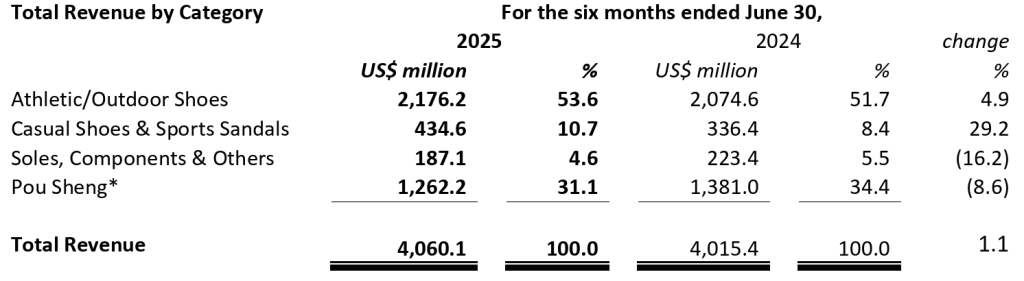

Yue Yuen Industrial (Holdings) Limited, one of the largest footwear manufacturers in Asia, and owner of the Pou Sheng retail business in Greater China, recorded revenue of $4.06 billion in the 2025 first half, an increase of 1.1 percent compared with the corresponding H1 first half last year (year-over-year, y/y).

Yue Yuen Industrial Ltd. (YY, Group) and its Manufacturing business report in the U.S. dollar ($) currency, while the company’s Pou Sheng China retail business reports in the Chinese renminbi (RMB, Yuan) currency. Yue Yuen dividends are calculated in the Hong Kong dollar (HK$) currency.

- Total Manufacturing revenue, including athletic/outdoor shoes, casual shoes and sports sandals, soles, components and others, was $2.90 billion in the first half, representing an increase of 6.2 percent year-over-year.

- Footwear Manufacturing activity, which excludes soles, components and others, increased 8.3 percent y/y to $2.61 billion. The volume of shoes shipped during the first half increased 5.0 percent y/y to 126.7 million pairs. The average selling price (ASP) increased 3.2 percent to $20.61 per pair, which the Group attributed to a higher-quality order mix.

Pou Sheng Retail business revenue decreased 8.6 percent to $1.26 billion in the first half, compared to $1.38 billion in the 2024 first half. In reported renminbi terms, revenue decreased 8.3 percent to RMB9.16 billion in H1, compared to RMB10.0 billion in the corresponding first half of previous year.

- Overall Retail sales were said to be hindered by volatile foot traffic across regions amid an increasingly dynamic retail environment in mainland China, including a substantial decline in the offline direct retail and sub-distributors channel compared to the H1 last year. Despite this, the performance of Pou Sheng’s omni-channels were said to remain resilient, rising by ~16 percent y/y, with livestreaming sales more than doubling year-over-year.

- As of June 30, 2025, Pou Sheng had 3,408 directly operated retail stores across the Greater China region, representing a net closure of 40 stores as compared with the 2024 year-end.

Profitability and Expenses Summary

Group gross profit decreased 5.8 percent y/y to $918.6 million, with the overall gross profit margin decreasing 170 basis points to 22.6 percent of revenue.

Manufacturing business gross profit decreased 1.4 percent y/y to $495.6 million, with the gross margin decreasing 140 basis points y/y to 17.7 percent of revenue. This decrease was said to be mainly attributed to uneven production leveling across various manufacturing plants, the production efficiency of some production lines that fell short of set targets, as well as higher labor costs stemming with expanding labor force and rising wages across various regions.

Pou Sheng Retail gross profit margin was 33.5 percent of revenue during the first half, a decrease of 70 basis points y/y, reportedly due to “aggressive promotions” across the retail industry and increased average markdowns. The Group said the decline occurred despite Pou Sheng’s efforts to optimize its inventory mix and sales structure.

Group selling and distribution expenses for the first half decreased by 5.9 percent to $399.0 million, or 9.8 percent of revenue, from $424.2 million, or 10.6 percent of revenue, in H1 2024.

Administrative expenses for the first half increased by 2.8 percent to $283.0 million, or ~7.0 percent of revenue, compared to $275.3 million, or 6.9 percent or 6.9 percent of revenue, in H1 2024.

Total H1 selling and distribution expenses and administrative expenses decreased by 2.5 percent to $682.0 million, or 16.8 percent of revenue, compared to 17.4 percent of revenue in H1 2024.

Other income for the first half decreased by 23.2 percent to $48.7 million (H1 2024: $63.4 million).

Other expenses decreased by 1.9 percent to $78.2 million (H1 2024: $79.7 million).

As a result, the Group’s net operating expenses for the first half decreased by $4.2 million to $711.6 million, or ~17.5 percent of revenue, compared to 17.8 percent of revenue in H1 2024.

During the first half, interest paid on bank borrowings (excluding finance costs on lease liabilities) amounted to $22.4 million (H1 2024: $26.9 million).

During the first half, in accordance with applicable Financial Reporting Standards, finance costs on lease liabilities amounted to $4.0 million (H1 2024: $5.1 million).

Income tax expense for the first half amounted to $39.0 million, with $221.3 million of profit before taxation, resulting in an effective tax rate of 17.6 percent (H1 2024: 23.1 percent).

In regards to the previously reported Tax Disputes in Indonesia, as at June 30, 2025 the two Indonesian subsidiaries of the Group had provisionally paid the Disputed Taxes in full, amounting to $109.0 million in total.

The Group, based on its best estimate, recognized additional income tax expenses and administrative penalties of $40.5 million in total in the consolidated financial statements for the year ended December 31, 2024, while the remaining paid amount of approximately $19.4 million and $49.1 million were recognized as tax recoverable and other receivable, respectively, as at June 30, 2025. No additional income tax expenses and administrative penalties related to the Tax Disputes were recognized in the condensed consolidated financial statements for the first half.

The profit attributable to owners of the company was $171.2 million, a decrease of 7.2 percent compared to $184.4 million for the first half of 2024.

- Profit attributable to owners of the Manufacturing business amounted to $155.0 million, reflecting a “largely flattish trend” compared to H1 last year.

- Profit attributable to owners of Pou Sheng decreased by 44.1 percent, to RMB187.6 million due to a decline in sales.

During the first half, the Group recognized a non-recurring profit attributable to owners of the company of $8.4 million, as compared to $5.5 million recognized in the corresponding first half of last year. This included a one-off gain on the disposal/partial disposal of associates totaling $3.4 million, and a gain of $5.0 million due to fair value changes on financial instruments at fair value through profit or loss (FVTPL). The non-recurring profit recognized in the corresponding first half of last year included a one-off gain on the partial disposal of associates totaling $24.0 million, which was largely offset by a loss of $11.9 million due to fair value changes on financial instruments at FVTPL and a combined impairment loss of $6.6 million on interests in a joint venture and an associate.

Excluding all items of non-recurring in nature, the recurring profit attributable to owners of the company for the first half was $162.8 million, representing a decrease of 9.0 percent compared with $178.9 million for the corresponding first half of last year.

Basic earnings per share was 10.67 cents in H1, compared to 11.44 cents in H1 last year.

The Yue Yuen Board has resolved to declare an interim dividend of HK$0.40 per share (flat to H1 2024) for shareholders whose names appear on the register of members of the company on Tuesday, September 16, 2025. The interim dividend shall be paid on Thursday, October 9, 2025. The Group said its commitment to upholding a relatively steady dividend level over the long-term remains intact.

Balance Sheet Summary

The Group had net borrowings of $85.8 million at June 30, 2025, compared to net cash of $185.9 million at December 31, 2024. The Group’s gearing ratio (total bank borrowings to total equity) was 19.6 percent, versus 15.4 percent at 2024 year-end.

Free cash outflow amounted to $35.6 million in H1, compared to inflow of $79.9 million in the first half of 2024, said to be mainly due to payments recognized during the first half for projects settled last year, which resulted in a significant increase in capital expenditure.

The overall net decrease in cash and cash equivalents in the 2025 first half amounted to $84.3 million, compared to $223.9 million in the 2024 first half.

Image courtesy Yue Yuen Industrial (Holdings) Limited