In an update on its recently sharpened ‘Lead Global, Win Local’-strategy, Accell Group said it determined that the U.S. business is a non-core asset and management will explore a sale of the unit. Accell’s cycling brands sold in the U.S. include Raleigh, Diamondback and Redline.

In its statement, Accell announced new steps to create a more performance focused, consumer centric bicycle and bicycle parts company.

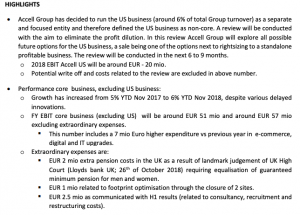

“The most important decision is to focus on our European business and to run our US activities as a separate and non-core business,” Accell said. “The main reason for this is to focus on elimination of profit dilution as well as to focus on the core business. Also other steps have been taken to roll out the strategic plan.”

The company also provided guidance on its financial performance 2018, reporting a net sales growth YTD November in its, as of today, core business (excluding US), of 6 percent vs the same period last year. Group EBIT-performance for the core business will be around €51 million and €57 million excluding extraordinary expenses. Group EBIT-performance for the full year including US activities (€- 20 million) and extraordinary expenses (€ 6 million) will be around €31 million. All numbers refer to the midpoint of the guided range

Ton Anbeek, CEO of Accell Group: “Now that our management board is complete, we are stepping up the pace in executing our growth strategy. We’ve invested time and money in our move towards an even more focused and more consumer centric company. This allows us to bring our innovations more in line with consumer trends and demand. In addition, it allows us to reach consumers in a more effective way through more effective distribution. We need to be where the demand is, with the propositions that consumers are looking for. We can see that for our core business we are effective in the majority of the markets where we operate, resulting in growth and good margins. We have decided to run our US activities as a separate and non-core entity. This means that we need to reconsider and decide on our US activities in the next 6 to 9 months, apart from improving the results of the US business. While considering future options for the US will require our attention, we expect these measures to free up management time, allowing us to focus more on the further execution of our growth strategy. Looking at the underlying results of the company, we are confident that we are taking the rights steps. It gives us comfort and confidence to reconfirm our 2022 strategic and financial objectives.”

PROGRESS TRANSITION AND STRATEGY IMPLEMENTATION

The sharpened strategy ‘Lead Global, Win Local” has been announced on 9 March 2018. The group’s transition has since then been progressing in line with plan. The company has launched various initiatives within each of its strategic thrusts. Management has implemented a new structure since July 2018, with a centralized commercial-, supply chain- and IT function and the establishment of 6 regions focussing on execution of commercial plans. A clear strategic brand portfolio has been established with 10 core brands, based on competitively researched and sharpened brand positionings. This provides maximum clarity and guidance to innovation, communication and distribution strategies.

The company is winning business at the point of purchase through strong brands like Winora, Ghost & Haibike, with also the recently acquired cargo bike Babboe driving strong profitable growth. With focus on the consumer and the e-bike segment, the Group has prepared a 3-pillar omnichannel strategy, which is being implemented at this very moment. The Parts & Accessories (P&A) business has been centralised under one leadership to create the right synergies and conditions ensuring further profitable growth. This division has optimized its logistics and is rolling out its XLC brand further. The targeted savings for 2019-2022 have been identified and all projects have started.

OBJECTIVES 2022 RECONFIRMED

The successful execution of Accell’s strategy is the base for its 2022 objectives. Based on the company’s performance in sales and profitability in the core business (excluding US business) management is confident to reconfirm its 2022 strategic objectives:

- Turnover : €1.4 to €1.5 billion, through organic-, ecommerce growth and acquisitions

- Added value / Turnover: > 31 percent

- EBIT / Turnover: 8.0 percent

- Trade Working Capital / Turnover: < 25 percent

- ROCE: > 15 percent

MANAGEMENT AGENDA

On March 8, 2019 the company will host an analyst meeting, where a concrete status update will be given on all strategic initiatives

Image courtesy Raleigh