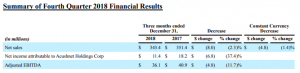

Acushnet Holdings Corp., the parent of Titleist, reported Fourth quarter net income of $11.4 million, down 37.4 percent year over year. Sales of $343.4 million were down 2.3 percent year over year and dipped 1.4 percent in constant currency.

Adjusted EBITDA of $36.1 million, down 11.7 percent year over year

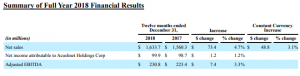

For the year ended December 31, net income attributable to Acushnet Holdings Corp. was $99.9 million, up 1.2 percent year

over year. Adjusted EBITDA of $230.8 million was up 3.3 percent year over year. Full year net sales was $1,633.7 million, up 4.7 percent year over year and ahead 3.1 percent in constant currency

“We are pleased with our results for 2018, which were driven by exciting new product innovation, particularly in the equipment categories of golf balls and golf clubs,” said David Maher, Acushnet’s President and Chief Executive Officer. “The Titleist golf ball business continued its unparalleled performance as Pro V1 notched 180 wins across worldwide tours, our new AVX franchise was embraced by golfers globally and new Tour Soft and Velocity models surpassed our high expectations,” continued Mr. Maher. “Titleist golf clubs also had a terrific year, led by the successful introduction of TS Metals, continued success of Titleist irons, and the wide acceptance of new Vokey SM7 wedges and Cameron Select Putters. Our valued associates and trade partners continue to excel at meeting the high expectations of dedicated golfers.

“As we head into 2019, we are optimistic about the opportunities in front of us. The global golf business is structurally healthier than in recent years, and the dedicated golfer remains, we believe, the most attractive market opportunity and one we are particularly suited to serve, as they place a premium on product performance and quality,” continued Mr. Maher. “Against this backdrop, Acushnet sees itself in a strong position. The new Pro V1 and Pro V1x are off to great starts, our TS metals bring great momentum into the new year and we have broad strength across our entire golf club line. New FootJoy and gear product lines have been well received and are off to promising starts early in the season. With leading products across a broad platform, we are confident in our ability to successfully execute our strategy in 2019 and beyond and deliver as a long term, total return investment for our supportive shareholders.”

Consolidated net sales for the full year increased 4.7 percent, or 3.1 percent on a constant currency basis, driven by an increase of Titleist golf clubs due to higher sales volumes of our newly introduced TS drivers and TS fairways.

On a geographic basis, consolidated net sales in the United States increased 4.6 percent in the twelve month period. Net sales in regions outside the United States were up 4.8 percent, up 1.6 percent on a constant currency basis with Korea up 6.8 percent, EMEA up 1.3 percent, and rest of world up 1.2 percent, partially offset by Japan down 2.8 percent.

Segment specifics:

- 2.3 percent increase in net sales (1.2 percent increase on a constant currency basis) of Titleist golf balls, primarily driven by a sales volume increase attributed to our new AVX premium performance golf balls and our performance golf balls launched in the second quarter and first quarter, respectively, partially offset by a planned sales volume decline in Pro V1 and Pro V1x golf balls, which were in their second model year.

- 11.9 percent increase in net sales (10.5 percent increase on a constant currency basis) of Titleist golf clubs, primarily driven by higher sales volumes of our newly introduced TS drivers and TS fairways launched in the third quarter of 2018 and by our wedges launched in the first quarter of 2018, partially offset by lower sales volume of our previous generation hybrids.

- 2.2 percent increase in net sales (0.3 percent increase on a constant currency basis) of Titleist golf gear, primarily driven by higher average selling prices across all categories of the gear business, largely offset by a sales volume decline in travel gear.

- 0.5 percent increase in net sales (1.4 percent decrease on a constant currency basis) in FootJoy golf wear. The decrease in constant currency primarily resulted from a sales volume decline in footwear, partially offset by higher average selling prices across all FootJoy categories and a sales volume increase in apparel.

Net income attributable to Acushnet improved by $1.2 million to $99.9 million, up 1.2 percent year over year, primarily as a result of an increase in income from operations.

Adjusted EBITDA was $230.8 million, up 3.3 percent year over year. Adjusted EBITDA margin was 14.1 percent versus 14.3 percent for the prior year period.

Consolidated net sales for the quarter decreased 2.3 percent, or 1.4 percent on a constant currency basis, driven by decreased sales of Titleist golf clubs, Titleist golf balls and our FootJoy golf wear segments, partially offset by increased sales of Titleist golf gear.

Consolidated net sales for the quarter decreased 2.3 percent, or 1.4 percent on a constant currency basis, driven by decreased sales of Titleist golf clubs, Titleist golf balls and our FootJoy golf wear segments, partially offset by increased sales of Titleist golf gear.

On a geographic basis, consolidated net sales in the United States decreased 5.2 percent in the quarter. Net sales in regions outside the United States were up 0.1 percent, up 1.8 percent on a constant currency basis. On a constant currency basis, consolidated net sales in Korea were up 21.0 percent, Japan was down 8.8 percent, EMEA was down 0.2 percent and rest of world was down 1.6 percent.

Segment specifics:

- 2.7 percent decrease in net sales (1.8 percent decrease on a constant currency basis) of Titleist golf balls as a result of a planned sales volume decline in Pro V1 and Pro V1x golf balls, which are in their second model year as well as a sales volume decline in our performance golf ball models as a result of lower rounds of play in the quarter, partially offset by a sales volume increase in our new AVX premium performance golf balls.

- 5.5 percent decrease in net sales (4.6 percent decrease on a constant currency basis) of Titleist golf clubs as product launches of our TS drivers and TS fairways in September 2018 were offset by lower volumes in irons which were launched in the third quarter of 2017.

- 13.8 percent increase in net sales (14.8 percent increase on a constant currency basis) of Titleist golf gear. This increase was primarily due to higher sales volumes in golf bags and headwear.

- 2.9 percent decrease in net sales (1.9 percent decrease on a constant currency basis) in FootJoy golf wear as a result of a sales volume decline in footwear, partially offset by higher sales volumes in apparel and gloves.

Net income attributable to Acushnet decreased $6.8 million to $11.4 million, down 37.4 percent year over year primarily as a result of a decrease in income from operations.

Adjusted EBITDA was $36.1 million, down 11.7 percent year over year. Adjusted EBITDA margin was 10.5 percent for the fourth quarter versus 11.6 percent for the prior year period.

Declares Quarterly Cash Dividend

Acushnet’s Board of Directors today declared a fourth quarter cash dividend in an amount of $0.14 per share of common stock. This represents an increase of 7.7 percent versus the prior quarterly dividend. The dividend will be payable on March 29, 2019, to stockholders of record on March 15, 2019. The number of shares outstanding as of February 22, 2019 was 75,029,111.

Share Repurchase

On February 14, 2019, Acushnet’s Board of Directors authorized the company to repurchase up to an additional $30.0 million of its issued and outstanding common stock, bringing the total authorization up to $50.0 million.

2019 Outlook

- Consolidated net sales are expected to be approximately $1,655 to 1,685 million.

- Consolidated net sales on a constant currency basis are expected to be in the range of up 2.8 percent to 4.7 percent.

- Adjusted EBITDA is expected to be approximately $235 to 245 million.