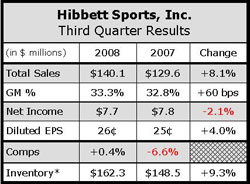

Hibbett Sports Inc. attributed a high-single digit increase in revenues for the third quarter ended Nov. 1 to strength in its footwear business, a segment that traditionally generates a significant portion of the retailers total sales.

The strong footwear result boosted overall sales and also helped to increase margins. However, expenses increased as a percentage of net sales for the quarter, which caused net income to decline in the low-single-digits from the year-ago result.

The footwear segment, which was up single-digits for the quarter, generated increased sales in every category except womens. Essential in the improvement was strong sales growth from Nike Shox, Jordan, and adidas Bounce, among others.

Management noted that weakness in the apparel segment is indicative of expected softening sales for urban apparel. Activewear, led by strong sales of Nike and Under Armour product, was slightly up, while licensed gear was down mid-single-digits. Management said they would capitalize on the success of the Alabama Crimson Tides football program and the NFLs Tennessee Titans to bolster licensed sales in the fourth quarter.

Equipment revenues for the company were down low-single-digits, but management stressed that key vendors, including Nike, Under Armour, and Shock Doctor, remain strong. Branded accessories and footwear accessories, which include socks, shoe care products, and shoelaces, were up high singles for the quarter.

Regionally, revenues for the quarter were strongest in the Midwest and Southwest, while the East Coast exhibited softening sales.

On a calendar basis, August generated the strongest results, boosted by strong footwear sales and a very strong tax-free holiday, which management said was more meaningful to consumers this year because of the volatility of the economy. Comps were up 4% for the month. Gas shortages, an erratic stock market and tropical storms and hurricanes dampened sales for September as comps fell 3.7%.

Seventy-eight stores were affected by the storms, as weather conditions forced stores to close for a total of 330 days. Cooler October weather slowed declines, as the retailer reported a 1% decrease in comps as compared to the same period of 2007. Unaudited comps for the first 2 weeks of November were up 1%.

As a whole, management noted that a slightly lower traffic count was partially offset by a higher average of items-per-consumer. Likewise, as fuel prices started dropping near the end of the quarter, sales began to climb accordingly.

Gross margins for the retailer were up 55 basis points for the quarter. Management said about 75% of the improvement came in leveraging inbound freight and the reducing shrinkage, with the remaining percentage coming from the leveraging of occupancy and warehouse costs.

The company has also upped their annual guidance for fiscal 2008 by one penny, to a range of 97 cents to $1.04 from an initial range of 93 cents to $1.03.

During the third quarter of 2008, Hibbett opened 22 new stores and closed eight for a quarter ending total of 726. Due to economic conditions and other factors, the expected store growth rate of 9.5% is less than what the company had originally projected. Several deals have been delayed by landlords until next year, while others have been delayed indefinitely.

Looking ahead, management expects Under Armours entrance into the running market to will boost overall footwear sales. Likewise, the recent demise of Steve & Barrys will likely boost college apparel sales for Hibbetts licensed apparel segment. The company will also continue using a third-party shipper to cut distribution costs. Management said third-party shipping was employed recently and has been an effective at reducing shipping costs to remotes stores.

The company has slightly reduced its initial estimate for new store openings. Management has set a new “conservative” goal of 60 new stores for 2009, but maintained that securing locations for new stores would pose a formidable challenge. The company will also hire less district managers next year to cut expenses.

For the future, Chairman and CEO Mickey Newsome said the company expects almost all new locations to be in strip centers. Citing the “de-malling” of America, Newsome said that strip mall location are outperforming enclosed malls and currently account for around 72% of Hibbett locations.

Regarding the companys pursuit of a new president, Newsome said the company was currently searching, and that they were “looking very seriously internally”. He added that a decision regarding the new president would likely come before March of 2009. Former President and COO Nissan Joseph left the company in September.