Moody’s Investors Service changed the rating outlook for Vista Outdoor Inc. to positive from negative.

Concurrently, Moody’s affirmed Vista’s B2 Corporate Family Rating (“CFR”), B2-PD Probability of Default Rating, and its Caa1 senior unsecured notes rating. The Speculative Grade Liquidity Rating remains SGL-2.

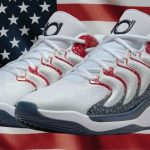

Vista Outdoor’s brands include Federal Premium, CamelBak, Bushnell, Camp Chef, Primos, Blackhawk, Bell, and Giro.

The positive outlook acknowledges Vista’s improved EBITDA margin following the completion of on-going restructuring efforts and the company’s demonstrated commitment to debt and leverage reduction. Furthermore, Moody’s expects Vista’s operating performance to meaningfully improve over the next 12-18 months as demand for ammunition, Vista’s largest business segment at roughly 50 percent of pro forma fiscal year March 2020 revenue, continues to surge.

Moody’s affirmed the ratings because of the high execution risks associated with the acquisition of Remington’s unprofitable ammunition assets out of bankruptcy, the uncertainty around the duration of ammunition tailwinds, and the challenges Vista faces in sustaining organic revenue growth during normalized operating periods. Moody’s believes the pick-up in demand for ammunition, and to a lesser degree the company’s outdoor products, is temporary and Vista will be subject to earnings volatility once the coronavirus pandemic eases and demand levels normalize. These factors create some uncertainty that the company can sustain debt-to-EBITDA below 4.0x.

Moody’s wrote in a statement, “Vista’s B2 CFR reflects its low debt-to-EBITDA leverage of 3.4x for the twelve months ending June 2020 (excluding incremental debt used to fund the acquisition of Remington’s ammunition assets), its improved operating cash flow generation after completing restructuring initiatives and reducing debt and cash interest, and its leadership position as one of the largest ammunition manufacturers in the US. The ratings also reflect Vista’s good competitive position with leading brands in multiple niche outdoor product categories and favorable US outdoor activity participation trends. Vista’s credit profile is constrained by the volatility in ammunition demand, difficulties sustaining organic revenue in the competitive outdoor products market, and societal risks of its ammunition products. Debt-to-EBITDA leverage declined meaningfully from 5.0x at the end of fiscal March 2020 because of debt reduction, increased consumer demand for ammunition and outdoor products related to the coronavirus, and the benefits of cost-efficiency initiatives. Moody’s projects debt-to-EBITDA in a 3.7x range in fiscal March 2022 assuming normalized demand for ammunition, but the business volatility and Remington execution risks create a broad range of uncertainty around this projection.

“The rapid spread of the coronavirus outbreak, deteriorating global economic outlook, low oil prices, and high asset price volatility have created an unprecedented credit shock across a range of sectors and regions. Moody’s regards the coronavirus outbreak as a social risk under our ESG framework, given the substantial implications for public health and safety. The consumer durables industry is one of the sectors most meaningfully affected by the coronavirus because of exposure to discretionary spending.

“Moody’s believes social risk will remain high for Vista due to its participation in the gun ammunition industry, although the risk has decreased after its exit from firearms manufacturing after divesting Savage Arms in July 2019.”

Photo courtesy Vista Outdoors