Amazon Passes Walmart to Become Number One for Apparel

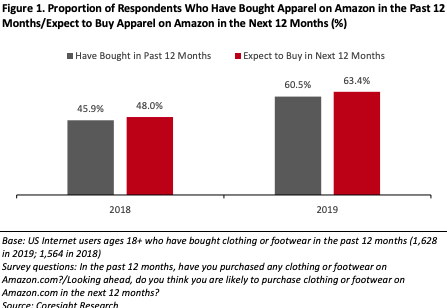

Measured by the number of shoppers, Amazon Fashion is the most-shopped apparel retailer in the U.S., up from second place in 2018 and moving ahead of Wal-Mart for the first time, according to a study from Coresight Research.

Among the key findings:

- Apparel shopping rates show signs of peaking among Prime members. Around three-quarters of Prime members bought apparel on Amazon in the past year. However, we recorded a much greater uplift from “have bought” to “expect to buy” among those without Prime membership than among Prime members.

- Amazon’s private-label collections as a group comprise the fourth-most-bought clothing or footwear “brand” on Amazon and one in six Amazon apparel shoppers surveyed said that they have bought Amazon private-label apparel in the past 12 months.

- Amazon has established its #1 position by penetrating the heart of the mid-market. Reflecting this, Walmart is now the top retailer that Amazon Fashion shoppers have switched some or all of their apparel spending from, followed closely by Target.

- Amazon Fashion shoppers are satisfied with the site’s online experience and cited the ease of browsing and searching as the top reason to buy apparel on the site. Only 13 percent of shoppers think that the site could be made easier to browse.

- Amazon apparel shoppers show only average rates of concern with sustainability. Overall, apparel shoppers try to buy from brands with a good environmental record but are less likely to want to pay for sustainable practices.

Amazon Earns High Trust With Data

Nearly half (48 percent) of consumers trust Amazon over other brands to use their data responsibly, beating out bank (29.8 percent); Apple (26.6 percent), Google (26.2 percent), other big brand stores (18.7 percent ), airlines (18.7 percent ), and hotels and resorts (14.0 percent ), according to a study from SmarterHQ. The sentiment was strongest among Millennials and Generation Z, who trust Amazon 2.1x more than their banks. Social media companies ranked last (6.3 percent) on the list, which might seem not-so surprising given recent Facebook headlines, and the fact that half of the survey respondents said they know someone who has had their social media account hacked.

Amazon The Go-To Destination For Search And Purchase

A survey of over 2,000 U.S. consumers from Feedvisor found shopper loyalty to Amazon is at an all-time high — a large majority of consumers (89 percent) and nearly all current Prime members (96 percent) are more likely to buy products from Amazon than other e-commerce sites.

Other findings:

Other findings:

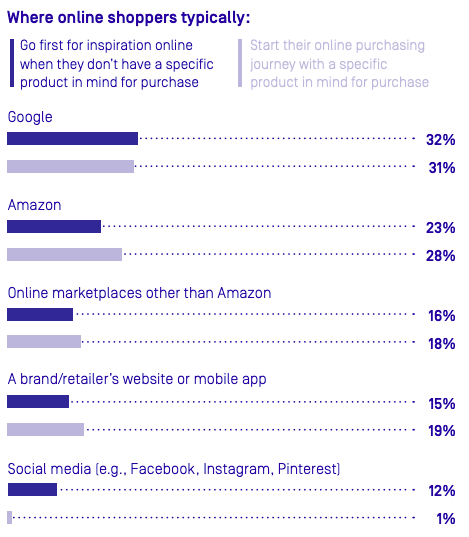

- Amazon is the go-to destination for search and purchase: Two-thirds of consumers (66 percent) typically start their search for new products on Amazon, and nearly all (95 percent) are satisfied with Amazon search results. When consumers are ready to buy a specific product, nearly three-fourths (74 percent) go to Amazon to do so.

- Prime reigns supreme on Amazon: Of the consumers who make a purchase on Amazon daily or almost every day, a large majority (89 percent) are Prime members. Also, Prime eligibility is a significant factor for most consumers (67 percent) when choosing to purchase a product on Amazon, and three-fourths (75 percent) of Prime members search specifically for Prime-eligible items on Amazon.

- Frequent online shoppers find Amazon ads helpful: Nearly three-quarters (73 percent) of daily or almost daily online shoppers have clicked on an Amazon product ad while browsing the web, and 83 percent ultimately purchased the product. Three-fifths (60 percent) of daily shoppers found those ads to be helpful. Moreover, when browsing on Amazon specifically, more than three-fourths (76 percent) of daily Amazon shoppers have clicked on a product ad

- Consumers are eager for more brands to have a presence on Amazon: Of the consumers who shop on Amazon daily, all of them (100 percent) at least occasionally go to Amazon in search of products from specific brands. However, less than half of consumers (41 percent) strongly agree that they are satisfied with the number of brands they know on Amazon.

“Our study confirms that Amazon is at the center of the customer’s purchasing journey, so it should be at the center of every seller and brand’s e-commerce strategy,” said Dani Nadel, President and COO, Feedvisor. “Today’s consumers actively seek brands they know, are heavily influenced by price, rarely search past the first two pages of search results, and frequently buy the first product listed. With these evolving behaviors and expectations, brands and retailers need to optimize their content, strategically advertise, and price competitively. With a holistic Amazon strategy, they can connect and engage with high-value prospects and loyal consumers.”

Amazon Is Now The No. 3 Digital Ad Platform In The U.S.

Based on responses from 100 digital advertising decision-makers at retail companies generating at least $50 million in online sales annually, Amazon is rapidly gaining momentum in the digital advertising race, according to a study from Nanigans.

The study found retail marketers estimate Amazon gets 14 percent of their digital ad spend, placing it third behind the duopoly of Google (21 percent) and Facebook/Instagram (19 percent). Half of those surveyed are planning to spend more with Amazon over the next 12 months – with an average planned increase of 25 percent. While some marketers are shifting ad dollars from other channels like Google (29 percent) and Facebook/Instagram (34 percent), 41 percent are adding incremental budget to support their increased Amazon spend.

Most Amazon-Owned Brands Aren’t That Popular Yet

According to a study from Marketplace Pulse research, only a handful of brands, notably the very successful AmazonBasics and Pinzon, made up the bulk of Amazon’s private brand sales. The research firm analyzed over 23,000 products launched by Amazon under more than 400 different brands.

“Amazon added more than 100 brands in 2018, but none of the recent launches are category leaders,” the study found. “Amazon has attracted much attention with every new brand they launched, however the assumption that every new brand will be as impactful as AmazonBasics is unfounded.”

AmazonBasics represents less than 5 percent of products launched, but more than 57 percent of sales, the report said. Based on its analysis, Marketplace Pulse said that Amazon’s private label efforts have been given too much credit, both in their ability to disrupt categories and the capability to utilize internal data. “Outside the outliers like AmazonBasics batteries, most brands launched didn’t do well, despite the unfair access Amazon has to its platform,” the report said.

Consumers Double-Check Web Content By Heading To Amazon

According to a study by Episerver, 87 percent of online shoppers compare what they find on a brand or retailer’s site to Amazon. The survey of over 4,500 global online shoppers found that offering a variety of options is only effective to a point, and getting the content and experience right is just as important. In fact, the report found nearly half of online shoppers (46 percent) have failed to complete a purchase online because there were too many options to choose from. The study also found that incorrect or incomplete content on a brand’s website and/or mobile app has stopped 97 percent of online shoppers from completing a purchase.

Other key findings from the report include:

Other key findings from the report include:

- Almost half (46 percent) of online shoppers with a product in mind for purchase start their online purchase journey at a marketplace (Amazon included), and marketplaces remain a popular first touchpoint for online shoppers without a product in mind for purchase (39 percent).

- When shopping online, 60 percent of consumers prefer marketplaces (Amazon and others) for their price options and over half (58 percent) for their product selections.

- Eighty percent of the most frequent online shoppers ((those who shop online at least weekly) often or always compare what they find on a brand or retailer’s site to Amazon – but just 60 percent of the least frequent online shoppers do so at the same rate.

- When shopping with brands and retailers via their websites, 26 percent of online consumers enjoy a company’s product information most, compared to just 11 percent for Amazon.

More Than Half Of U.S. Households Will Be Amazon Prime Members In 2019

In 2019, 51.3 percent of US households will be Amazon Prime members, according to a study from eMarketer. Prime’s growth is expected to be fueled by lower-income households and consumers attracted to the platform’s new offerings. Expanding beyond the flagship Prime benefit – fast or free shipping – is seen as Amazon continues to diversify its value to customers.

“New membership is driven by the company’s continuous expansion of Prime product categories, like groceries, apparel, and pantry—as well as new options for media consumption, like books and video games,” said Martín Utreras, eMarketer’s vice president of forecasting.

Amazon-Funded Study Points Digital Divide For Rural Businesses

Improving access to digital technology for rural businesses could contribute more than $140 billion to the U.S. economy over the next three years, and create more than 360,000 full-time jobs in rural communities, according to a study commissioned by Amazon and conducted by the U.S. Chamber of Commerce.

The study found that nearly 20 percent of rural small businesses in the U.S. generate at least 80 percent of their revenue by selling their products and services online. According to the results, 55.2 percent of 5,300 rural business owners agreed that e-commerce helps them grow their customer base, and 54.6 percent indicated that online tools positively affected their revenue in the past three years. Almost 40 percent of small business owners said digital technology has helped them sell outside their own states, and 16 percent have been able to sell internationally via digital. The study found that 33 percent sell their products through their own websites, while 12.7 percent rely on third-party online marketplaces.

Lead photo courtesy Coresight Research