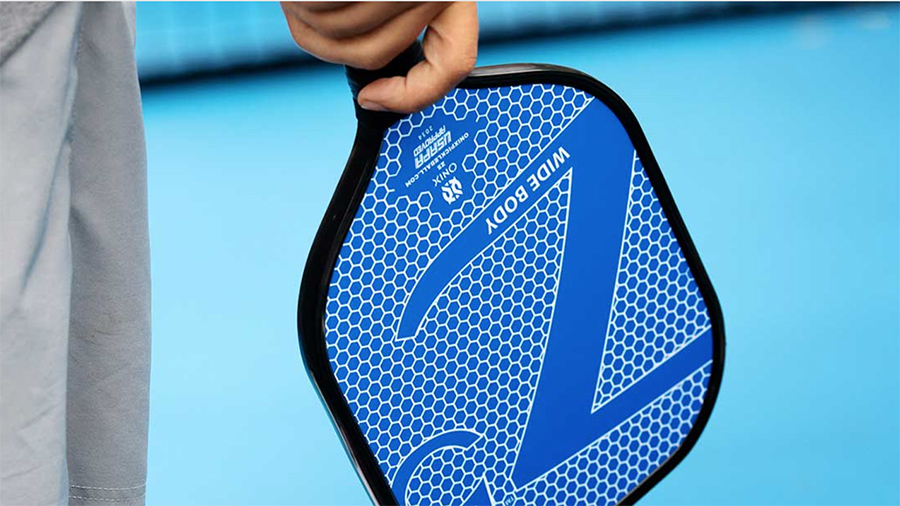

Escalade, Inc. reported lower earnings in the fourth quarter and year as demand for many of its sporting goods gear normalized and it warned of continued challenges in 2023. However, pickleball, led by its Onix and Dura brands, was a bright spot, landing among the few categories managing growth in the fourth quarter.

On an analyst call, Walt Glazer, president and CEO, said Onix and Dura “have continued to garner rave reviews and gain additional distribution, capitalizing on rapid consumer adoption of America’s fastest-growing sport.”

Other categories showing gains in the fourth quarter included indoor games, table tennis and billiards.

Other positives in the fourth quarter included gross margins improving 19 basis points to 22.4 percent despite increased logistics expenses mainly associated with ongoing inventory, handling and storage, and the return of a “seasonally promotional environment.”

Glazer told analysts, “Even during a period of weakening consumer demand, we continue to maintain our price discipline, underscoring the resilience of our brands, the loyalty of our customers, and the generally affluent demographic we serve.”

Inventory also declined in the fourth quarter from the third quarter due to planned reductions in inbound product flow, seasonal demand and selective promotional activities. The inventory reduction of more than $13 million during the quarter enabled Escalade to repay nearly $12 million in outstanding debt.

However, organic sales, which exclude acquisition contributions, declined 14.4 percent in the fourth quarter as declines were seen year-over-year across most outdoor categories, including archery, basketball, outdoor games, water sports and playground. Net sales, including the acquisitions, decreased 1.8 percent to $72.1 million.

Headquartered in Evansville, IN, Escalade’s brands include Brunswick Billiards, Stiga table tennis, Accudart, Rave Sports water recreation, Victory Tailgate custom games, Onix and Dura pickleball, Goalrilla basketball, Lifeline fitness, Woodplay playsets, and Bear Archery.

SG&A expense as a percent of sales in the quarter increased to 15 percent compared to 12.9 percent in the prior year period due to the January-2022 acquisition of Brunswick Billiards.

Net income slumped 44.9 percent to $2.7 million, or 20 cents a share. Operating income fell 23.8 percent to $4.9 million. EBITDA decreased 21.5 percent to $5.8 million

For the year, sales were slightly up to the prior year at $313.8 million against $313.6 million a year ago. Organic sales, excluding acquisition contributions, declined 9.8 percent

Gross margin declined 112 basis points, to 23.5 percent. Operating income decreased 17.5 percent to $26.3 million. Net income dropped 26.2 percent to $18.0 million, or $1.31 per share.

Glazer said that following two years of elevated pandemic-related consumer demand for sporting goods and recreational equipment, demand conditions for most of Escalade’s categories began to return to more normalized levels in 2022. He added, “From an operations perspective, supply chain-related congestion and elevated inventory levels led to higher logistics costs for our business throughout most of last year, negatively impacting our profitability. Demand softened as the year progressed given elevated channel inventory levels with many of our customers.”

For the current year, Escalade is preparing to launch patented paddle technology to further support its strong positioning in the pickleball category and also to release a suite of American Cornhole League licensed products together with accessory and ancillary products in other leading categories.

Escalade is also combining its Brunswick Billiards, Cue & Case and American Heritage brands to better leverage its larger presence in the billiard market to drive additional revenue opportunities as well as realize cost savings. The Brunswick acquisition was accretive to full-year EPS, consistent with expectations.

Looking ahead, Glazer noted that while Escalade doesn’t typically provide guidance, difficult year-over-year comparisons will be faced in both the first and second quarters of 2023 as Escalade works through high-cost inventory levels, manage through continued excess inventory levels in the marketplace, and adjusts to overall softening consumer discretionary spending.

The year-ago first quarter was “unusually strong” and benefited from a favorable mix and sales pulled forward from the second quarter of 2022. Also, due to a calendar change, the second quarter will span 91 days this year versus the 112 days in last year’s 16-week second quarter.

On the positive side, gross margins are expected to improve in the second half of 2023 as lower ocean freight rates and reduced logistics expenses help offset further inflationary pressures.

Retail inventory levels in the system are projected to return closer to historical levels in the back half of the year, creating the potential for improved channel inventory replenishment later in 2023.

Given the current macro environment that includes high inflation and consumer sentiment at a 10-year low, expense reduction will be prioritized. Toward that end, Escalade has decided to close its manufacturing facility in Rosarito, Mexico and is evaluating other opportunities to further control expenses.

Glazer included, “In summary, while last year brought its fair share of challenges, adding temporary yet sizable cost burdens to our business, we continue to advance our strategic priorities, driving both market share gains in key categories, together with continued operational execution across our sourcing, manufacturing, product development, e-commerce, compliance and manufacturing centers of excellence.”

Photo courtesy Escalade