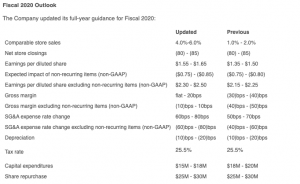

Hibbett Sports Inc raised its full-year outlook after reporting third-quarter profit and sales beat expectations. Earnings were more than double analysts’ targets as the retailer delivered its fourth consecutive quarter of comparable sales growth.

Jeff Rosenthal, president and chief executive officer, stated, “Our 10.7 percent increase in comparable sales in the third quarter represents our strongest quarterly increase since first quarter Fiscal 2013 and our fourth consecutive quarter with positive comparable sales. The business continues to perform very well as evidenced by the positive comparable performance in both our brick and mortar locations and our e‑commerce business. This sales growth has been made possible by our team’s execution of our strategic focus to lead with sneakers and connect toe-to-head concepts within our apparel and team sports businesses. Our e-commerce business continues to outperform expectations, as the business is now delivering over 10 percent of our total sales. During the third quarter, we integrated the City Gear website into our existing Hibbett platform with great success. City Gear has now been part of Hibbett for one year, and the acquisition will continue to enhance results through synergies as we complete the integration over the next three months. We are very enthusiastic about our business going forward and are pleased to increase our annual sales and earnings guidance.”

Third Quarter Results

Net sales for the 13-week period ended November 2, 2019, increased 27.0 percent to $275.5 million, including $43.7 million for City Gear, compared with $216.9 million for the 13-week period ended November 3, 2018. Wall Street’s consensus estimate was $260.7 million.

Comparable store sales increased 10.7 percent and will not include sales from City Gear until the fourth quarter of Fiscal 2020. E-commerce sales represented 10.5 percent of total sales for the third quarter. The increase in net sales was primarily attributable to the addition of City Gear. Footwear sales continued to drive the business along with positive sales in activewear and accessories connecting to footwear products.

Gross margin was 32.7 percent of net sales for the 13-week period ended November 2, 2019, compared with 32.5 percent for the 13-week period ended November 3, 2018. The 20 basis point increase was principally due to lower occupancy costs as a percent of sales.

Store operating, selling and administrative (SG&A) expenses were 29.1 percent of net sales for the 13-week period ended November 2, 2019, compared with 28.7 percent of net sales for the 13-week period ended November 3, 2018. While SG&A expenses as a percent of sales increased approximately 35 bps, the current year expense included City Gear acquisition costs of $5.0 million. The acquisition costs included a charge of $4.1 million for an increase in the estimated valuation of two contingent payments based on an update to City Gear’s projected achievement of defined EBITDA thresholds. On a non-GAAP basis, comparable SG&A expenses improved 80 basis points to 27.2 percent of net sales for the 13-week period ended November 2, 2019 from 28.0 percent of net sales for the 13-week period ended November 3, 2018.

Net income for the 13-week period ended November 2, 2019, was $2.3 million, or $0.13 per diluted share, compared with net income of $1.5 million, or $0.08 per share, for the 13-week period ended November 3, 2018.

Excluding non-recurring costs, non-GAAP net income for the 13-week period ended November 2, 2019, was $5.8 million, or $0.32 per share, compared with non-GAAP net income for the 13-week period ended November 3, 2018 of $2.6 million, or $0.14 per diluted share. Wall Street’s consensus estimate had been 15 cents.

The company has not included the $0.04 reduction in EPS for one-time executive compensation costs related to the CEO’s transition in its non-GAAP add-backs to net income.

For the quarter, the company opened four stores, rebranded four Hibbett stores to City Gear stores and closed 19 underperforming stores, bringing the store base to 1,097 in 35 states as of November 2, 2019. Store closures included Hibbett stores closed for rebranding. In addition, one high-performing store was expanded.

Strategic Realignment – Accelerated Store Closure Plan

As the retail environment continues to evolve, the company is focused on improving the productivity of the store base while continuing to grow its omni-channel business to serve customers where and when they want to shop. As previously reported, the company is proceeding with the closing of approximately 95 Hibbett stores in Fiscal 2020, which is expected to result in non-recurring impairment and store closure charges in the range of $0.08 to $0.12 per diluted share in Fiscal 2020.

Fiscal Year to Date Results

Net sales for the 39-week period ended November 2, 2019, increased 24.0 percent to $871.2 million compared with $702.7 million for the 39-week period ended November 3, 2018. Comparable store sales increased 5.4 percent.

Gross margin was 32.7 percent of net sales for the 39-week period ended November 2, 2019, compared with 33.2 percent for the 39-week period ended November 3, 2018. Excluding non-recurring expenses primarily related to the $1.0 million amortization of an inventory step-up value, non-GAAP gross margin was 32.7 percent for the 39-week period ended November 2, 2019.

Store operating, selling and administrative expenses were 26.9 percent of net sales for the 39-week period ended November 2, 2019, compared with 26.5 percent of net sales for the 39-week period ended November 3, 2018. SG&A expenses included $13.3 million in City Gear acquisition costs and $1.5 million related to the company’s accelerated store closure plan. Excluding these costs, store operating, selling and administrative expenses were 25.2 percent of net sales for the 39-week period ended November 2, 2019 compared with 26.3 percent for the 39-week period ended November 3, 2018. The company has not reflected a reduction in expense for the one-time executive compensation costs related to the CEO’s transition in our non-GAAP add backs to SG&A.

Net income for the 39-week period ended November 2, 2019, was $21.3 million, or $1.18 per diluted share, compared with $21.8 million, or $1.15 per diluted share, for the 39-week period ended November 3, 2018. Excluding non-recurring costs, non-GAAP net income for the 39-week period ended November 2, 2019, was $32.9 million, or $1.82 per diluted share, compared with non-GAAP net income of $22.9 million, or $1.21 per diluted share for the 39-week period ended November 3, 2018. The company has not included the $0.13 reduction in EPS for one-time executive compensation costs related to the CEO’s transition in its non-GAAP add backs to net income.

Balance Sheet and Stock Repurchases

Hibbett ended the third quarter of Fiscal 2020 with $77.4 million of available cash and cash equivalents on the consolidated balance sheet. As of November 2, 2019, Hibbett had $8.0 million in debt outstanding and $92.0 million available under its credit facilities.

During the third quarter, the company repurchased 371,976 shares of common stock for a total expenditure of $7.0 million. Approximately $167.2 million remained authorized for future stock repurchases through January 29, 2022.