Nike Inc.’s earnings in its third quarter ended February 28 came in well ahead of Wall Street guidance, while sales were slightly ahead.

Diluted net loss per share was 57 cents a share, reflecting significantly higher income tax expense from the enactment of the Tax Cuts and Jobs Act (the “Tax Act”). The impact of the Tax Act resulted in one-time provisional charges that reduced diluted earnings per share by $1.25.

“Nike’s Consumer Direct Offense drove strong double-digit growth across our international geographies, led by Greater China,” said Mark Parker, chairman, president and CEO, Nike, Inc. “As we close Q3, we now see a significant reversal of trend in North America, as momentum accelerates through the scaling of new innovation platforms and differentiated Nike Consumer Experiences expand across the marketplace.”

Third Quarter Income Statement Review

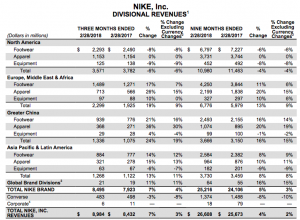

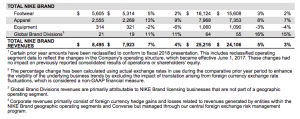

- Revenues for Nike, Inc. increased 7 percent to $9.0 billion, up 3 percent on a currency-neutral basis. Wall Street’s consensus estimate had been $8.85 billion.

- Revenues for the Nike Brand were $8.5 billion, up 4 percent on a currency-neutral basis, driven by Greater China, EMEA and APLA, including double-digit growth in Nike Direct and growth in Sportswear and Nike Basketball.

- Revenues for Converse were $483 million, down 8 percent on a currency-neutral basis, as international and digital growth were more than offset by declines in North America.

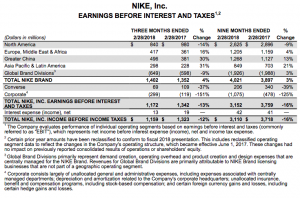

- Gross margin declined 70 basis points to 43.8 percent due primarily to unfavorable changes in foreign currency exchange rates, which were partially offset by lower product costs.

- Selling and administrative expense increased 11 percent to $2.8 billion. Demand creation expense was $862 million, up 15 percent, primarily driven by higher spend in sports marketing, brand moments and new innovation launches.

- Operating overhead expense increased 9 percent to $1.9 billion, largely due to higher administrative costs and continued investments in global digital capabilities and the NikePlus membership program.

- Income before income taxes decreased 12 percent to $1.2 billion as solid revenue growth was more than offset by lower gross margin, higher selling and administrative expense and lower other income.

- The effective tax rate was 179.5 percent, driven by the Tax Act, which impacted comparability. During the quarter, as a result of enactment of the Tax Act on December 22, 2017, the company recorded additional income tax expense of $2.0 billion primarily related to the transition tax on our accumulated foreign earnings and the re-measurement of deferred tax assets and liabilities. This amount was recorded as a provisional estimate and is subject to change as the company completes its analysis during the measurement period, which should not extend beyond one year from the enactment date.

- Net loss was $921 million and diluted net loss per share was 57 cents, driven by the enactment of the Tax Act. Excluding the charge, earnings would have been 68 cents a share, well above Wall Street’s consensus estimate of 53 cents. Earnings were flat versus 2017 earnings of $1.14 billion, or 68 cents.

February 28, 2018 Balance Sheet Review

Inventories for Nike, Inc. were $5.4 billion, up 9 percent from February 28, 2017, driven primarily by strengthening demand globally and, to a lesser extent, changes in foreign currency exchange rates.

Cash and equivalents and short-term investments were $4.8 billion, $1.4 billion lower than last year as share repurchases, dividends and investments in infrastructure more than offset net income and proceeds from employee exercises of stock options.

Share Repurchases

During the third quarter, Nike, Inc. repurchased a total of 14.6 million shares for approximately $962 million as part of the four-year, $12 billion program approved by the Board of Directors in November 2015. As of February 28, 2018, a total of 126.4 million shares had been repurchased under this program for approximately $7.2 billion.

Photo courtesy Nike