Mizuno Corporation said the Japanese economy maintained a gradual recovery trend in the fiscal first half period ended September 30 (H1, first half). The company said this was due primarily to improved employment and income conditions and continued strong consumption by inbound tourists. However, Mizuno management also said there are concerns regarding the volatility of the financial market due to the monetary policies of individual countries and changes in political and global landscapes, as well as changes in consumer sentiment amid the continued rise in prices.

“While overseas economies have also continued to recover, there are concerns about the slowdown of consumption owing to continuing high interest rates and increases in prices, as well as the impacts of growing instability in the global situation on financial markets and distribution networks,” the company wrote in its summary of its fiscal first half results. “Thanks to the global sport events that took place, the sport market has enjoyed growing opportunities for a wide range of sports.”

Meanwhile, the company said the expansion of the sport market for outdoor personal sports such as golf, which continued to expand since the COVID-19 pandemic, has been steady.

Under such circumstances, the company said sales in Japan reportedly remained robust in competitive sports products including football (soccer), volleyball, and racket sports, and sales of the work business remained strong. Overseas business performance also expanded, driven in part by the improvement of gross profit margin, in addition to the continued growth in sales of products for competitive sports such as football (soccer) and lifestyle shoes.

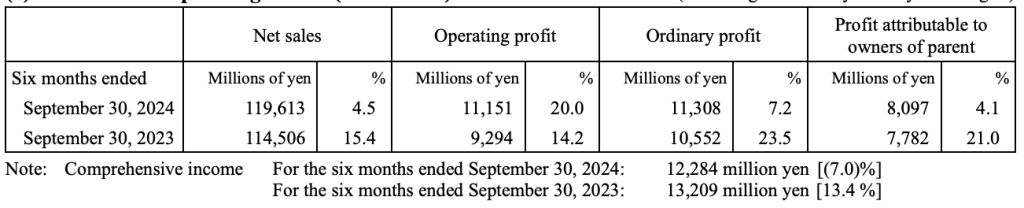

As a result of these factors, net sales were ¥119,613 million, up 4.5 percent year-over-year (y/y), operating profit was ¥11,151 million, up 20.0 percent y/y, ordinary profit was ¥11,308 million, up 7.2 percent y/y, and profit attributable to owners of parent was ¥8,097 million, up 4.1 percent y/y, all of which were said to be record highs for the H1 period of a fiscal year.

Regional Summary

Japan Region

In Japan, sales of products for competitive sports, such as football, volleyball, and racket sports, reportedly “remained

strong.” In addition, the company said the work business, which is its non-sports businesses, “remained solid.” Sales of lifestyle shoes, which are the focus of the brand’s business expansion efforts in the Japan region, reportedly increased as well.

As a result, Mizuno recorded net sales of ¥70,292 million, up 3.1 percent y/y, and operating profit of ¥5,952 million, up 6.2 percent y/y.

Europe

In Europe, the football business and lifestyle shoes business, which are the focus of the brand’s business expansion efforts in the region, reportedly “enjoyed growth.” Additionally, sales of products for competitive sports, such as volleyball, also increased. Gross margin of running shoes, which was said to be one of Mizuno’s main products, improved, reflecting efforts to improve the margin.

As a result, although net sales decreased by 6.1 percent y/y to ¥12,344 million, operating profit increased by ¥375 million (up 144.3 percent y/y) to ¥635 million.

The exchange rates for each currency in Europe during the period under review are as follows:

Pound Sterling: ¥195.55yen (¥177.07 in H1 last year); Euro (branches): ¥165.47 (¥153.51 in H1 last year); Euro (subsidiaries): ¥164.82 (¥147.00 in H1 last year); Norwegian Krone: ¥14.35 (¥13.02 in H1 last year)

Americas

In the Americas, sales increases came primarily from products for competitive sports in spite of downward pressures on business activities such as continuing high interest rates and advancing inflation. Gross profit margin improved thanks to progress in optimizing inventory levels.

As a result, net sales were ¥20,466 million, up 8.8 percent y/y, and operating profit was ¥2,335 million, up 18.3 percent y/y, both of which were said to be record highs for the fist half period of a fiscal year.

The exchange rates for each currency in the Americas during the period under review are as follows:

U.S. Dollar: ¥152.30 (¥135.99 in H1 last year); Canadian Dollar: ¥112.40 (¥100.73 in H1 last year).

Asia and Oceania

In Asia and Oceania, the football business, which is the focus of the brand’s business expansion efforts in the region, experienced growth in South Korea and Southeast Asia. Furthermore, sales of products for competitive sports, such as racket sports and volleyball, also reportedly increased. Sales of lifestyle shoes grew as well, even though the sales volume was relatively small.

As a result, net sales were ¥16,509 million, up 14.8 percent y/y, and operating profit was ¥2,288 million, up 50.5 percent y/y, both of which were said to be record highs for the fiscal first half.

The exchange rates for each currency in Asia and Oceania during the period under review are as follows:

New Taiwan Dollar: ¥4.78 (¥4.44 in H1 last year); Hong Kong Dollar: ¥19.47 (¥17.36 in H1 last year); Chinese Yuan: ¥21.08 (¥19.48 in H1 last year); Australian Dollar: ¥100.61 yen (¥91.28 in H1 last year); Korean Won (per 100 won): ¥11.28 (¥10.48 in H1 last year); U.S. Dollar (Singapore): ¥152.30 (¥135.99 in H1 last year); Thai Baht: ¥4.22 (not used in H1 last year).

Balance Sheet Summary

Total assets at the end of the period under review increased by ¥4,628 million from the end of the previous fiscal year to ¥210,779 million. This was primarily due to increases of cash and deposits by ¥5,581 million and other non-current assets, such as tangible leased assets, by ¥2,373 million, while accounts receivable – trade decreased by ¥3,066 million.

Liabilities at the end of the period under review decreased by ¥5,629 million from the end of the previous fiscal year to ¥58,455 million. This was primarily due to decreases of notes and accounts payable – trade by ¥5,984 million and accounts payable – other, and accrued expenses by ¥2,548 million, while other non-current liabilities, such as lease liabilities, increased by ¥2,097 million.

Net assets increased by ¥10,257 million from the end of the previous fiscal year to ¥152,323 million.

As a result of the above, the equity ratio increased by 3.3 percentage points from 68.6 percent at the end of the previous fiscal year to 71.9 percent.

Outlook

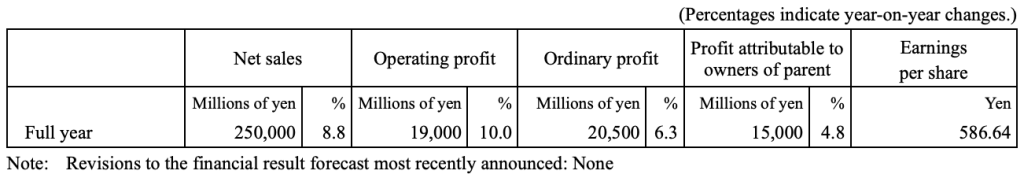

The consolidated financial results forecast for the fiscal year ending March 31, 2025 has not changed from

the financial results forecast announced on May 10, 2024.

Data, tables and images courtesy Mizuno Corporation