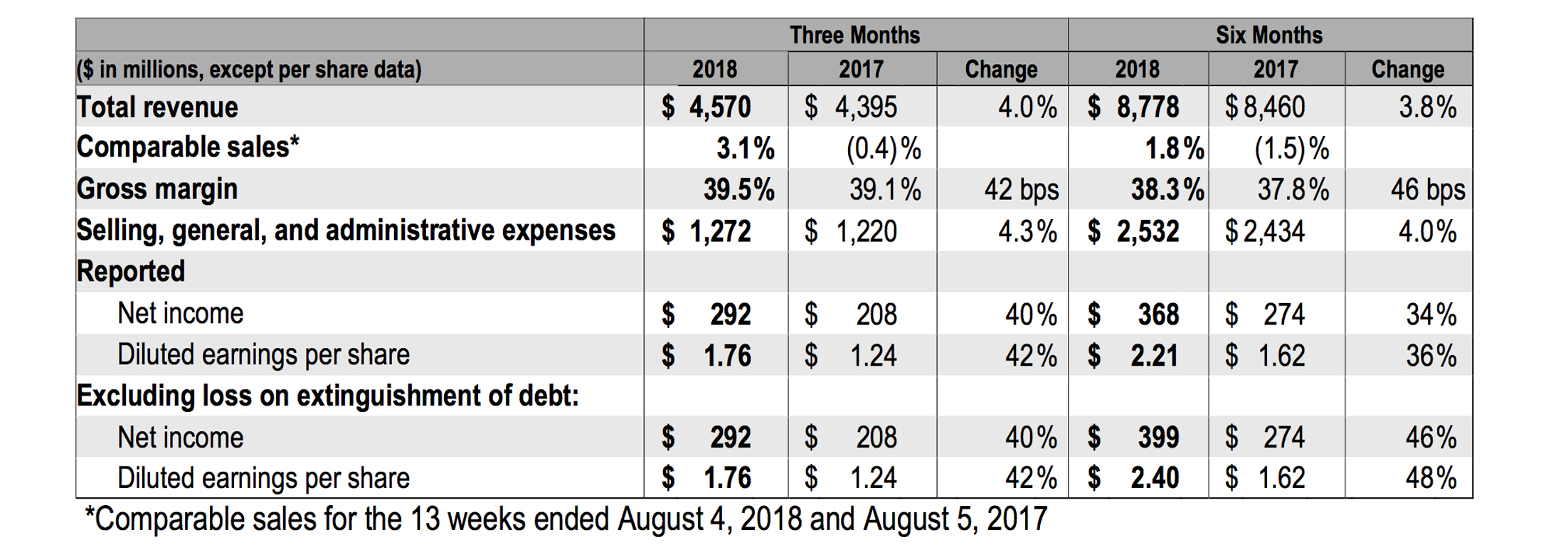

Kohl’s Corp. reported net earnings in the second quarter ended August 4 rose 40 percent on a 3.1 percent comp gain and 42 basis points improvement in gross margins. The department store operator lifted the company’s guidance for the year.

Results topped Wall Street’s consensus estimate calling for $1.64 in earnings, revenue of $4.27 billion and same-store sales growth of 2.6 percent.

Michelle Gass, Kohl’s chief executive officer, said, “We are pleased to report that our sales momentum continued in the second quarter, resulting in a comparable sales increase of 3.1 percent, our fourth consecutive quarter of positive comparable sales. We saw strength across the business, both our store and digital channels, all regions of the country and our proprietary and national brands. Our Men’s and Women’s apparel businesses led the company, followed closely by Footwear. We also reported higher gross margin as a result of our ongoing focus on inventory management. I would like to thank our team for their outstanding efforts in delivering strong and sustainable performance, which are reflected in our results.”

Guidance Update

The company now expects its fiscal 2018 diluted earnings per share to be $4.96 to $5.36, compared to its prior guidance of $4.86 to $5.31. Excluding the loss on extinguishment of debt, fiscal 2018 diluted earnings per share is expected to be $5.15 to $5.55, compared to prior guidance of $5.05 to $5.50.

Photo courtesy Kohl’s