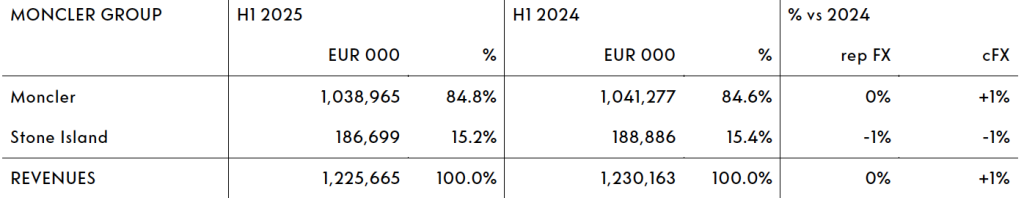

Moncler Group reached consolidated revenues of €1.23 billion in the first half of 2025 ended June 30, up 1 percent in currency-neutral (cFX) terms compared with the 2024 H1 period. These results include Moncler brand revenues of €1.04 billion and Stone Island brand revenues of €186.7 million.

In the second quarter, Group revenues were €396.6 million, down 1 percent cFX compared with the 2024 Q2 period. The Moncler and Stone Island brands recorded revenues equal to €317.2 million and €79.4 million respectively in Q2.

Moncler Group Brand Summary

Moncler Brand Summary

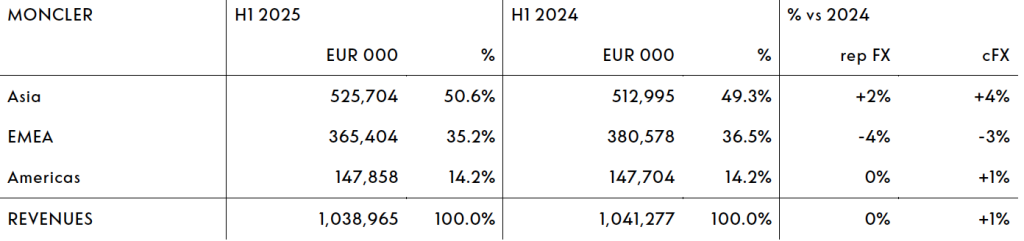

In the first six months of 2025, Moncler brand revenues were €1.04 billion, an increase of 1 percent cFX compared with the first half of 2024.

In the second quarter, revenues for the brand amounted to €317.2 million, down 2 percent cFX year-over-year, said to be mainly due to a sequential slowdown in the DTC channel, reflecting challenging macroeconomic conditions globally.

Moncler Brand Region Summary

In the first half of 2025, revenues in Asia (which includes APAC, Japan and Korea) were €525.7 million, up 4 percent cFX compared with the 2024 H1 period. In the second quarter, revenues in the region were flat year-over-year at constant exchange rate. The deceleration compared to the first quarter of the year was mostly due to softer tourist flows in Japan, which faced a high comparable base. Korea slightly improved sequentially, supported by stronger tourism spending, while China and the rest of Asia held up versus the previous quarter.

EMEA recorded revenues of €365.4 million, which was down 3 percent cFX compared with H1 2024. In the second quarter, revenues in the region were down 8 percent cFX year-over-year, reportedly due mainly to a slowdown in tourist flows across the region.

Revenues in the Americas increased by 1 percent cFX compared with H1 2024 to €147.9 million. In the second quarter, revenues in the region were up 5 percent cFX year-over-year, accelerating compared with the previous quarter mainly thanks to the sequential improvement registered in the DTC channel.

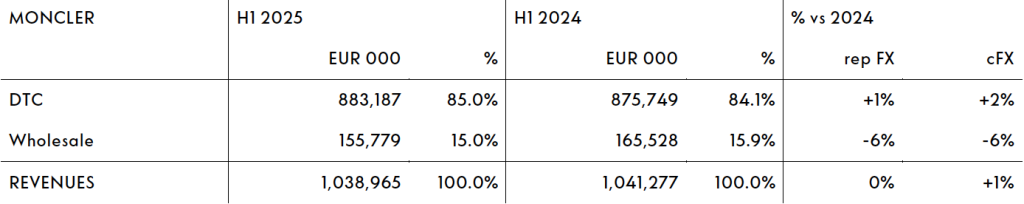

Moncler Brand Channel Summary

In the first half of 2025, the DTC channel recorded revenues of €883.2 million, up 2 percent cFX compared with the first half of 2024.

DTC revenues in the second quarter of 2025 were down 1 percent cFX year-over-year, due to a challenging global macroeconomic environment affecting consumer confidence and a deceleration in tourist flows, particularly affecting EMEA and Japan, while revenues in the Americas accelerated sequentially.

In H1 2025, revenues from stores open for at least 12 months (Comparable Sales Growth) were down 4 percent compared with H1 2024. The wholesale channel recorded revenues of €155.8 million, a decline of 6 percent cFX compared with H1 2024.

In the second quarter, revenues in the wholesale channel declined 6 percent cFX year-over-year, as planned, mainly due to the ongoing efforts to upgrade the quality of the distribution through further network optimization.

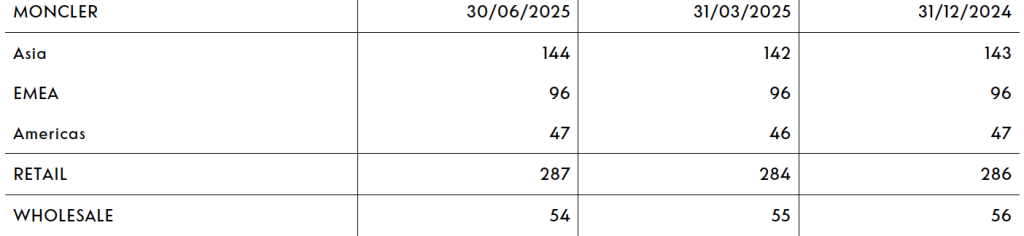

Moncler Brand Mono-Brand Distribution Network

As of June 30, 2025, the network of Moncler mono-brand boutiques counted 287 directly operated stores (DOS), a net increase of 3 units compared with March 31, 2025. Relevant activities included the opening of the Sydney Westfield store in Australia, the conversion of the Chongqing airport store in China and of the King of Prussia store in Philadelphia, as well as the relocation of the store in South Coast Plaza in Costa Mesa (California). The Moncler brand also operated 54 wholesale shop-in-shops (SiS), a net decrease of 1 unit compared with March 31, 2025.

*Comparable Store Sales Growth (CSSG) considers revenues growth from DOS (excluding outlets) open for at least 52 weeks and the online store; stores that have been expanded and/or relocated are not included.

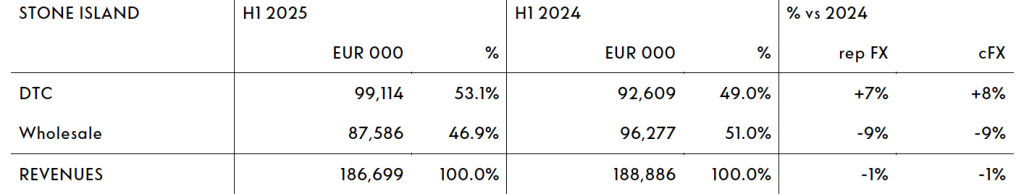

Stone Island Brand Summary

In the first six months of 2025, Stone Island brand revenues reached €186.7 million, a decrease of 1 percent cFX compared with the first half of 2024.

In the second quarter, revenues for the brand amounted to €79.4 million, up 6 percent cFX year-over-year, with the DTC channel maintaining solid growth and the wholesale channel improving sequentially

Stone Island Region Summary

In the first six months of 2025, Asia (which includes APAC, Japan and Korea) reached €52.3 million revenues, growing 14 percent cFX compared with the 2024 H1 period.

In the second quarter, the region grew by 13 percent cFX year-over-year, mainly driven by the continued solid performance of China and Japan.

EMEA recorded revenues of €123.3 million, a decrease of 5 percent cFX compared with H1 2024. In the second quarter, revenues were up 5 percent cFX year-over-year, thanks to the sequential improvement of the wholesale channel in its largest region.

Revenues in the Americas were down 15 percent cFX compared with H1 2024. In the second quarter, revenues were down 11 percent cFX year-over-year, with the wholesale channel slightly recovering sequentially.

Stone Island Channel Summary

|

In the first six months of 2025, the DTC channel grew by 8 percent cFX compared with H1 2024 to €99.1 million. In the second quarter, revenues in this channel were up 3 percent cFX year-over-year, marking a deceleration from the previous quarter amid a generally more challenging global operating environment. Asia outperformed the other regions.

The wholesale channel recorded revenues of €87.6 million, down 9 percent cFX compared with H1 2024.

In the second quarter, revenues increased by 9 percent cFX year-over-year, showing substantial improvement compared to the previous quarter, also due to a different timing of deliveries in Q1 vs Q2 that had negatively impacted performance in the first quarter of the year.

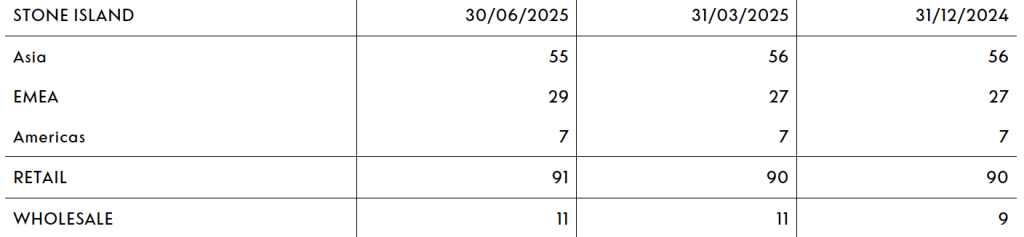

Stone Island Mono-Brand Distribution Network

As of June 30, 2025, the network of Stone Island mono-brand stores comprised 91 directly operated stores (DOS), a net increase of 1 unit compared with March 31, 2025. Relevant activities included the opening of the store in Hangzhou Euro Street in China and the relocation of the Hankyu Men store in Osaka. The Stone Island brand also operated 11 mono-brand wholesale stores, unchanged compared with March 31, 2025.

Image courtesy Moncler