Topgolf Callaway Brands Corp. net revenues grew 5.7 percent (+6.5 percent constant-currency) to $1.8 billion in the second ended June 30. The revenue increase was said to be driven by strong 16.6 percent growth at Topgolf, including approximately 1 percent same-venue sales growth. The company said it achieved this result despite an $8.0 million negative impact from changes in foreign currency rates.

Consolidated income from operations decreased by 10.1 percent. On a non-GAAP basis income from operations decreased 3.4 percent and was flat on a constant currency basis.

Net income increased $12.0 million on a GAAP basis or decreased $15.7 million to $77.8 million on a non-GAAP basis. This non-GAAP performance includes a $20.3 million increase in interest expense related to higher interest rates and additional term loan debt.

Adjusted EBITDA of $206.2 million slightly exceeded the high end of the company’s guidance range, as compared to $207.3 million in the second quarter of 2022. This year-over-year performance was due to unfavorable changes in foreign currency rates, and partially offset by operational efficiencies. On a constant currency basis, Adjusted EBITDA increased by 1.7 percent.

For full details for the Topgolf Callaway quarter, including segment and category analysis, CEO vision and executive commentary from the analyst conference call, including an IT incident that prompted the company to briefly shut down systems, go here:

EXEC: Topgolf Callaway Leadership Talks Up Modern Golf Trend, Q2 Results, IT Incident

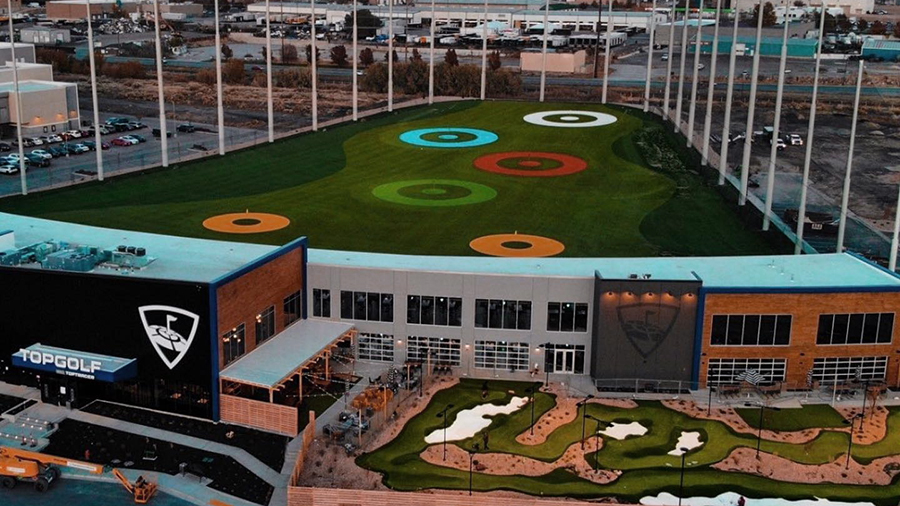

Photo courtesy Topgolf Callaway Brands