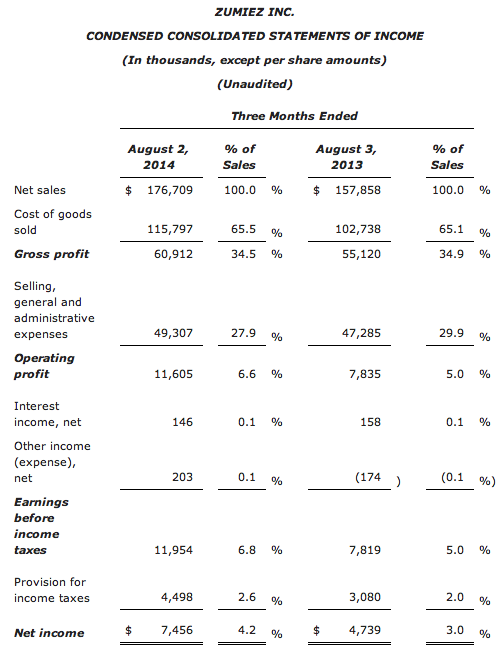

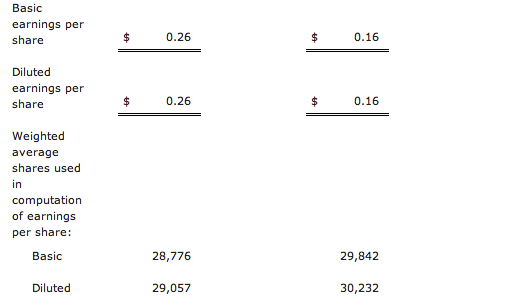

Zumiez Inc. reported net income in the second quarter of fiscal 2014 increased 57.3 percent

to $7.5 million, or 26 cents per diluted share, compared to net income of

$4.7 million, or 16 cents, a year ago. Both sales and EPS came in well above the action sports chain’s guidance.

The results for fiscal 2014 include costs of

approximately $0.6 million, or $0.01 per diluted share, for charges

associated with the acquisition of Blue Tomato, and the results for

fiscal 2013 include approximately $1.7 million, or 4 cents per diluted

share, of Blue Tomato acquisition related costs.

Sales Increased 11.9 percent to $176.7 Million. Comparable sales for the thirteen weeks ended August 2, 2014 increased 3.4 percent on top of a comparable sales increase of 0.9 percent for the thirteen weeks ended August 3, 2013.

In reporting first-quarter results. Zumiez projected sales in the range of $167 to $171 million resulting in net income per diluted share of approximately 12 to 16 cents a share. It expected comps in the low-single digit range.

Total net sales for the six months (26 weeks) ended August 2, 2014 increased 10.9 percent to $339.6 million from $306.4 million reported for the six months (26 weeks) ended August 3, 2013. Comparable sales increased 2.6 percent for the twenty six weeks ended August 2, 2014 on top of a comparable sales increase of 0.2 percent for the twenty six weeks ended August 3, 2013.

Net income in the first six months of fiscal 2014 increased 37.5 percent to $10.0 million, or $0.34 per diluted share, compared to net income for the first six months of the prior fiscal year of $7.2 million, or $0.24 per diluted share. Results for the first six months of fiscal 2014 include approximately $1.3 million, or $0.03 per diluted share, for charges associated with the acquisition of Blue Tomato. Results for the first six months of fiscal 2013 include approximately $3.4 million, or $0.09 per diluted share, of Blue Tomato acquisition related costs.

At August 2, 2014, the company had cash and current marketable securities of $113.4 million compared to cash and current marketable securities of $95.0 million at August 3, 2013. The increase in cash and current marketable securities is a result of cash generated through operations, partially offset by capital expenditures and stock repurchases.

Rick Brooks, Chief Executive Officer of Zumiez Inc., stated, “We are pleased with our second quarter performance. Our ability to connect consumers with our unique assortment of brands drove higher than expected sales which allowed us to better leverage our expense. Our organization continues to get smarter and more efficient at executing our global omni-channel strategy and we believe there is still runway for added improvement in the years ahead.”

August 2014 Sales

Total net sales for the four-week period ended August 30, 2014 increased 9.4 percent to $94.0 million, compared to $85.9 million for the four-week period ended August 31, 2013. The company’s comparable sales increased 2.0 percent for the four-week period ended August 30, 2014 on top of a comparable sales increase of 3.0 percent for the four-week period ended August 31, 2013.

Fiscal 2014 Third Quarter Outlook

The company is introducing guidance for the three months ending November 1, 2014. Net sales are projected to be in the range $207 to $211 million resulting in net income per diluted share of approximately $0.47 to $0.50, which includes an estimated $0.6 million, or approximately $0.02 per diluted share, for charges associated with the acquisition of Blue Tomato. This guidance is based on anticipated comparable sales increase in the low single digit range for the third quarter of fiscal 2014.

The company currently intends to open 56 new stores in fiscal 2014, including 7 stores in Canada and 6 stores in Europe.