American Outdoor Brands Corp,, formerly Smith & Wesson, reported net were $229.2 million in its fourth quarter ended April 30 compared with $221.1 million for the fourth quarter last year, an increase of 3.6 percent.

Gross margin for the quarter was 39.6 percent compared with 41.6 percent for the fourth quarter last year.

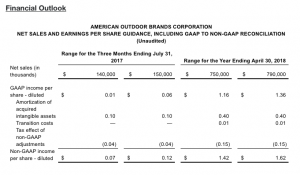

Quarterly GAAP net income was $27.7 million, or 50 cents per diluted share, compared with $35.6 million, or 63 cents per diluted share, for the comparable quarter last year. Fourth quarter 2017 and 2016 GAAP net income per diluted share included expenses of $3.8 million and $1.7 million, respectively, for amortization, net of tax, related to acquisitions.

Quarterly non-GAAP net income was $31.8 million, or $0.57 per diluted share, compared with $37.4 million, or 66 cents per diluted share, for the comparable quarter last year. GAAP to non-GAAP adjustments to net income exclude a number of acquisition-related costs, including amortization, one-time transaction costs, and inventory valuation adjustments, as well as discontinued operations and a holding company rebranding expense.

Quarterly non-GAAP Adjusted EBITDAS was $60.5 million, or 26.4 percent of net sales, compared with $68.7 million, or 31.1 percent of net sales, for the comparable quarter last year.

The company also announced the completion of $50.0 million stock repurchase program and Board of Directors authorization of an additional $50.0 million in common stock repurchases through March 28, 2019.

Full Year Fiscal 2017 Financial Highlights

• Full year net sales totaled a record $903.2 million compared with $722.9 million a year ago, an increase of 24.9 percent.

• Full year gross margin was 41.5 percent compared with 40.6 percent last year.

• Full year GAAP net income was a record $127.9 million, or $2.25 per diluted share, compared with $94.0 million, or $1.68 per diluted share, last year.

• Full year non-GAAP net income was $146.5 million, or $2.58 per diluted share, compared with $102.5 million, or $1.83 per diluted share last year.

• Full year non-GAAP Adjusted EBITDAS was $266.3 million, or 29.5 percent of net sales, compared with $202.4 million, or 28.0 percent of net sales, last year.

James Debney, American Outdoor Brands Corporation president and chief executive officer, commented, “Record level revenue and profitability reflected successful execution across our strategic growth objectives, further validating our vision of being the leading provider of quality products for the shooting, hunting, and rugged outdoor enthusiast. During fiscal 2017, we rebranded our holding company name to better reflect our expansion into new and larger markets. Accordingly, we are organized into two segments – Firearms and Outdoor Products & Accessories – providing a broad foundation for long-term organic and inorganic growth.

Debney continued, “In our Firearms segment, we introduced several important new products, including the Smith & Wesson M&P M2.0, which is our next generation full size polymer pistol and an important platform for the addition of new M&P pistols that we plan to add in 2018 and beyond. Sales of our market-leading M&P Shield pistol designed for concealed carry remained strong. In the fourth quarter alone, we sold over 195,000 Shield units, reflecting tremendous consumer adoption rates and extraordinary market share gains. We also continued to leverage our flexible manufacturing model, allowing us to quickly respond to consumer market changes, capture revenue, and deliver healthy gross margins. In our Outdoor Products & Accessories segment, we completed three acquisitions that drove revenue growth and gross margin expansion, and marked important progress in expanding our business into new markets that resonate with our core firearm and rugged outdoor enthusiast consumers.”

Jeff Buchanan, executive vice president, chief financial officer, and chief administrative officer, commented, “The strength of our financial performance in fiscal 2017 supported a number of successful initiatives throughout the year, including several acquisitions designed to fuel our strategic growth, as well as the completion of $50.0 million in stock repurchases on the open market. We ended the year with cash and cash equivalents totaling $61.5 million and total bank debt and Senior Notes of $219.0 million. In fiscal 2018, we expect to continue employing the strength of our balance sheet, including the unused portion of our revolving line of credit, which is expandable up to $500 million, to fuel additional growth opportunities, both organic and inorganic.”

Photo courtesy American Outdoor Brands Corp