Outdoor Footwear was able to post high-single-digit sales growth in the trailing 13-week period ended September 30 (Calendar Third Quarter). The majority of this growth has been focused in the Specialty Internet and General Internet channels, both posting strong double-digit sales growth. Incidentally, General Internet saw the greatest decrease in Outdoor Footwear average selling prices (ASPs) in the CalendarThird Quarter.

This observation, and much more, is contained in the 2017 Calendar Third Quarter reports now available from SSI Data.

“The only major category to post a decline in the Calendar Third Quarter was Casual Outdoor Footwear, which had marginal declines, explained James Hartford, CEO and Chief Market Analyst at SportsOneSource, LLC, which manages the SSI Data retail sales trend reporting platforms. “Mary Janes and Slip-ons were the two subcategories of Casual Outdoor Footwear that are most responsible for the declines posted in the Outdoor Footwear category in the quarter.”

Outdoor/Action Sports Sandals posted the most growth in the Calendar Third Quarter, with the majority of growth for the category coming from mid-teen increases in the second quarter. Most other subcategories, like Outdoor/Action Sports Thongs, grew in the mid single digits in the period.

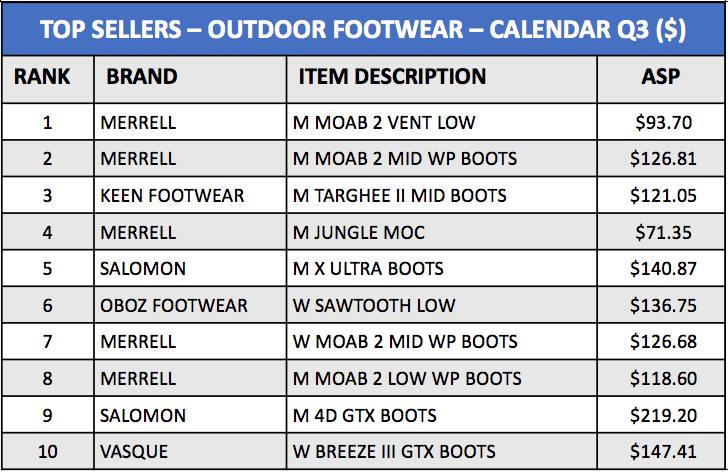

Source: SSI Data

SSI Data, managed by SportsOnesource, LLC, collects weekly retail point-of-sale data from over 20 retail channels of distribution and delivers timely sales trending reporting for footwear, apparel, essentials and equipment within 5 days of each fiscal week close, enabling retailers and brands to react to nearly real-time data to better manage their businesses.

For more information on how your brand performed, email Matt Tucker at solutions@ssidata.com or call SSI Data at 303.997.7302.

Photo courtesy Merrell