Nike will stop selling on Amazon, ending a pilot program that started in 2017. Nike said in a statement, “As part of Nike’s focus on elevating consumer experiences through more direct, personal relationships, we have made the decision to complete our current pilot with Amazon Retail.”

The statement added, “We will continue to invest in strong, distinctive partnerships for Nike with other retailers and platforms to seamlessly serve our consumers globally.”

The news was first reported by the Wall Street Journal and Bloomberg.

In 2017, Nike was hoping to reduce the sale of counterfeits and increase those of its own products by signing a pilot deal to sell directly to Amazon.com rather than through third-parties.

Nike supposedly thought that partnering with Amazon would give it more control over third-party sellers and potential counterfeit goods. Bloomberg wrote, however, “Nike reportedly struggled to control the Amazon marketplace. Third-party sellers whose listings were removed simply popped up under a different name. Plus, the official Nike products had fewer reviews, and therefore received worse positioning on the site.”

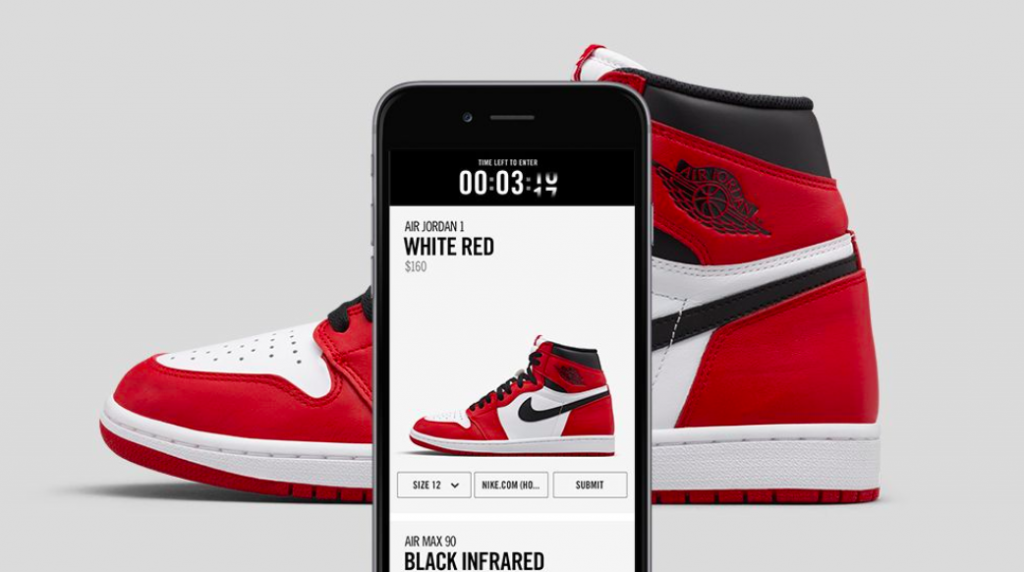

Soon after its Amazon pilot began, Nike announced plans to streamline its wholesale base to focus primarily on about 40 partners in a shift away from “undifferentiated retail.” The Wall Street Journal reported at the time that Amazon was one of those 40 that Nike intended to prioritize. Aggressively building its own direct-to-consumer business is also part of that push.

Amazon has supposedly been preparing for the break, according to Bloomberg. Amazon is looking to recruit a network of third-party sellers so Nike shoes are still expected to be widely available on the site. Nike will also continue to use Amazon’s AWS web services.

The ending of the deal with Amazon comes on the heels of last month’s announcement that former eBay CEO John Donahoe will take over as Nike’s chief executive in January.

Many see Donahoe’s hiring as a sign that Nike intends to ramp up its consumer direct digital transformation strategy. Nike, which generated about 15 percent of its sales from its own website and retailer partner sites last year, has previously said it sees that percentage rising to 30 percent by 2023. The company has also said it expects that online sales of its products will eventually surpass those sold in stores.

Nike’s departure could be a blow for Amazon, which is increasingly facing complaints over the amount of counterfeit merchandise found across its marketplace. More than half of all goods sold on Amazon come from independent merchants who pay Amazon a commission on each sale.

Amazon has mostly kept a hands-off approach and let brands police the problem, but recently vowed to spend billions of dollars to keep vendors from selling such illegal products. Bloomberg noted that one project lets brands put unique codes on their products to make it easier to identify fakes.

Photo courtesy Nike