of associates and joint ventures was a combined profit of $29.1 million, compared to a combined profit of $30.3 million in the corresponding period of last year

Prospects

While the Group remains optimistic about the long-term prospects of its manufacturing business, the uncertain macroeconomic outlook including persistent inflation and high interest rates, alongside the conservative approaches being seen across the industry will continue to weigh on the order visibility of its manufacturing business in the near term.

The Group will continue to proactively monitor the situation and dynamically allocate its manufacturing capacity to balance demand, its order pipeline and labor supply. The Group will sustain its efficiency and productivity, as well as the highest level of flexibility and agility, by leveraging its core strengths, adaptability and competitive edges to overcome any short-term disruptions and safeguard its profitability, while focusing on cost controls and cash flow management to ensure the healthiness of its liquidity and financial position.

Having adopted a disciplined approach to capital expenditure in the short-term, the Group remains committed to its mid to long-term capacity allocation strategy of diversifying its manufacturing capacity in regions such as Indonesia and India where labor supply and infrastructure are supportive of sustainable growth. It will continue to exploit its strategy of prioritizing value growth, leveraging the ‘athleisure’ and premiumization trends to seek more high value-added orders with a better product mix.

The Group will continue to pursue its long-term digital transformation strategy aimed towards achieving operational excellence through digital lean management, having continuously rolled out SAP ERP implementation coupled with the implementation of other real-time data applications and remote monitoring systems. It will also continue to proactively adapt its production capacity and capability to cater to the fast-moving market environment and ongoing trends, including increased demand from brand customers for greater versatility, flexibility, eco-friendliness, more efficient turnaround times, on-time delivery and end-to-end capabilities. This includes enabling digital prototyping and production simulations, automation, more flexible set-ups and frequent line change-overs through process re-engineering, and the further integration of other digitalization tools such as increasingly important Operational Control Procedures (OCP) and Distributed Resource Scheduler (DRS) to optimize its ongoing eco-intelligent and smart manufacturing strategy.

The Group is optimistically cautious about the recovery momentum in its retail business Pou Sheng continuing into the second half of 2023, with overall top-line recovery being supported by improved foot traffic and purchasing intent although the extent of this will vary month to month due to the uneven impact that control measures had on its retail business in the corresponding periods of 2022. The prospects for the sports industry in mainland China remain bright and Pou Sheng intends to fully leverage this by continuing to pursue its digital transformation, strengthening and diversifying its omni-channels while elevating digitally-enabled physical stores as part of its retail refinement strategy. Pou Sheng will also continue to actively expand its strategic alliance with its brand partners, many of whom are long-term customers of the Group’s manufacturing business, strengthening inventory integration, growing memberships and loyalty, increasing in-season sales, and accelerating the sales cycle to ensure better profitability and operating efficiency. The Group will continue to benefit from cross-business synergies while providing differentiated value-added and one-stop services to its customers and strategic partners.

Going forward, the Group remains confident that the above strategies will enable it to continue providing its brand partners with the best possible end-to-end solutions, anchoring its quality growth while safeguarding its solid long-term profitability and ability to deliver sustainable returns to shareholders.

Lu Chin Chu the Chairman of Yue Yuen commented, “Despite the de-stocking cycle being experienced by the global footwear industry across the board, we have been able to defend our profitability to a certain extent thanks to the milestones we had already reached as part of our multi-year capacity allocation and digital transformation strategies. This fuels our optimism about the long-term prospects of our manufacturing business. The streamlined business structure, store refinements, omnichannel investments and our expanding alliances with brand partners will allow our retail business to further safeguard its long-term competitive edge.”

Photo courtesy Yue Yuen