Yue Yuen Industrial (Holdings) Limited reported net earnings declined 23.3 percent in the first quarter ended March 31 despite an 8.9 percent gain in revenues.

The Group recorded revenue of US$2,287.4 million in the three months ended March 31, 2018, an increase of

8.9 percent compared to revenue of US$2,100.8 million recorded in the same period in 2017. Profit attributable to owners of the company decreased by 23.3 percent to US$95.4 million, compared to US$124.5 million recorded in the same period in 2017. It was mainly due to operating deleverage from the sales decline within the

manufacturing business, a reduction of the non-recurring gain for the period and higher finance costs during the period.

During the period, a non-recurring profit totaling US$4.7 million was recognized, which included a gain of

US$0.2 million due to fair value changes on derivative financial instruments and a gain of US$4.3 million from

the disposal of an associate. Excluding all items of non-recurring in nature, the recurring profit attributable to

owners of the company amounted to US$90.8 million, representing an decrease of 13.8 percent compared to the

same period in 2017.

Business Review

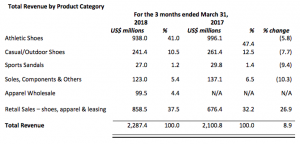

Revenue

Total revenue attributable to footwear manufacturing activity (including athletic shoes, casual/outdoor shoes and sports sandals) during the period decreased by 6.3 percent to US$1,206.4 million, whereas the volume of shoes produced and average selling price per pair decreased by 5.1 percent to 76.6 million pairs and by 1.3 percent to US$15.75 per pair, respectively, as compared with the same period of last year. As a result, the total revenue with respect to the manufacturing business (including footwear, as well as soles, components and others) and the apparel wholesale business during the period was US$1,428.9 million, representing an increase of 0.3 percent.

During the period, the revenue attributable to Pou Sheng, the group’s retail subsidiary, increased by 26.9 percent to US$858.5 million, compared to US$676.4 million in the same period of last year. In RMB terms (Pou Sheng’s operating currency), revenue during the first three months of 2018 increased by 17.7 percent to RMB5,502.9 million, compared to RMB 4,674.1 million in the same period of last year.

Gross Profit

During the period, the group’s gross profit increased by 9.8 percent to US$577.4 million. Due to unfavorable fluctuations in customer orders, together with an unfavorable product mix that resulted in operating deleverage, the gross profit of the manufacturing business decreased by 17.1 percent to US$248.0 million during the period. As such, the gross profit margin for the manufacturing business during the period fell by 2.3 percentage points to 18.7 percent.

The gross profit margin for the group excluding Pou Sheng (i.e. the manufacturing business and the apparel wholesale business) during the period was 20.1 percent.

Selling & Distribution Expenses and Administrative Expenses

The group’s total selling and distribution expenses during the period amounted to US$288.4 million (2017: US$213.7 million), equivalent to approximately 12.6 percent (2017: 10.2 percent) of revenue. The increase in selling and distribution expenses was mostly attributable to the group’s retail business, which has been exploring and investing in a variety of initiatives to adapt to the shifting market dynamics. In RMB term, Pou Sheng’s selling and distribution expenses increased by 18.5 percent, compared to the same period of last year. Administrative expenses for the period were US$143.9 million (2017: US$151.0 million) and remained stable, equivalent to approximately 6.3 percent (2017: 7.2 percent) of revenue.

Fair Value Changes on Derivative Financial Instruments

During the period, the group recorded a gain of US$0.2 million due to fair value changes on derivative

financial instruments, compared to a gain of US$9.4 million during the same period of last year.

Share of Results from Associates and Joint Ventures (“Share of A& JV”)

During the period, the share of results from associates and joint ventures was a combined profit of US$15.3

million, compared to a combined profit of US$14.2 million recorded in the same period of last year.