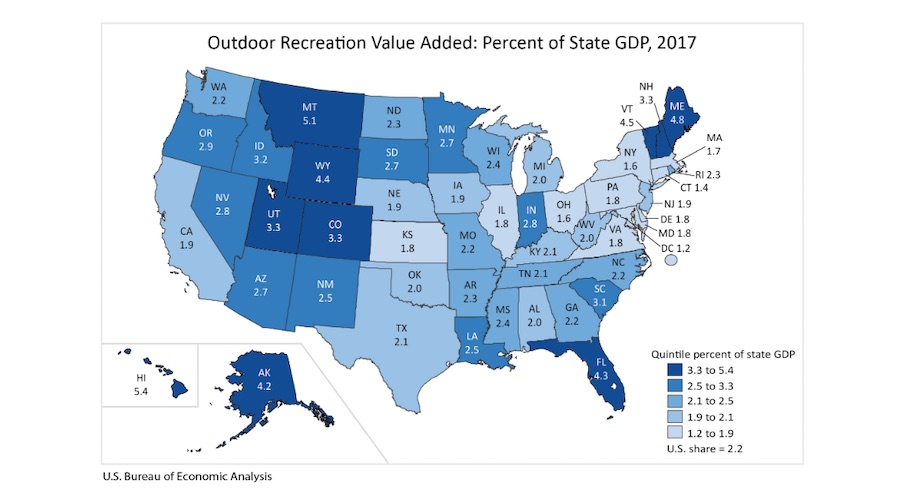

The U.S. outdoor recreation economy accounted for 2.2 percent ($427.2 billion) of current-dollar GDP in 2017 and grew faster than the overall U.S. economy, according to statistics released Friday, September 20, by the Bureau of Economic Analysis (BEA).

The Outdoor Recreation Satellite Account (ORSA) also shows that inflation-adjusted (real) GDP for the outdoor recreation economy grew by 3.9 percent in 2017, faster than the 2.4 percent growth of the overall U.S. economy. Real gross output, compensation, and employment all grew faster in outdoor recreation than for the economy as a whole.

Click here to access the report, including data for all 50 states.

“The outdoor industry has always known it is a huge contributor to the national economy, this report brings new data to bear to underscore that fact – to the tune of outdoor recreation’s real GDP growing significantly faster than the U.S. economy,” said Amy Roberts, executive director of the Outdoor Industry Association. “The icing on the cake is the new state by state analysis, which will be immensely helpful to lawmakers, communities and businesses in promoting outdoor recreation-related activities and economic opportunities – the beneficial uses are endless and we look forward to our continued work with the Bureau of Economic Analysis to enhance the analysis moving forward.”

OIA helped lead the charge to pass the Outdoor REC Act and have it signed into law, which for the first time ever required the Bureau of Economic Analysis (BEA) to count the outdoor recreation economy as a part of national gross domestic product (GDP) by creating the Outdoor Recreation Satellite Account. The BEA’s statistics support OIA’s own analysis that shows that outdoor recreation contributes $887 billion to the U.S. economy annually and confirms the national importance of investments in recreation funding and infrastructure.

OIA also published some FAQs about the report and the outdoor industry’s impact on the economy:

How is the Bureau of Economic Analysis (BEA) data different from the data in the Outdoor Industry Association (OIA) Outdoor Recreation Economy report? The BEA measures “gross domestic product outputs” on the total value of domestic goods and services produced by an industry. The OIA study measures consumer spending on all gear-, apparel-, footwear- and equipment-related expenses and associated travel for outdoor recreation.

Also, BEA’s analysis does not measure travel expenses or associated recreation spending on close-to-home recreation or on trips that are less than 50 miles from a consumer’s home. In the OIA report, the research shows that more than two-thirds of outdoor recreation trips are within 50 miles of home and these close-to-home trips represent 67 percent of the $887 billion in consumer spending.

How does the $427 billion toward U.S. GDP or over $778 billion toward total U.S. gross output line up with OIA’s $887 billion in consumer spending on outdoor recreation? The BEA analysis and the OIA Outdoor Recreation Economy report measure different economic contributors. The BEA measures contribution to the U.S. GDP and gross domestic product outputs, while the OIA study measures U.S. consumer spending on all gear-, apparel-, footwear- and equipment-related expenses and associated travel for outdoor recreation.

On a macro scale, U.S. consumer spending is much larger than the U.S. GDP and gross output, demonstrating why the numbers are different and all are relevant. The three data points are companion numbers that validate that outdoor recreation is a growing and critical sector of the U.S. economy.

Also, the BEA analysis only includes the U.S. “value-add” or the wholesale and retail mark-ups applied to imported products, while the OIA figures report consumer spending on the total value of outdoor products.

What is the difference in methodology between the BEA analysis and the OIA Outdoor Recreation Economy report? The two reports are based on different methodologies. Essentially, the OIA economic report – which is basic economic input-output modeling – starts with the consumer and works down to the manufacturing/imports point. The BEA analysis goes in the opposite direction, starting with manufacturing and imports and works up to the consumer. The BEA approach uses different data sets and methods which account for differences too.

Will OIA continue to reference the numbers from its report or will it adopt the new numbers from the BEA?Because the reports are based on two different methodologies and measure different aspects of recreation’s economic impacts, both are relevant. We hope that the BEA will receive the needed ongoing funding for this to become an ongoing study that will track outdoor recreation’s contributions beyond direct impact and continue to dive deeper. We will continue to ask Congress to provide that funding. In the interim, we will continue to use both the OIA Outdoor Recreation Economy report and the BEA Outdoor Recreation Satellite Account data, as these companion numbers validate that outdoor recreation is a growing and critical sector of the United States economy and an important part of American communities.

Image courtesy BEA